- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Mandatory efile Form 990-T

Mandatory efile Form 990-T

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

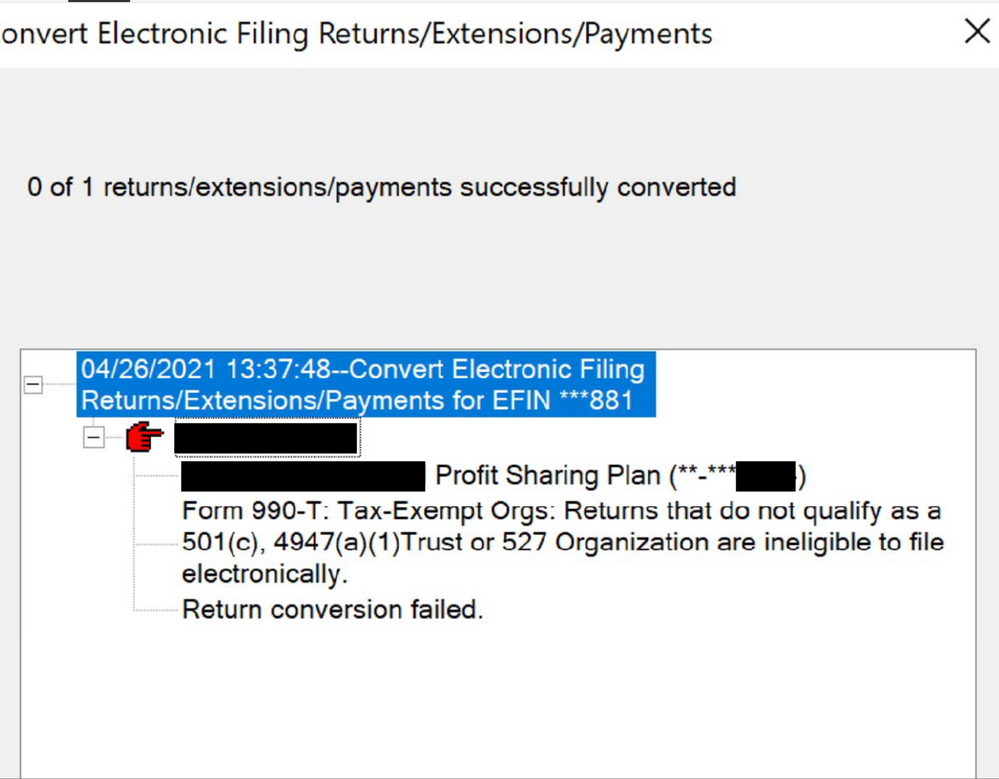

Is anyone else having issues efiling a 2020 Form 990-T for a profit sharing plan - 401(a) organization? When attempting to convert and transmit, I receive the message "Form 990-T: Tax-Exempt Orgs: Returns that do not qualify as a 501(c), 4947(a)(1) Trust or 527 Organization are ineligible to file electronically. Return conversion failed.

If I uncheck the box for efiling on the information worksheet, the program shows an error, and says that the return must be efiled.

It appears that IRS is requiring all 990-T returns due on or after April 15, 2021 to be filed electronically and will not accept paper returns.

I spent 2+ hours with tech support yesterday and they were unable to figure out what the issue was.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This unexpected behavior has been addressed in a program update available May 6, 2021.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for posting this... Others have brought this up in other posts.. I hope Pro Series is reading this and correct all of these matters because these returns are going to be due May 15th for calendar year entities..... Come on now get this stuff fixed... Just my opinion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There was an update to 990 program today. I hoped that it would take care of my problem with efiling the 990T, but it didn't. The program still will not convert 990T for the reasons stated in original post.

How do we get the attention of ProSeries to fix this problem?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

👍 cmel, thank you very much for the information. I believe that Pro Series monitors posts on this forum, so hopefully someone will read this and take care of this matter. Even if they do not read this it is their job to correct these issues in my opinion. We paid a lot of money for this software and we should not have to put up with this. I hope they correct these issues soon since the return or extension is due as you said May 15th. .....COME ON INTUIT, TAKE CARE OF THIS MATTER... just my opinion...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"I believe that Pro Series monitors posts on this forum"

So does Bigfoot ------ he is probably more likely to resolve the issue.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@cmel just an update... It still will not let me file a 990 T extension for a regular 501c entity, but it will let me e-file the actual 990T return supposedly... The 990 return is no problem either with the return or with the extension but there appears to be a problem on the 990-t extension part... Hope Pro Series update this soon since extension is due May 15th for calendar-yearcalendar year entities

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Call out for "please read this topic"

The Forms and Update releases show nothing more is planned by the due dates:

| Form 990-T, Sch A UBTI From an Unrelated Trade or Bus | Final, EF Ready |

| Form 990-T, Exempt Organization Business Income Tax Return | Final, EF Ready |

| 2020.045 | 2021-04-21 |

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you qb... I am busy right now trying to finish up the 2020 calendar year 990 / 990-t entities... Instead of waiting for the 990-t extension to be available for e-filing, I figured I would just finish the actual returns before the due date and e-file them... hopefully next year they will have the 990-t extension available for e-filing, if I am still doing this... Thanks again qb

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Still cannot file the 990-T. Posted a screenshot.

