- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: QBI loss carryover not rolling forward to 2022

QBI loss carryover not rolling forward to 2022

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

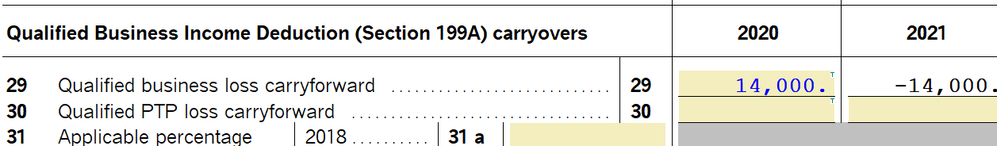

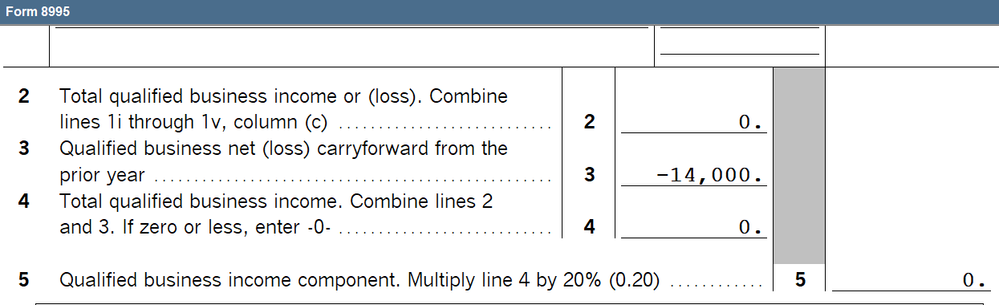

2020 final K-1 had QBI loss which shows as carryforward from 2020 in 2021 carryover worksheet. There is no business activity on 2021 return and no K-1 worksheet for the final K-1 in 2020. The QBI loss carryforward does not show on the carryover worksheet from 2021 to 2022. It would flow from Form 8995 or 8995A but those forms didn't populate.

Shouldn't that QBI loss carryforward to 2022? Does it need to reported anywhere on 2021 return? I can override on the carryover worksheet but wondering if I'm missing something?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The system won't allow you to enter a negative value on line 29. But line 29 flows from Qualified Business Income Deduction Summary line 8. I can override that line with the negative and it then shows on line 29. I don't like to override, but don't know of another solution right now.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That sounds reasonable, but the 2020 box shows a negative that transferred from the prior year. 2020 also allows a negative to be entered. The 2021 box doesn't, maybe since it should flow from the other worksheet?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When I put a positive number in the 2020 column in Line 29 of the Carryover worksheet, it carries it as a negative onto Line 3 of the 8995...isnt that what you want?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When I do that, nothing populates in form 8995. Maybe because there are no business activities in the return?

Do you agree that this prior year QBI loss should carryforward indefinitely until offsetting other QBI income? The activity generating the QBI loss ended in 2020. It's unlikely that the client will have other QBI businesses in the future. But I want to carryforward the QBI loss if required.

I do appreciate your input especially during this very busy time.