- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: S Corporation Retained earnings

S Corporation Retained earnings

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A couple of questions: 1. Where do I input PPP loan forgiveness proceeds and make it go to Other Adjustments account. 2. I have a client that wrote-off their treasury stock to retained earnings - any way to show on ProSeries? Perhaps show as accumulated tax/book timing differences? 3. How to input PPP fund expenditures - my understanding is that they also reduce Other adjustments account. 4. Where would a non-deductible loss due to related party rules go - to AAA or OAA?

Thanks

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

1. Read the Help articles, such as: https://proconnect.intuit.com/community/business-income-taxes/help/how-to-enter-forgiven-ppp-loans-i...

2. Huh?

3. See 1.

4. Whose loss? What loss?

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

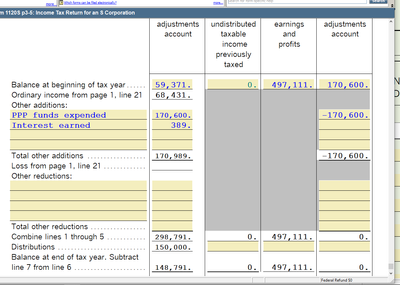

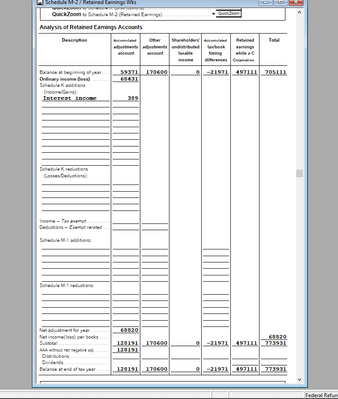

By doing this, it takes the income and puts it nowhere on the M2 worksheet. PPP forgiveness is supposed to go into other adjustments account and then the ppp funds utilized for proper expenses is supposed to be a subtraction from other adjustments account.

If you fill out the M2 worksheet, there is no place to put these amounts in - it's like every line is linked to nowhere.

Below, I overrode the M2 schedule for the PPP funds expended which offset the PPP forgiven 12/31/20.

But the override did not impact the M2 worksheet.

If you try override on this worksheet, it doesn't carryover very well. And I really can't locate any place to actually enter in anything.