ProSeries please review this problem.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

UBTI

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I figured that. What kind of UBTI?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

real estate investment

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Debt financed?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"ProSeries please review this problem."

You are asking Peer Users; we already tried to use the "callout" function for

who could share this with the staff. Right here, this is not Customer Support; this is Peer Users.

"I spent 2+ hours with tech support yesterday and they were unable to figure out what the issue was."

You might try calling them, again.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN 👍 I gave up trying to call long time ago unless it is absolutely necessary... I've learned more on this forum with tax professionals like you Iron Man and others that I could ever learn anywhere else...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But sometimes we don't have a clue and need a little insight from Intuit. It tends to perturb me just a bit, when nobody from Intuit will at least acknowledge a cry for help. It's amazing that we seem to be able to take time out of our day to help other folks --------------- saving how many calls to support -------- but it seems so difficult for someone from Intuit to step up to the plate from time to time. It really sucks.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN @sjrcpa @qbteachmt you three and others like Lisa should receive your software at no fee considering the number of people that you help which relieves pressure from Intuit handling the issues/questions... just my opinion👍🤓🐕

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks. Intuit does not agree with you about FREE software.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

FREE SOFTWARE

FREE BEER

FREE MUMBAI DANCING GIRLS

FREE STUPID MORONS

Just trying to figure out which words get their attention since normal paging doesn't seem to work.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Intuit does not agree with you about FREE software."

Just earlier today, I was digging around for an "ethernet-to-USB WiFi doohickey" and came across my drawer with some of the free Intuit doohickeys they sent me over the years, such as USB chargers and converter cable-packs and an Intuit memory stick (or 3) and even a QB pen. I have no idea what happened to the Intuit tote bag or T Shirt.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have you tried - Beetlejuice Beetlejuice Beetlejuice ? Maybe that will summon up some PS support

sorry trying to give you some cheap humor for a frustrating situation

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks. There was an update to 990T today. Did not solve the problem.

Honestly, I don't have the time right now to keep calling them. Luckily, I was able to get an acquaintance using Lacerte to get an extension, since I was also not able to do an extension electronically. I will get really worried in October....

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

And just to make the record clear. In this situation, the return was due on 4/15, not 5/15 as it is for most. After the acquaintance was able to get the extension, I asked her to see if she could file the 990T, and she was also not able to do that. So at this point, I feel screwed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A little help on e-filing 990Ts and their extensions?

I'll get the call in a little earlier today.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maybe their employment contracts ended on April 15th so there is no longer any support !!! Yikes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

They have posted since April 15th, so they are still around. Maybe our contracts need to end and we stop posting here.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

I apologize for the delay, Austin has been out the past couple of days and usually covers the ProSeries boards. I am looking into this and will update you as soon as I get any info.

-Betty Jo

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yay!! Thanks.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This unexpected behavior has been addressed in a program update available May 6, 2021.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you. It worked!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The problem still has not been fixed. I spent two hours on the phone this morning with a very knowledgeable and patient technician. IMO this is not a technical issue. It's a lack of programing and professional tax recourses allocated to this problem. Intuit monitors this board and this problem goes back to at least last April. Bottom line is that the program does not allow for two extensions to be filed for the same entity in the same fiscal year. Filing deadline today and I need to paper file 990-T extension with detailed disclosure and explanation. Hopefully it doesn't get rejected but more importantly the service does assess draconian interest and penalties.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In 2020 and before I've filed the 990 for a client. In 2021 the form is not there and there is no form to transfer from 2020.

Please help

Dawn

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Dcr, I don't think the module has been released yet and maybe that is why you can't transfer it. The 990 module is usually not released until March or so. Just my opinion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you check your Forms Release info:

| Form 990, Return of Organization Exempt from Income Tax | Final on 02/25/2022, EF on 02/25/2022 |

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@hockeyguy thanks a million for that information. I guess what you are saying is we can't file a 990 extension and a 990 T extension for the same entity? If so that is absolutely absurd and intuit needs to take care of this. Just my opinion.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This. Is last year 2020 when the irs mandates were already in place

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Transfer has nothing to do with it. It’s in the same tax year at 9:98 990 T I can file both 990 and the 1980 electronically with no problem and 990 extension prior to that. I can’t file the 990 T extension in the same year and the same module has nothing to do with any transfer I don’t know what you’re talking about

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"has nothing to do with any transfer I don’t know what you’re talking about"

That's what happens when people post New issues into an old topic. And when multiple people with different issues, start using the same One Topic. It gets confusing.

That wasn't directed to you, @hockeyguy .

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just selected "select and download new products". The 990 box is checked. There was a download, but it was not a 990 module download. Nothing is downloaded for the 990, so it is not ready yet, therefore you can't transfer a file from last year since the module has not been downloaded and that is what I meant. Not sure what other comments mean but that's what I meant

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"And when multiple people with different issues"

I have multiple personalities with lots of issues so does that mean I can or can't post here?

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Right on Iron Man. And since I'm a mixed breed, I can be multiple people depending on who the client is... if the client is Mediterranean, then they identify me as one of their own. If they are from East European extraction, then I can play that card, and they'll also accept me, and so forth.... works out pretty well. 🤔😉

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have the same problem for 2021 990-T retruns.