- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Form 8288-A

Form 8288-A

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I routinely have foreign sellers of real estate and ProSeries now allows us to enter the FIRPTA withholding through the "Form 8288-A Wks". However, whenever the withholding agent (Buyer) is an individual, I receive an error message that the Withholding Agent's FEIN is invalid. It also defaults to an EIN mask. This is clearly a programming error. Does anyone have a work-around for this?

Thanks.

Sebastian

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I wonder if it's an IRS requirement. They protect their e-filing parameters like state secrets, but if they're telling Intuit not to send anything but EIN's, that's what the program must require. Isn't there an escrow agent involved in these deals? Maybe that's the EIN that is needed. The whole point is to match the amount reported with the amount collected from the paying agent.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is the misconception that somehow the title company/law firm that acts as Settlement Agent is the Withholding Agent but that is not the case. The Withholding Agent is the Buyer or Transferee in the transaction. This can be an individual or an entity and in my case(s) the individuals are properly listed along with their SSN's. It's just that Pro-Series won't allow that information, thereby requiring paper filings.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Or there may be the misconception that the Settlement Agent is not the entity that writes the check to the United States Treasury. The purpose of requiring the EIN of the withholding source is so that it can be matched to the return filed by that company. Does the buyer send a tax return to the IRS with the money? I don't know what form that would be, that only requires an SSN.

In any case, I wouldn't blame Intuit for a programming error. Their fault seems to be a lack of interest in explaining their hands are tied. They are just following orders, on what IRS will allow.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Bob,

There is no misconception on my part. I own a Title Company as well as a CPA Firm and my clients are predominantly foreign nationals who deal with real property here in Florida.

The withholding "source" is the Buyer (Transferee), who reports the withholding on Form 8288 which is the Buyer(Tranfereee)'s Tax return, which attaches Forms 8288-A's for the Seller(s). (Analogous to W-3 being remitted by an employer with W-2's being issued to employees).

This is straightforward a programming issue that needs to be resolved (similar to the 1042-S Submissions that are possible with ATX but not Proseries).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So it's another case of socialized software -- thousands of users should pay for a feature that half a dozen people might find useful. But, to make my question clear, who writes the check to IRS? The title company that has an EIN? If that's how it works, then it's not a programming error, it's an IRS error in instructions and procedures.

A few years ago IRS had a real problem with phony refunds being issued on 1040-NR returns that claimed fantasy withholding. If IRS won't accept electronic 1040-NR returns claiming withholding that can be matched to 8288 forms, that's just their way of protecting the revenue. The 1042-S requires an EIN, so don't compare it to the 8288. If you find another software that allows electronic filing with an SSN, then buy it and tell others where it can be found.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't think there is any use in continuing this discussion. I asked if there was a work-around and the answer appears to be "no". You trying to argue with me about who remits funds without having any clue as to how these things work is just wasting my time. Thank you for your input. Let's call it quits.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just spent about fifteen minutes with a customer servicerep and could not get anywhere. I suggested ProSeries should simply allow for an override on this line.

We sign the return and we take all the responsibility and should be allowed to to override the entire return if we so wished.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Sebicap,

I use Pro-Series Pro. I don't know if you ever got a clear answer to your question. I deal with a lot of 1040NR. In fact, that's 90% of my clients and I think I may have a workaround for you.

Here is what I do on the 8288-A Wks when I have a FIRPTA withholding that results in a refund to the client of the excess withholding. I still manage to E-file and the IRS refunds the money directly on the clients bank account.

By the way, this process works whether or not I/the client have received back from the IRS the stamped Form 8288-A. In circumstances when I don't have it, I simply use the Final Settlement Sheet (or HUD-1 on some states) issued by Escrow. On it, it shows the amount of the FIRPTA Withholding.

For privacy reasons, the IRS blacks out the Withholding agent TIN.

Use "11-11111" as the substitute TIN for the withholding agent's tax ID. It makes no difference if it is an individual with an SSN or an ITIN who does the withholding, or if is it a company with an EIN.

You will get an error message. That's ok. You want that error message.

Once you've completed all the other steps related to preparing the file for e-filing, do the final review. The only error message that remains should be the error related to the wrong TIN for the withholding agent.

Next steps are on the E-filing Center:

- Your e-file MUST have an attachment to it. Attach a PDF of the cover letter and the Form8288-A received from the IRS to your client file. In the attachment dialog box, select "Other" for the type of the attachment, then insert a description of the attachment. I typically use "LastName_Form 8288-A". When you use the HUD-1 from Escrow, the same description applies.

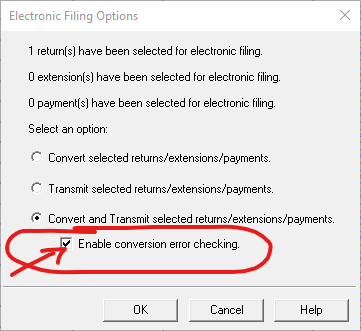

- Start Electronic Filing process. On mine, the dialog box shows that the "Convert and Transmit selected returns/extensions/payments" option is selected. Below that, there is another line with a checkbox for "Enable conversion error checking". I UNCHECK that box.

- Then I proceed to E-file. The software processes the E-filing file without performing the error check.

I've done this several times on multiple year versions of Pro-Series, including today on Pro-Series22 without issues. Hopefully, it works for you too.

Franck K

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ingenious! IRS really isn't looking at any attachments, they just want to stop the casual fraudster who would attach something like his cousin's wedding invitation.

Which, of course, would work just as well.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You may enter the SSN of your client directly in the EIN box.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you, Franck!

Makes perfect sense to use 11-11111 for the TIN

Dr. Charles Hills, JD

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How for my client to recover FTW with which form 4797 Schedule D?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

4797 is for property used in a trade or business.

Schedule D is for investment or personal use property.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where do i enter form 8288-a? pls help

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Form 8288-A worksheet is a form of Form 1040 NR in pro series professional.