- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Shareholders with a final k-1 in 2022 are transferring to 2023 and I am unable to delete their k-1 worksheet. How do I remove them form the 1120s return?

Shareholders with a final k-1 in 2022 are transferring to 2023 and I am unable to delete their k-1 worksheet. How do I remove them form the 1120s return?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You cant open the K-1 worksheet and Delete it?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's a problem that seems to be popping up more and more this tax season. For the one I had, I left the former shareholder's K-1 in the software with zero percent ownership. If you catch it early you could make a copy of the prior year return, delete the former shareholders, adjust the percentage of current shareholders and re-transfer the return. But that is a lot of extra work if you have the current year return basically done already.

@Anonymous since there have been a number of posts about this issue this year, is this on anybody's radar at ProSeries?

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- - no, you can't. The issue has been around for at least a couple of years but seems to be a lot more common this year.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We'll do some research on this. Thanks @IRonMaN @Just-Lisa-Now- @kbear70

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you I have the same issue

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In the meantime, @kbear70 @pweymouth13 have you tried permanently deleting the partner/shareholder from your return? Scroll to the bottom of this help article to the section Deleting or removing a Schedule K-1 Worksheet from a 1065 or 1120S return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes I have tried this with no success.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

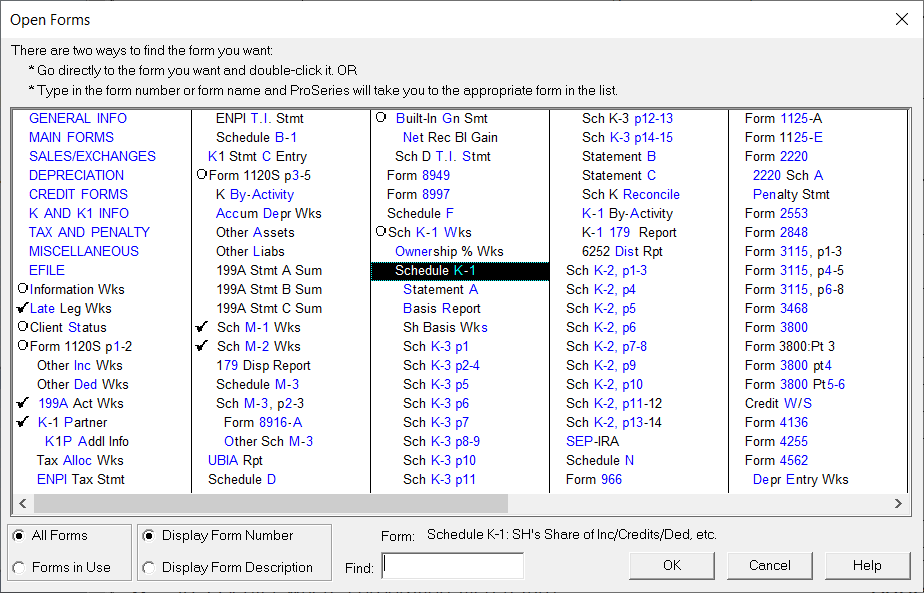

ProSeries was able to guide me through removing the Schedule K-1 for the former shareholders. I had removed the shareholder information in the K-1 worksheet but it was still showing errors because the K-1 was not able to be deleted. My shareholder count was still at 2 etc. They had me go to the k-1 worksheet of the nonexistent shareholder, click on “quickzoom” to the Sched K-1. This brought up an untitled K-1, right click in the middle of the panel containing the check boxes for Final & amended K-1 (under the tax year information). A drop down box appeared and the top choice was “remove K-1 Untitled”. All info associated with this K-1 was deleted and I was able to e-file the extension and will be able to e-file the return without entering shareholder info with 0 ownership.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As we investigate this, the workaround at this time is remove the whole K1 worksheet and rekey the partners.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Followed those steps but did not work for me. Still ended up with errors on K-1 worksheet. Will file with the former shareholders showing 0 ownership interest and 0 shares.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Let us know if this helps @pweymouth13

