- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Reporting of Section 1231 gain and unrecaptured Section 1250 gain on Sch K-1 of S Corp

Reporting of Section 1231 gain and unrecaptured Section 1250 gain on Sch K-1 of S Corp

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Why does program, when reporting 1231 gain on S Corp K-1, not reduce the gain by the unrecaptured 1250 reported. The total gain is being duplicated. Have I missed checking a box? Thanks.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

1250 gain is not part of 1231 gain, so the 1231 gain should not be reduced.

For example, let' say some real estate was purchased for $100,000, they took $5,000 in depreciation and it was sold for $120,000. In that scenario, there is $20,000 of 1231 gain (not $25,000).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Tenn Jeff Intuit / ProSeries does a good job on this... Had a similar situation about 3 months ago on a partnership return... Pro series did everything to the T... Check your work papers and/or adjusting journal entries and compare your total gain to the gain on the K1...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Understood but the program is showing the entire gain as 1231 and then adding on top of that the 1250 gain.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Not this go round. The program is entering two numbers on Line 9 of the K-1 for net section 1231 gain - the number in the column on the far right is the entire gain (1231 plus 1250) and the number on the left is the true net section 1231 gain. Of course, it also shows 1250 in item 8. So, if I enter the true net section 1231 gain in the beneficiary's return (the number on the left), will the Service say "Oops, you should have entered the number on the right" - which is not correct because the number on the right is the entire gain despite being captioned "Net Section 1231 gain (loss)." Got to be a box to check or something to tell the program to separate the 1231 gain from the entire gain.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Double Check the asset entry worksheet boxes for all information including accumulated depreciation, sales information, type of property sold, etc..

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

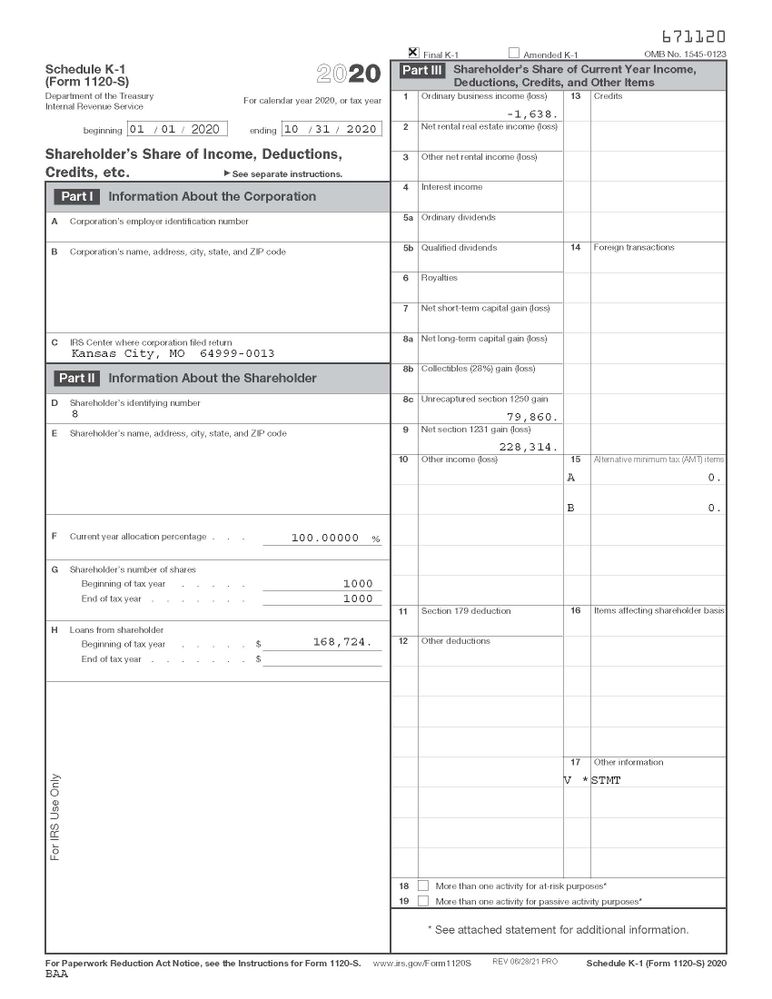

Thank you. The calculations are all correct, the issue is how the program enters the numbers on the forms. It designates the entire gain as "net section 1231 gain" even though there is substantial unrecaptured 1250 gain, which the program calculates. At the end of the calculations, the program enters two numbers on the K-1 entry form: on Line 9 of the K-1 entry form for net section 1231 gain, the number in the column on the far right is the entire gain (1231 plus 1250) and the number on the left (captioned "15/0% Section 1231 gain (loss)") is the true net section 1231 gain. Of course, it also shows 1250 in item 8. The true net section 1231 gain is not entered on the K-1 (below). These are amounts that cannot be changed absent an override.

The program generates the K-1 below, which shows the entire gain in the net section 1231 section, even though that gain contains the section 1250 gain, which is also shows!

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I guess I was completely wrong about the idea that the 1250 gain is not part of the 1231 gain. Hmmm, I'll need to think about that one.

But I tested it out, and it seems to be working correctly. Form 4797 and Schedule D still shows the proper TOTAL gain as it should. The amount on Line 19 of Schedule D is *NOT* an 'additional' gain; it is just saying of the total gain, Line 19 is 1250 Gain.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@TaxGuyBill @Tenn Jeff Bill is right... And it is the K-1 that determines what flows through to the tax return...enter the K1 information on the 1040 of the client and see what happens...