- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Form 7202

Form 7202

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

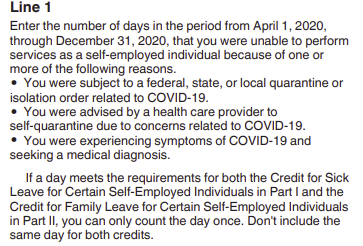

The instructions read

"You were subject to federal, state or local quarantine or isolation order related to COVID 19"

Does that mean when my county went into lockdown back in March/April for 3 weeks, those self employed people that didnt work during that time would qualify for this?

I broke the lockdown and came to work anyhow (I could quarantine here alone in my office just the same as at home), so it doesnt apply to me, but Im sure some SE people didnt leave their homes during that time and couldnt go do their job.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- wrote:The instructions read

"You were subject to federal, state or local quarantine or isolation order related to COVID 19"

Does that mean when my county went into lockdown back in March/April for 3 weeks, those self employed people that didnt work during that time would qualify for this?

Yes. Well, sort of. Their must have been work available to be done (see below, including the link to Questions 23-27).

This is worded towards being an employee, but the same rules apply:

How do I know if I can receive paid sick leave for a Federal, State, or local quarantine or isolation order related to COVID-19?

For purposes of the FFCRA, a Federal, State, or local quarantine or isolation order includes quarantine or isolation orders, as well as shelter-in-place or stay-at-home orders, issued by any Federal, State, or local government authority that cause you to be unable to work (or to telework) even though your employer has work that you could perform but for the order. You may not take paid sick leave for this qualifying reason if your employer does not have work for you as a result of a shelter-in-place or a stay-at-home order. In the instance where your employer does not have work for you as a result of a shelter-in-place or a stay-at-home order, please see Questions 23-27.

https://www.dol.gov/agencies/whd/pandemic/ffcra-questions#60

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lockdown or "stay at home" order isn't the same as quarantine.

From the CDC:

"Quarantine is used to keep someone who might have been exposed to COVID-19 away from others. Quarantine helps prevent spread of disease that can occur before a person knows they are sick or if they are infected with the virus without feeling symptoms. People in quarantine should stay home, separate themselves from others, monitor their health, and follow directions from their state or local health department.

Quarantine keeps someone who might have been exposed to the virus away from others.

Isolation keeps someone who is infected with the virus away from others, even in their home."

My State is handling the qualification for SE unemployment (pandemic funds) as "were you impacted because of..." and then a list of things which is a little different, yet.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So what would be considered a federal, state or local quarantine?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Check with Austin. I edited it to correct some formatting and then got this message:

This reply was marked as spam and has been removed. If you believe this is an error, submit an abuse report.

I'll send you something privately.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- wrote:The instructions read

"You were subject to federal, state or local quarantine or isolation order related to COVID 19"

Does that mean when my county went into lockdown back in March/April for 3 weeks, those self employed people that didnt work during that time would qualify for this?

Yes. Well, sort of. Their must have been work available to be done (see below, including the link to Questions 23-27).

This is worded towards being an employee, but the same rules apply:

How do I know if I can receive paid sick leave for a Federal, State, or local quarantine or isolation order related to COVID-19?

For purposes of the FFCRA, a Federal, State, or local quarantine or isolation order includes quarantine or isolation orders, as well as shelter-in-place or stay-at-home orders, issued by any Federal, State, or local government authority that cause you to be unable to work (or to telework) even though your employer has work that you could perform but for the order. You may not take paid sick leave for this qualifying reason if your employer does not have work for you as a result of a shelter-in-place or a stay-at-home order. In the instance where your employer does not have work for you as a result of a shelter-in-place or a stay-at-home order, please see Questions 23-27.

https://www.dol.gov/agencies/whd/pandemic/ffcra-questions#60

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yeah, don't edit things more than once or it goes to spam.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

One of my clients that has an auto repair shop, he had to close and his guys sat home for weeks due to the county shut down (they had plenty of work!) he paid them for the first 2 weeks and we took it as FFCRA on his 941 then after the 2 weeks, they went on unemployment.

So by what qb stated above, I was kind of panicking that they werent entitled to that sick leave, but it seems like my interpretation is correct.