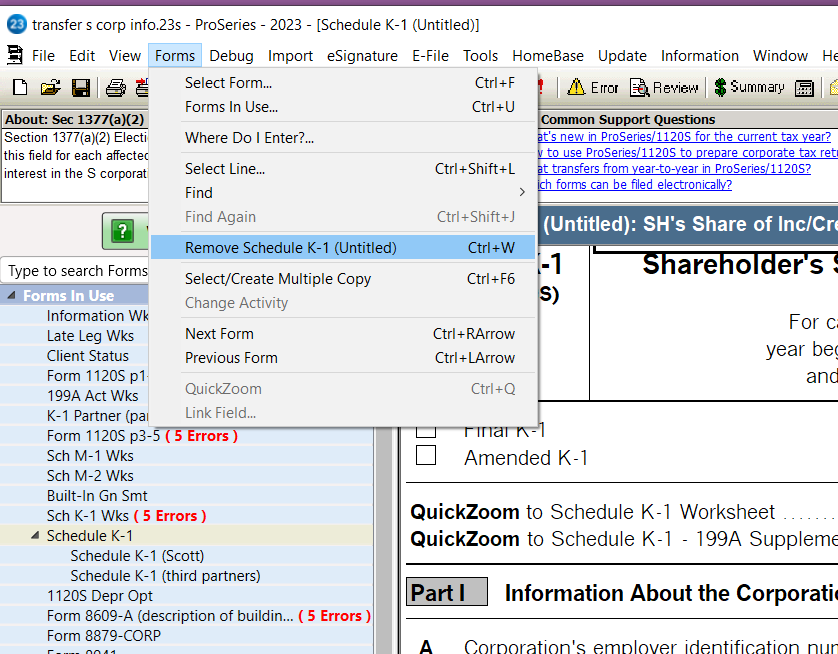

Steps to delete K-1 Worksheet

1. Click on Sch K-1 Wks on the forms bar on the left

2. Click Forms menu button

3. Click "Remove Sch K-1 Wks"

3. Click Yes

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That doesn't work. I tried e-filing an extension and I get an error message that "the schedule K-1 worksheet address is invalid. The entry must begin with either a letter or a number". When I checked on the K-1 I found it is a case of another phantom K-1 issue causing the error. I deleted the K-1 worksheet and just as quick as it is gone the phantom returns. I am having a priest stop by later to see if an exorcism does any good. This is unbelievable nonsense just to file an extension.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No did not work

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@pweymouth13 @IRonMaN

Update to remove errors:

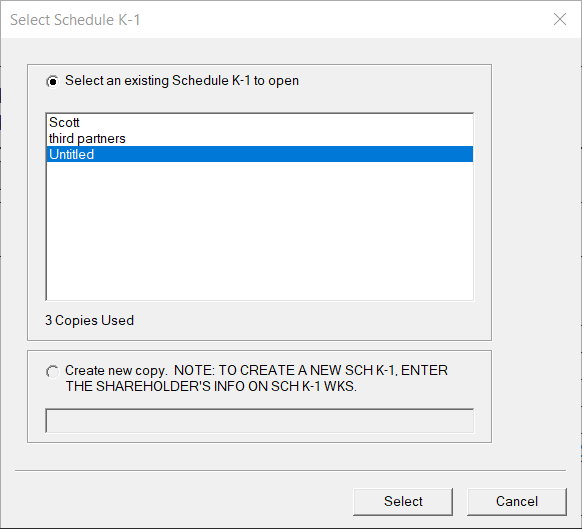

1. To remove the errors, instead of removing the entries on the Sch K-1 Wks, go to the forms menu, select Schedule K-1. The window that pops up will list "untitled" for all of the prior year K-1s.

2. Open each "untitled" Schedule K-1

3. Select to remove that form. When all "untitled" Schedule K-1s are removed the errors requiring an entry on the Sch K-1 Wks will be gone, however, there may still be an error for the percentage of ownership not totaling 100%".

Let us know if this works for you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Anonymous - that worked for the return that I had issues filing an extension for yesterday and that return did not have any data in it yet. I tried that on the return that I had e-filed a week or two ago that I had left the former shareholder as zero and when I attempted to fix it with the suggested fix, it still left the phantom of the opera lurking in the return.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Removing the Untitled K-1 worksheet does not work. What is another way to get the k-1s to be correct to the owners that carried from prior year? In 2022, one shareholder was a final K-1, but he system is still looking for an additional owner???

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Exact same issue last year and same this year. I was able to file an extension surprisingly but I am now ready to file the return and have 12 errors for the 2 shareholders who were bought out last year. I've tried all the recommendations and none have worked. Am I going to have to re-enter the return?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

FINALLY!! Yes, this worked. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think the key is to remove the phantom k-1's from the list not the K-1 wks as originally suggested.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This worked!! WOOHOO!!!