- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: ProSeries not checking federal extension box on Ohio IT 1040

ProSeries not checking federal extension box on Ohio IT 1040

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In troubleshooting with an Ohio tax agent, we discovered a ProSeries bug. ProSeries is not checking the box on the front page of the Ohio individual return for Federal extension filers.

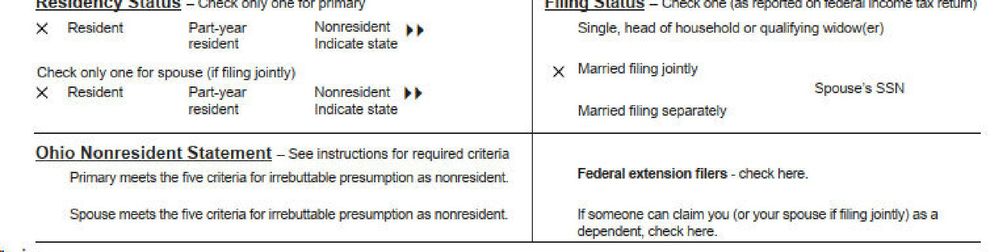

Ohio is like most states in recognizing a properly filed federal extension as also extending the Ohio filing deadline. On the Ohio Information Worksheet, there is a box to check to indicate whether there is a federal extension in place. This should carry over to page 1 of the Ohio return, where there is a corresponding checkbox. (This checkbox on page 1 of Ohio's IT-1040 does not appear in the software. However, it does print on a paper copy of the form.)

Due to this bug, my own tax refund and carryover-to-next-year designation was messed up. The agent tells me that if that box is not checked on page 1 of the IT-1040, their system does not recognize any Ohio extension payments as extension payments. It uses the payment, but since it appears to the Ohio Dept. of Taxation that there was not a federal extension, it messes up other things.

This needs to be fixed in ProSeries' Ohio individual module for 2024. Posting here because I don't know how else to get ProSeries' attention on bugs that need fixing. Thanks for listening!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Anonymous

If anyone knows of any tags to possibly get an Intuit rep's attention, please feel free to add them.

@IntuitBettyJo

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't know if this fixes it but on the Ohio Information Worksheet, in part X there is a box to check for the federal return being extended.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It seems to me that there was a similar issue a couple of years back with the software not checking a box for an extension. But I don't recall if it was OH or if it was another state with a similar requirement.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, Jim! Yes, that box was checked on the Information Worksheet, but still no carryover to the front of the Ohio return. I looked at some others filed with that federal extension box checked on the Info Worksheet, and none of them are carrying over to the front of the return. (You can only see that box on page 1 on a pdf or paper copy.)

How about yours? It's directly to the right of the Ohio Nonresident Statement.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

interesting.. I have checked that box in the Ohio Information Worksheet for the federal return being extended but I don't think that X in the box actually prints out anywhere on the actual Ohio tax form. Should that X actually print out on the face of the Ohio return?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I tested it on my side and got the same no check on front of ohio return.. I wonder though if the ohio return is efiled that somehow the state gets the info still that the federal was extended

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That is why I always file state extensions for All State returns, regardless of whether the state accepts the federal extension or not. I would rather be a safe nerd, than a fool lookin nerd.😉🤓🐕☝

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As far as I can remember The Ohio returns that I have done I have always finished by the deadline. But you are right they do not have a separate extension form. They do have form it40p that allows to make an extension payment. I wonder if this can be filed, e filed or paper filed, even if zero payment and accepted as a legitimate extension? Or can a copy of the federal extension be mailed directly to Ohio and accepted by them? Maybe Jim from Ohio or someone else from Ohio can answer this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'll find out what I can about this. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have the same issue with Indiana IT-40. If I remember correctly, PS stopped automatically checking the extension on the Indiana state return with the 2020 version (may be 2021).

I complained about it to PS staff. It didn't get anything changed.

I make myself open each return on extension and check the box on the Indiana information worksheet.... it is a pain in the donkey.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Anonymous Can i ask where on the 4868 do you mark it so the X shows up on the ohio return? thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You should be able to get the X on the Ohio Return by checking the "Check this box to freeze the amounts flowing to this form" on the Federal Form 4868.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have the freeze box checked but it still does not check the ohio return