- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Tax Return Rejected Code: SA-F1040-025

Tax Return Rejected Code: SA-F1040-025

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

IRS is Rejecting a tax return for the Gambling Winnings deduction:

Detail If Schedule A(Form 1040) 'Other Miscellaneous Ded Amt' has a non-zero value, then 'OtherIncome Amt' in (OtherIncomeType Statement) with corresponding 'OtherIncomeLitCd' having the value 'Gambling Winnings" must be greater than or iqual to 'MiscellaneousDeductionAmt' in (OtherMiscDeductionsStmnt) with corresponding 'MiscellanbeousDeductionTypeDesc' having the value "Gambling Losses".

I think is a technical error of Proseries software because the amount on the Other deduction is the same as the Other Income.

Please anybody can help with this technical error??

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you enter more losses than winnings that are shown on the W2G?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is the explanation:

Detail:

If Schedule A(Form 1040) 'Other Miscellaneous Ded Amt' has a non-zero value, then 'OtherIncome Amt' in (OtherIncomeType Statement) with corresponding 'OtherIncomeLitCd' having the value 'Gambling Winnings" must be greater than or iqual to 'MiscellaneousDeductionAmt' in (OtherMiscDeductionsStmnt) with corresponding 'MiscellanbeousDeductionTypeDesc' having the value "Gambling Losses".

and not, even I reduced the amount by $ 1.00 and was rejected again

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Give us the scenario...how much in winnings is shown on the W2Gs?

How much in losses are you claiming on Sch A?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

$ 10,328.00 Other Income Schedule 1 Line 8 Gambling Winnings

$ 10,327.00 Other Itemized deduction Line 16 Other "Gambling Losses"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you enter the gambling winnings on the W2G worksheets? If you just entered them as Other Income that may be whats tripping it up.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think is a technical issue and I do not know how to fit that. I did it in the same manner that I Have been done for ever, I have never have this issue before.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I received the same rejection code today. Same situation. Gambling winnings entered via W-2G of $7504. Gambling losses entered on Schedule A Miscellaneous Deductions of $7504.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On another post someone said the resubmitted, didnt change anything and then it was accepted.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, I waited a day, I installed the Proseries updates and after that I transmitted again the returns without any change and they were accepted this time, .

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can someone help please. I am having this same problem you all discussed back in February. I've done all suggested in your thread and nothing is working. I have had several clients that have itemized and deducted gambling losses to the extent of winnings throughout tax season and never had this problem before.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

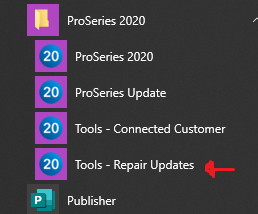

Id try closing ProSeries then use REPAIR Updates from the Windows programs menu under the PS2020 menu heading....see if that helps at all.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks but that did not work.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So youre getting the same IRS rejection as shown in the original post? Or youre getting an error that wont even let you transmit to the IRS?

You have the gambling winnings entered as a W2G?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am getting an error that stops the return from being transmitted to the IRS. Yes I'm getting the same error as the original post. Winnings are posted under W2G.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Youre saying when you hit the Review button on the toolbar and run through it, youve got a Red screen that tells you it cant be Efiled?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

Getting the same SA-F1040-025 efile rejection even though gambling losses are equal or less than gambling winnings. Did not have this problem with other tax returns earlier in the year. Please investigate and fix!

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Anonymous can you look into this problem? It seems to have been an issue back early in the season but was fixed, now its back.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sure! Let me look into this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@marissa2c Checking in..were you able to e-file?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No!!!

I'm still having this issue on several of my clients gambling losses equal or less than winnings.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Try putting the losses on schedule 1 right after gambling winnings which should have carried to line 8 from w2g's.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- if client itemizes, yes normally, but if there is an issue with proseries doubt if irs would catch it. and if they do as long as client is itemizing it would be legit. I have a couple of clients that have winnings and do not itemize, but it is "Per-Session" gambling losses which you can put on schedule 1.

See notice 2015-21

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I've read the thread here and don't see a definitive root cause/resolution. I'm now dealing with this same issue in 2022, and hoping someone can point me to resolution. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Solution provided by a tax expert in the intuit community page (for Turbo Tax online):

It depends. I think I may have a solution for your dilemma. Before we begin though, delete your previous 1099-MISC entry into your program. To report.

- Federal>wages and income

- less common income>show more

- Miscellaneous Income, 1099-A, 1099-C>start

- Other reportable income>start

- Answer yes to the first screen

- Next will be a dialog box asking for the description of the income. Type in 1099-Misc for gambling winnings. Record the amount of income that is listed on the 1099-Misc.

- After you make this entry and press continue. This will take you to a summary screen. Here select add another miscellaneous Income Item

- Here you will first describe this as Gambling Losses that offset my Gambling winnings. You will enter this number as a negative number such as -xxxx.xx.

- Caution do not enter an amount of gambling losses in excess of your winnings. Also, if you entered gambling losses elsewhere in your return like from a W2G, be careful not to duplicate these losses against other losses you may have already claimed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But - since when do gambling winnings get reported on 1099-MISC?

The more I know the more I don’t know.