- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: IRS adjustment in error?

IRS adjustment in error?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello Community,

My client received an adjustment letter from the IRS stating that their SEP amount was not allowed.

"We didn't allow the amount claimed as a deduction for self-employed SEP, SIMPLE, and qualified plans on your tax return. Your employer has already adjusted Box 5 of your form W-2 to exclude this amount. (1610)."

I've directed my client to contact their employer and the HR lady says she hasn't heard anything from the IRS.

Not sure what steps to take next either for myself or to advise them to do.

Thoughts?

Thank you, everyone, hope you are all staying safe and well out there,

Dawn

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What SEP? Is your client self employed? or did you try to claim the SEP contribution their employer made on their behalf?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If a SEP contribution was taken on the face of the 1040 there is no use talking to the employer, they had nothing to do with it. However, the person that prepared the return should be able to explain why a SEP contribution was taken.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you look at the W2 info, to see what is there? An employee cannot participate in their own SEP outside of the employer, for the work paid as an employee. Did they also have a Sched C for that tax year?

More details are always helpful.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

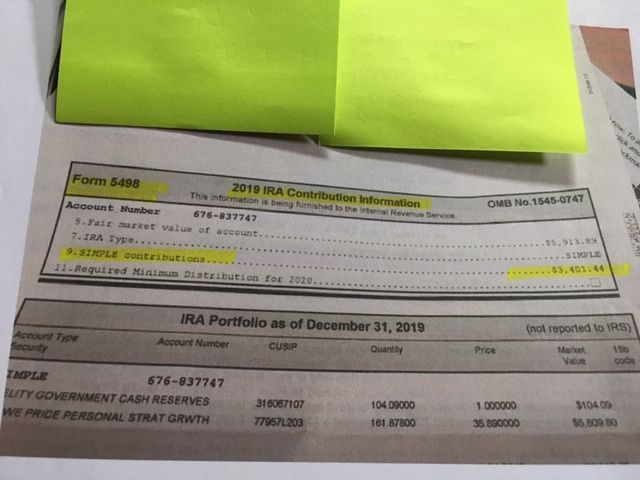

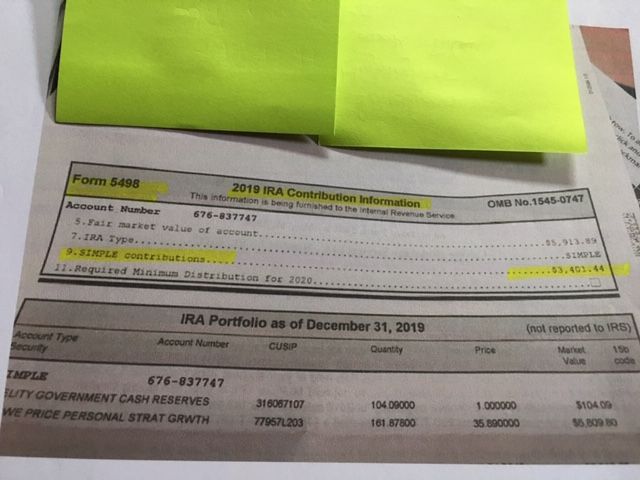

My apologies, The contribution was a SIMPLE, not a SEP. The contribution was reported on Form 5498. I do not see the pertinent dollar amount on his W-2 from his current employer. Before I contact the client again, any thoughts on clarifying questions, I should be asking him?

Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My apologies, The contribution was a SIMPLE, not a SEP. The contribution was reported on Form 5498. I do not see the pertinent dollar amount on his W-2 from his current employer. Before I contact the client again, any thoughts on clarifying questions, I should be asking him?

Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A SIMPLE is an employer plan. Generally employees make deferral from their pay, which should be shown in Box 12 on their W-2 and the employer makes a contribution, too. Nothing is deductible on the employee's 1040. Looks like IRS is correct.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you,

I just checked the W-2 again. Box 12a is "S 1649.96". Retirement Plan box is checked in section 13. I'm wondering where the 3401.44 comes from? Maybe that is the error the IRS said that it corrected with the employer? The message was "We didn't allow the amount claimed in a deduction for self employed SEP, SIMPLE, and qualified plans on your tax return. Your employer has already adjusted Box 1 of your Form W-2 to exclude this amount. (1610)

Sure do appreciate the feedback, thank you!

Dawn

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you,

I just checked the W-2 again. Box 12a is "S 1649.96". Retirement Plan box is checked in section 13. I'm wondering where the 3401.44 comes from? Maybe that is the error the IRS said that it corrected with the employer? The message was "We didn't allow the amount claimed in a deduction for self employed SEP, SIMPLE, and qualified plans on your tax return. Your employer has already adjusted Box 1 of your Form W-2 to exclude this amount. (1610)

I put into the system exactly what was on the W-2 AND the Form 5498. Because the figures didn't match, I thought it was two separate deposits. However, I am definitely happy to make right with the client.

Thank you for taking the time to respond!

Dawn

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ah, I understand. Thank you! So glad to have this online resource!!

Warmly,

Dawn

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A 5498 is informational and not for Tax Filing. It is proof of activity in that account for that year. Think of it as a type of account statement, not a tax form.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm completely good with that extra 3.28! 😉