- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Rebate Recovery

Rebate Recovery

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client who lives with and is a dependent of her parents but she's filling for the first time with a 1099 for $24. Because she's filing for the first time it is showing that she should get $1,200 and $600 stimulus payments added to her return. Would this be correct or should I put in what her parents received FOR her in E1 and E2?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

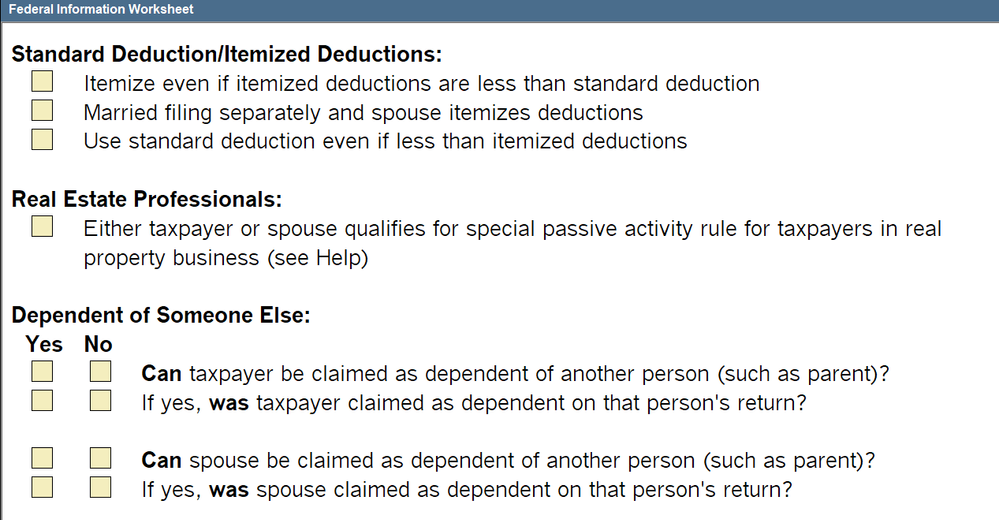

if she is a dependent of her parents, be sure you mark the boxes on the Fed Info worksheet that she is such...no recovery rebate should compute for her. This is what it looks like in Professional, Basic should be similar

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You "should" mark that she is being claimed as a dependent of someone else.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Make sure she is marked as a dependent on the federal information worksheet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Why is she filing a tax return for $24 of income?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Beth... jinx 😁

edit,

and Lisa.... 😂

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

To get $ 1800 in "free" money?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Only one thought comes to mind - holy crap!

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

1099-NEC with $24,400 in box #1 as a property mgr. She's single with a $12,400 standard deduction. I checked Other on the 1099-NEC so it went in as Ordinary Income but she still has to file. But even though I checked that she was claimed by her parents the Recovery Rebate form showed her with $1,200 for E1 and $600 for E2 and when I put zero for amount rec'd it shows she's qualified for $1,800 credit. My question was should I put in what her parents got for her - $500?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did that right away but Recovery Rebate still comes up with a credit of $1,800

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"My question was should I put in what her parents got for her - $500?"

No It asks what SHE received, she received 0. Doesnt matter what parents got.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If shes a property manager, it should be self employment income (Sch C), not other ordinary income.

And with 24K in income its doubtful she qualifies as a dependent.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But if she was claimed as a dependent on her parents 2020 return, it does matter.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Paul-G-328 Your OP said $24, not $24,400.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

And by the way, there is a little difference between a 1099 for $24 and $24,000 ---------------- $23,976 to be exact.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Susan - ya beat me by a few seconds 😁

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The original post was:

"I have a client who lives with and is a dependent of her parents but she's filling for the first time with a 1099 for $24. Because she's filing for the first time it is showing that she should get $1,200 and $600 stimulus payments added to her return. Would this be correct or should I put in what her parents received FOR her in E1 and E2?"

Recording just in case, and for posterity...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So you did decide to take that job as Intuit historian after all.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yeah, well.... the salary/signing bonus was just soo high I couldn't resist. I do have to think about having enough for Juno to live on (in the style to which she is accustomed) if this tax season is the end of me.

Right now, just the ERC may do me in 🤣

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, I was afraid of that

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

so she qualifies for the $1,800 then even though her parents got $ for her in a stimulus payment?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"so she qualifies for the $1,800"

I think you need to work through the EIP #1 and EIP #2 qualification details, again.

If she qualifies in 2020, what was paid in Advance based on 2018 or 2019 (a projection) to someone else has no bearing on 2020. But it doesn't seem you have confirmed this person qualifies.

Don't yell at us; we're volunteers