- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Sale of 2nd Home

Sale of 2nd Home

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do you report the sale of a 2nd home/vacation home on the Home Sale Worksheet & just indicate "Not eligible for Exclusion"?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, that will automatically show up on the 8949 as Sale of Main Home, you don't want that if its not the main home.

Just use the 1099B worksheet, scroll down to the entry table and enter it there as Sale of Second Home.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, that will automatically show up on the 8949 as Sale of Main Home, you don't want that if its not the main home.

Just use the 1099B worksheet, scroll down to the entry table and enter it there as Sale of Second Home.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- wrote:

No, that will automatically show up on the 8949 as Sale of Main Home, you don't want that if its not the main home.

Really? If you indicate it doesn't qualify for the exclusion, I wouldn't think it would work fine. What does it show on the 8949 to indicate it was a main home?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

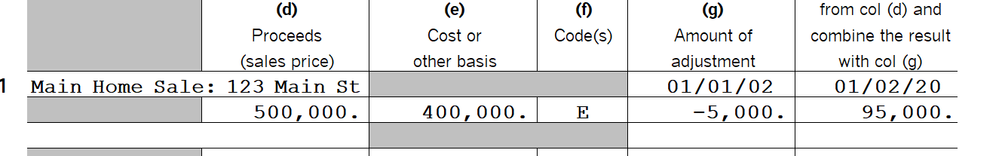

when you use the Home Sale worksheet, it pulls the description to the 8949 like this, its not editable. Even if you mark NO to the questions about living in it 2 years and the 121 exclusion.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Interesting, I didn't know that. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do I just go to capital gains and enter the information about the sale there ?