- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Local earned income tax return in PA

Local earned income tax return in PA

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hoi to all,

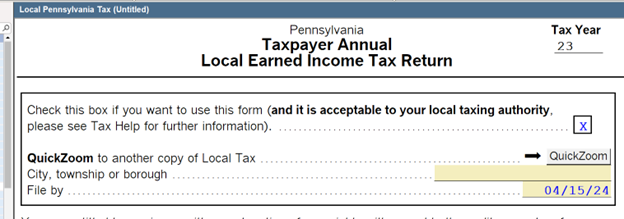

new client self-employed in PA when I mark on

For the first client who owes $220, I was wondering if this amount can be withdrawn automatically from the checking account provided on the FED and State return, or if the client should pay online by themselves.

Regarding the other client who is eligible for a refund, I indicated at the very bottom of the page to mail it to the client's address. Is this correct?

Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't believe the local return can be eFiled and it seems you're aware of that. With that said, I've never tried to have an amount due electronically drawn. I assume you can provide banking information when it's paper filed filed but I've always had my clients pay by paper check and, if they had a refund, asked it be by check as well.

I updated my reply as I always intended to say "when it is paper filed". I inadvertently said when it's efiled. The Local return cannot be efiled but I wish it could be.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@GodFather Thanks a lot.

"I checked the availability of forms, and this form is not yet ready for e-filing. You're correct.

When I reviewed my new client's 2022 return, I noticed they had net income from self-employment. I asked them if they had paid local income tax, to which he responded, 'No!' They have been living in PA for 8 years but have never paid any.

However, I do not know when this obligation to pay started."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You cannot e-file PA local taxes through ProSeries. It's not even an option in the e-file list. You can e-file PA NPT and PA BIRT. Either print and mail or have the client set up an account with one of the zillion local tax agencies and e-file through there.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@dascpa Thanks a lot.

To be honest am not familiar for this part.

Could please help me to understand more.

I should print this form and email to my client, and let me know how to find out the address should it go? Client should sign up or register for this form first?

All taxpayer in PA should do it? When Mark the Box on the top of the form, a credit appears. A couple both are on the form but husband's W-2 local is LMACU and wife's local is PHILA and I do not now how to explain what they should do. I aske them did you mail like this form to any address before, they responded no Please help me!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The vast majority of my Pennsylvania clients live in the suburbs of Philadelphia. Keystone Collection is normally who collects the earned income tax. Here is their website which will provide a great amount of information for you: Keystone Collections Group (keystonecollects.com

The website will provide specifics on individual townships that impose an EIT along with the addresses you will need to file the form. The address depends on the tax situation...do you owe, refund, no tax due. There is a different address for each circumstance.

It's important to know, not every town in Pennsylvania imposes an EIT, so make sure you investigate if the returns you are working on have that exposure or not.

I use the form that Intuit provides, I check the box, print it, and add the respective W2's. I sign the form, have my clients sign and then mail it in. You'll need to determine if there is a refund, amount due, or if it's paid in full. The program does a nice job of populating the pertinent information but you have to make sure you populate the appropriate tax the town imposes in order for the calculations to be correct.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@GodFather Thanks thousands.

New client MFJ, on their W-2s have different local names PHILA and 39 LMACU.

But PA state has been filed as non-resident should they file local Tax, EIT on one form or separately? Software give me just one! Also, I am not in PA, how do I sign and date it, however, I can mail them? right? let me know who should file on tax collector website client or me?

I have more question since this is the first time I am challenging with PA local, is it ok to ask you?

Appreciate!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hope...if your clients are non-residents of Pennsylvania, there is no need to file Pennsylvania Earned Income Tax Return. I'm 99.9% sure on this but maybe a Tax Stud like @IRonMaN can confirm this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm in MD (next door to PA) so I do a handful. PA has taxes for where you live, and where you work. Many times these two jurisdictions don't talk to each other so when payments or withholdings are made based on the wrong address it becomes a bureaucratic nightmare.

If you work in PA but live elsewhere your employer should have been withholding the proper local taxes. If so, no return is required unless there is other income (like a Sch C). But if you live in PA and work in MD (for example) the MD employer [probably] won't be withholding local PA taxes (check the W-2 to make sure) so a return is required to pay the taxes due.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@dascpa Thanks a lot.

I am confused. When employer should be withheld PA local tax, when you live in PA and work in PA, when you live in PA and work elsewhere, when you work in PA and live elsewhere?

Thanks for help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For Philadelphia, if the proper amount of Philly tax was withheld the spouse does not need to file a Philly return. @PATAX confirmed this in another post.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

And don't forget, if you live in PA and need to file Local, too, but you work outside PA:

Not only can you get a tax credit up to 3.07% PA tax if you pay the other state(i.e., NY), but your Local tax might be covered if you pay more than 3.07% to the other state.

IE, NY taxes are much higher than 3.07%, so there is more left to cover the Local's 1% or 0.5% or even Pittsburgh's 3.0%.

(Not Philly's wage tax, though. No credit for you!)

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Accountant-Man Thanks.

I am still need to know about: When employer should be withheld PA local tax?

when you live in PA and work in PA,

when you live in PA and work elsewhere,

when you work in PA and live elsewhere.

first, I need to know about this basic.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Then this happens: you work in a locale that charges a 0.5% local tax, but you live in a locale that charges 1%. Job withholds 0.5%, and you file at home.

Your home locale gives you a credit for the working locale's 0.5%, and you still owe 0.5% to your home locale.

If the reverse percentages are true, job withholds 1%, home charges 0.5%, you file at home and get a 0.5% credit so you owe nothing to home locale.

Confused yet?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Accountant-Man Thanks but what does mean IE?

I am confused for this part: (Not Philly's wage tax, though. No credit for you!)

Client lives in PA but work in NY, employer withholds local tax so he does not have PA wages.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I.e. is the abbreviation for the Latin "id est," meaning "that is." Another form of "for example."

He lives in PA so he has PA wages, the employer just doesn't tell you. PA taxes all compensation, so usually Medicare wages box 5. You need to enter it.

NY wages follow federal law, so box 1. Therefore, NY taxes less than PA and PA Local wages.

They might, but I highly doubt a NY employer withholds PA Local EIT.

ps NY doesn't allow "working at home in PA" in order to allocate wages outside NY state. 100% is taxable to a NY working non-resident.