Thanks Bill!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the employer or business has no work to perform, you are unemployed, not on sick leave. If you have work to do but can't do it due to being sick or caring for someone else, that would meet the leave rules. At least, that's how it is worded here, for purposes of unemployment and SE pandemic Unemployment qualification.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As QB pointed out, I think the employees or the owner might not qualify (if I'm reading your post correctly, but I'm not sure of the exact rules the CA had). Many of these FAQs were written well after the shut-down.

If the government shut down the actual business itself, there is no work available, and therefore no sick leave ("may not take paid sick leave ... if your employer does not have work for you as a result of a shelter-in-place or a stay-at-home order")

If the business was allowed to be open, it gets more confusing and more of a "gray area", especially for a self-employed person.

You may have gotten it already, but I did send you an email that is loosely based on this question you posted.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I understand. The one I was worried about was an auto repair shop that I took the FFCRA on his 941, he had to let numerous cars sit in his shop waiting to be fixed because the county shut everyone down and his employees had to sit home.

He, the owner, was still at the shop working, but he had way more work than he could handle himself. He needed his guys back.

I haven't had any SE clients come in for returns yet, Im just trying to make sure I have it clear in my head how it works.

For example, if I have a self employed carpenter in the middle of a residential job when the lockdown happened and he couldn't continue to work at the job because of the lock down, he could potentially qualify for this.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Here is what my State Dept Labor and Industry (the Fed DOL has their own list) has for SE:

Who Is Eligible for PUA Benefits?

You may be eligible for PUA unemployment benefits if you are not covered under regular unemployment and you are otherwise able and available to work but due to specified COVID-19 related reasons, are currently unable or unavailable to work.

- You are self-employed, an independent contractor, or not otherwise eligible for regular unemployment benefits.

- You have been diagnosed with COVID-19 or have symptoms of it and are trying to get diagnosed.

- A member of your household has been diagnosed with COVID-19.

- You are providing care for someone in your household diagnosed with COVID-19.

- You are providing care for a child or other household member who can't go to school or a care facility because it's closed due to COVID-19.

- You are quarantined or have been advised by a healthcare provider to self-quarantine.

- You were scheduled to start a job and no longer have the job due to COVID-19, the offer was rescinded, or you can’t reach the job.

- You have become the primary earner for a household because the head of household died as a direct result of COVID-19.

- You had to quit your job as a direct result of COVID-19.

- Your place of employment is closed as a direct result of COVID-19.

- You had a previous unemployment overpayment or something similar.

- You meet other criteria set forth by the Secretary of Labor.

There is another question in the list on the PUA site along the lines of "I am a gig worker and cannot do my job..." and that is the one I keep checkmarking for my spouse, a "non"performing musician, thanks to the pandemic.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- wrote:Im just trying to make sure I have it clear in my head how it works.

It is still confusing to me. 🤔

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"if I have a self employed carpenter in the middle of a residential job when the lockdown happened and he couldn't continue to work at the job because of the lock down, he could potentially qualify for this."

If that is just work-related, my State put construction on the Essentials list. If that is because, for instance, there is no Child Care available for that person's child while he works, that would fall under FFCRA.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Right here: "You were scheduled to start a job and no longer have the job due to COVID-19, the offer was rescinded, or you can’t reach the job."

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just came across this site, which was updated Jan 28:

https://www.irs.gov/newsroom/special-issues-for-employees

Ignore that title; the bottom half is SE Q&A and the FFCRA sections 7002 and 7004 and form 7202 are pretty thoroughly covered in it. So is the 50% SE tax.

Hope that helps.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm self-employed and I did not take sick leave or family leave for COVID-19. My business was closed by State executive stay at home order 4/1/2020 to 6/19/2020. This was 47 of my work days I had to cancel my massage clients. I also received pandemic unemployment assistance (PUA).

Do I qualify for the tax credit based on just the days I was not able to work? (entered in line 1 of form 7202)

Does getting PUA make me ineligible for the tax credit on form 7202?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Anonymous

No one can answer this for you, here, if you are not using ProSeries to prepare your clients' tax return.

You seem to be lost on the internet.

You’ve come to a Peer User community for Intuit Tax Preparation products supporting tax preparation professionals using ProSeries, Proconnect and Lacerte , and you may be looking for support as an individual taxpayer. Please visit the TurboTax Help site for support.

Thanks.

Don't yell at us; we're volunteers