- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: How to enter sales of capital assets from a 1099S to reflect on a Sch D

How to enter sales of capital assets from a 1099S to reflect on a Sch D

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On returns 2019 and prior you could enter the sale of assets (not business related) on a Capital Gains Tax Worksheet and it would flow to the Sch D. Where can I enter 1099s information for sale of land, not business related or investment related so it will go on the Sch D?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Could have sworn I just the same question on Friday or Saturday, did you ask it using another UserID? Heres the answer again.

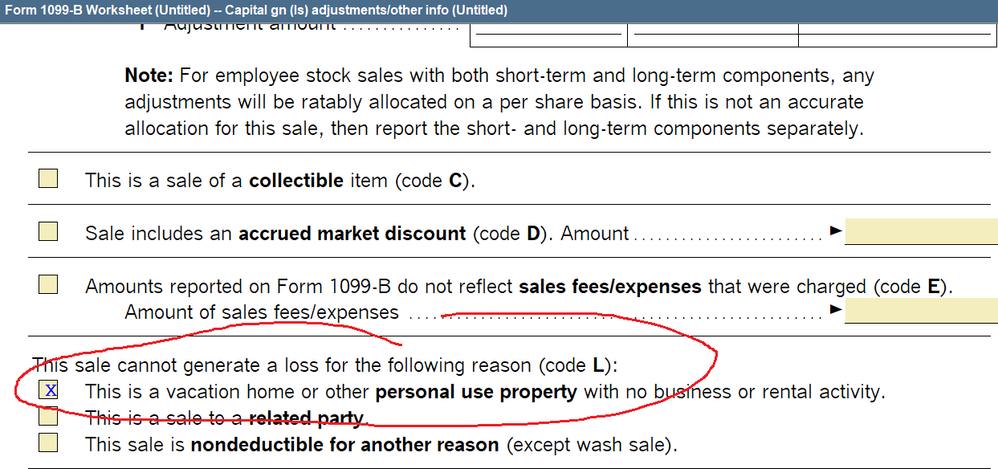

Sch D, use the 1099B worksheet, enter in the Entry Table, then double click on the description box that will open a window that has a box to check for personal property, so it disallows any loss.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Could have sworn I just the same question on Friday or Saturday, did you ask it using another UserID? Heres the answer again.

Sch D, use the 1099B worksheet, enter in the Entry Table, then double click on the description box that will open a window that has a box to check for personal property, so it disallows any loss.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

And Lisa is Right that Pro Series could do us a favor and change the name of the 1099-B worksheet to Capital Gain and Loss worksheet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you so much. No, it was not me, but I appreciate the help. I wish it would go back to how it was in the 2019 software. It was easier to find then.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, it would be nice, that was an option in 2019, would be nice to have that again. Thanks.