- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: PY Allocation for Georgia

PY Allocation for Georgia

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

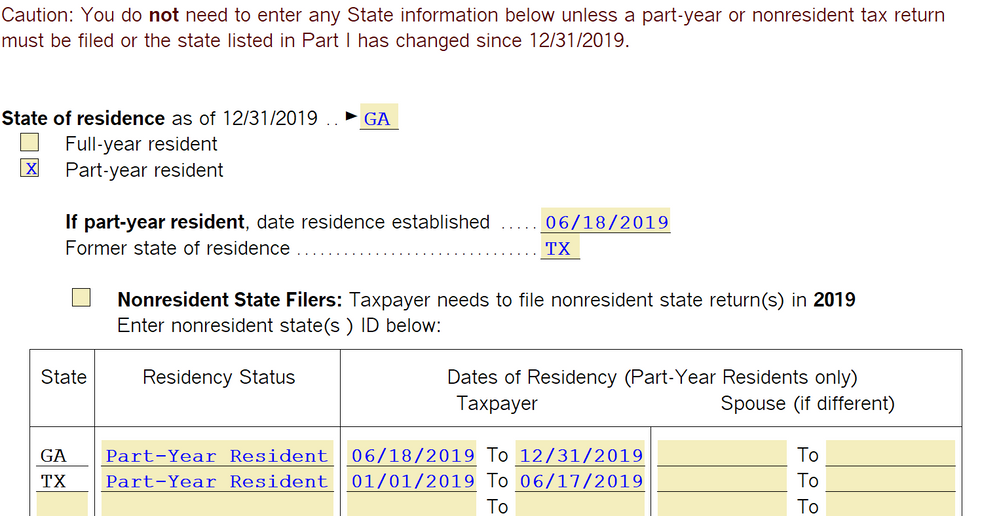

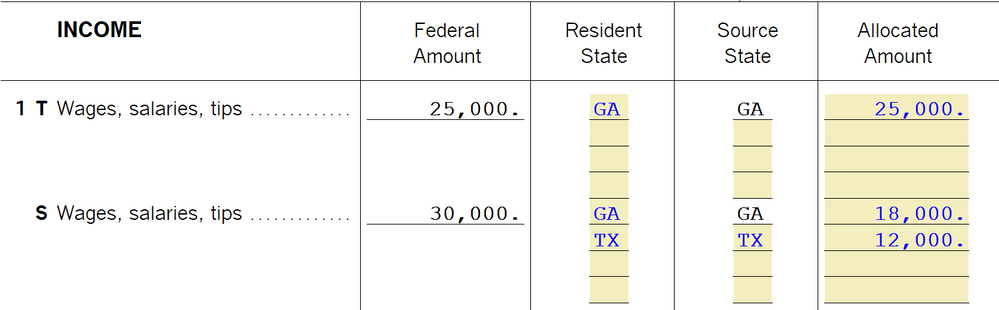

I have a couple married in 2018 that lived and worked in separate states. In 2019, the wife move from Texas to Georgia. She has a W2 from TX (old job) and then a W2 in GA (new job.) I've completed the PY allocation showing her dates PY GA and PY TX, but the husband was a full-year resident of GA. The problem comes with the GA return. Even though I've allocated the PY income to TX for the wife, it is not excluding it from the GA return - instead taking the FED AGI and not removing the TX W2. What am I doing wrong?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The part year resident is the spouse you still need to mark it as such.

Allocate the wages

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

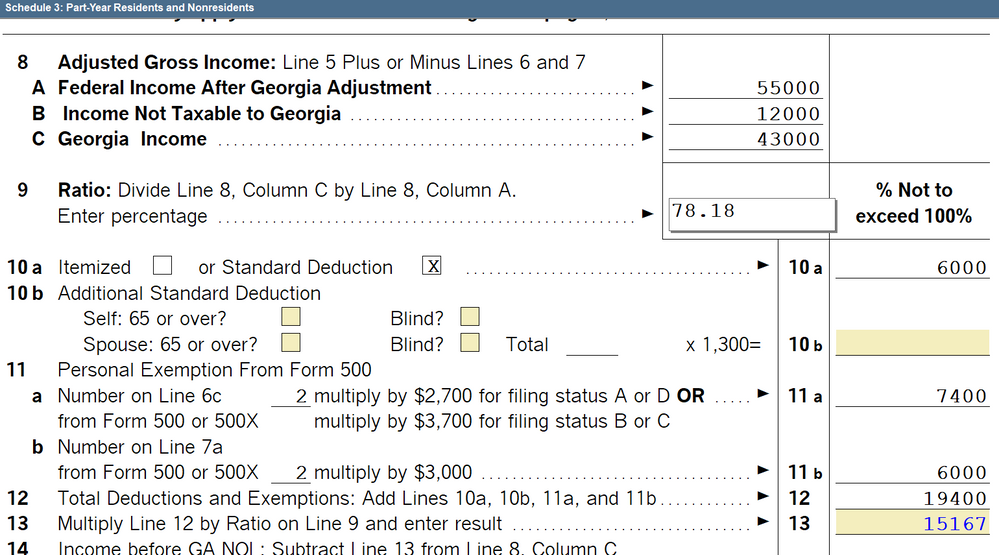

GA Schedule 3 "Part-Year Resident and Nonresident" should show you income not taxable to GA In Column B Line 1 for the TX W-2

If the amount is not there then the allocation worksheet is not correct.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In response to your last statement about the allocation being incorrect:

In section XI of info worksheet, I have marked Full-year resident for GA. If I mark part-year resident, it makes me enter in dates for the husband in TX where he never resided or worked, so I did the following

1. I have the husband as full-year resident on the info worksheet for GA.

2. I have allocated the wife as part-year with corresponding dates for TX/GA on the info worksheet.

3. On the PY allocation worksheet, I have the W2s allocated correctly.

After doing this, GA is showing the return as full-year resident and the schedule 3 still doesn't pull the TX w2 out. I entered in manually the amount on line 1 of Column B, but it doesn't change the wages for GA (and when pulled from the federal return, the amount (while allocated to TX) still brings it as GA income.

I also attempted just doing everything as part-year return for both, with the husband having 1/1/19-1/1/19 as dates for TX and 1/2/19-12/31/29 for GA. If done this way, it pulls everything appropriately to the true allocation (all W2s have correct state allocation.) But, I do not think this is allowable since he really was never a resident of TX and had no income in TX.

Help! What am I doing wrong or missing?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The part year resident is the spouse you still need to mark it as such.

Allocate the wages

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

GA Schedule 3 should look something like this

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Bottom line on Schedule 3 flows to Form 500 line 15a

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So even if the husband (taxpayer) was a full-year resident and worked in GA (and not in TX), that's how I should mark the year? He showed full-year in GA as a resident in 2018.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, I truly appreciate all your help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Happy to help