- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Inherited IRA

Inherited IRA

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello everyone,

I am helping a client who inherited an IRA in 2017 (non-spouse). I understand that she cannot combine it with her own Traditional IRA, or taxable account, but I'm a little unclear of other options available considering the SECURE act changes. The decedent passed away on May 14th 2017.

Thank you, in advance, for any thoughts on this situation.

Cheers,

Dawn

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is nothing in the SECURE Act that affects this old of an inherited IRA.

"If I understand the changes correctly under the Secure Act, non-spouse beneficiaries can no longer take that option and must disburse the funds within 10 years?"

That applies for someone who dies Now. Not back in 2017. Your client's IRA has already passed to this person.

Just like someone who was already 70 1/2 and taking RMD would not then completely stop and start again at 72 (setting aside that everyone gets a forgiven skip year of 2020), just because the new start date is 72.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What is your confusion?

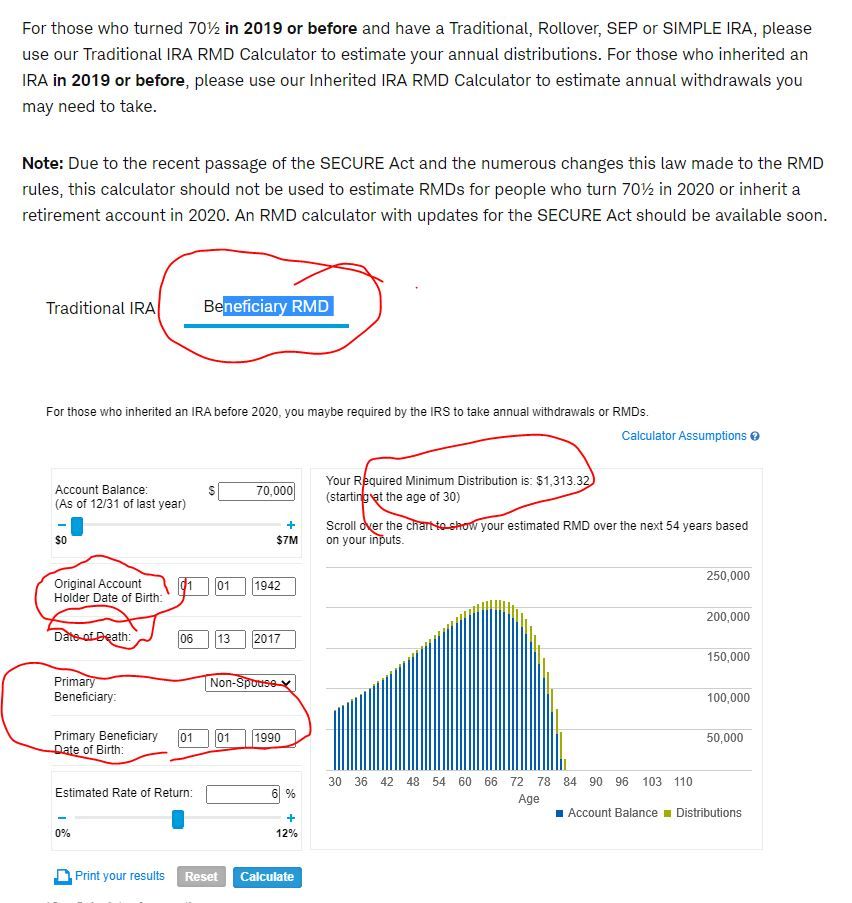

Is there a RMD? https://www.schwab.com/ira/understand-iras/ira-calculators/rmd

This example shows an RMD, but for 2019 2020 that requirement is waived. If already taken, it could have been redeposited https://www.irs.gov/newsroom/irs-announces-rollover-relief-for-required-minimum-distributions-from-r...

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@George4Tacks but for 2019 that requirement is waived

In our world it is still 2019 until October 15, but out in the real world it's now 2020.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you both. I'm curious if she could use the stretch IRA option as a non-spouse since the decedent passed away in 2017. If I understand the changes correctly under the Secure Act, non-spouse beneficiaries can no longer take that option and must disburse the funds within 10 years? However, is there any lee-way because she inherited before the Secure Act?

Cheers,

Dawn

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is nothing in the SECURE Act that affects this old of an inherited IRA.

"If I understand the changes correctly under the Secure Act, non-spouse beneficiaries can no longer take that option and must disburse the funds within 10 years?"

That applies for someone who dies Now. Not back in 2017. Your client's IRA has already passed to this person.

Just like someone who was already 70 1/2 and taking RMD would not then completely stop and start again at 72 (setting aside that everyone gets a forgiven skip year of 2020), just because the new start date is 72.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you. She will be glad to know she is not under the 10 year guideline.

Have a wonderful day,

Dawn