- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Form 1116 Schedule B prevents e-filing

Form 1116 Schedule B prevents e-filing

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Supposedly, form 1116 was going to become available on (today 3 March). However, the new schedule B does not seem to available so effectively if you have any carry forward foreign tax credits you cannot e-file. Is there any way around this? For example by attaching a PDF version of Schedule B?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maybe it's best to wait until the end of today to see if the form is updated? The form update day is March 3.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

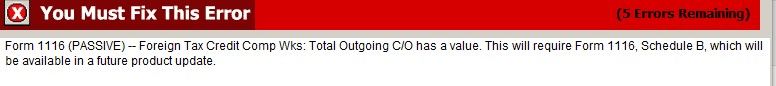

The March 3rd, 2022 date was for the main 1116, but if you need a Schedule B - there was no specific date given. Attached is a screenshot of the message - which indicates NO SPECIFIC UPDATE date.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

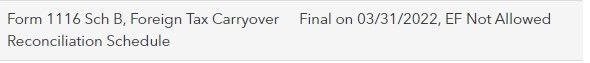

Just noticed on their latest forms availability page that Form 1116 Schedule B will NOT be available until 3/31/2022 and will mean that you will NOT be able to eFile!! (Neither on the Basic nor the Professional Proseries).

Drake Software seems to be ahead of the game on this - as they have this sorted out already. What's going on with Intuit Proseries??

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Follow up from ProSeries rep (which is NOT acceptable...)...

"I was informed from our Product Specialists that EFile will not be supported for 1116 Schedule B form. All 1116 Schedule B in ProSeries are paper file only. If you do have any further questions regarding how to file this return, please contact our Technical Support team and they would be able to assist you in better detail."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Utterly disappointing. Left in a lurch - this late in the filing season. E-filing essential, especially with pandemic, impossible to get through to the IRS, so, unable to check status on returns, as most online tools for taxpayers are not available for Americans abroad. At least if you e-file, fast, and you have confirmation of e-filing.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So does this mean we have to paper file (mail in) all tax returns with Form 1116 Schedule B?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That is my understanding based on what our proseries rep said....which is just unreal.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Unfortunately, yes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Unbelievable. I posted my same frustration earlier today on the ProSeries Support Group on Facebook. Here's one response I got from another user:

"Here is what I did. Go to 1116 Comp worksheet enter the carryover amount in disallowed column, error goes away. Lose the carryover for current year but maybe can be re-entered in a later year and hopefully form can be e-filed then. No way I am waiting until 3-31 to file a return by mail for a small carryover. Just my 2 cents."

I'll have to think about the risk that the IRS won't like me re-entering it in a later year.

BTW, I just found on the IRS website that the PDF of Schedule B was issued last December. So why isn't it available for efiling?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What do you think about this idea? Create a PDF of the Foreign Tax Credit Carryover Statement, which still prints out. Attach the PDF to the tax return. Then in ProSeries enter the carryover amounts in the disallowed column to make the error go away.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Great practical solution!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I completed the 1116 sch B on pdf, attached to tax return and labeled "other" "Form 1116 sch B"

I entered negative figures to zero out the carryforward on the proseries worksheet, which is just a worksheet and doesn't go to the IRS.

After I efile, I will go in and delete the negative entries. When proseries adds sched B, it should autopopulate and carryforward correctly to 2022. If Proseries can be counted on.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Will try that and see if it works!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just got this note from my Intuit rep:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is a big problem!!!!!!!

I hope Pro Series is aware how much trouble this is causing.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have done the same. Just follow the errors and override the carryover totals. I did not enter a negative number here. Zero worked and is quite easy to reverse. The ones I have filed have been accepted. In most cases this will have no effect on the amount of the credit.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does the Carry over information flow thru to IRS? If yes, it could be a MESS in 2023 explaining why FTC C/O reappears

Agree Paper File is NOT an option

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Stupid that a PRO SERIES is so far behind on Foreign Tax Credit.....

Drake Software seems to be ahead of the game on this - as they have this sorted out already. What's going on with Intuit Proseries??

Maybe DRAKE NEXT YEAR

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

31 MARCH is INSANE!!! TOO LATE IN THE SEASON

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

31 MARCH is next UPDATE

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

March 4 - CANNOT E-FILE Form 1116.

"Schedule B" update - 31 MARCH

DRAKE'S Form 1116 is e-filing just fine, apparently.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Proseries is so far behind. Need to try out out other products now.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ya that won't work. I have a $59,000 credit which must be used in the current year, then excess carried back 1 yr., and then the remaining carried forward 10yrs.

This might as well be called "Turbo Tax"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Update: Form 1116 Sch B, Foreign Tax Carryover Reconciliation Schedule is now estimated to be ready for print on 3/10.

Although Form 1116 Sch B is not supported for e-file, you will be able to E-File returns with the 1116 Schedule B attached as a PDF, once that form is finalized.

For more information, please see our ProSeries Release dates page.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Guess the next question is - for those who have manually adjusted and e-filed already - what happens once 1116 Schedule B is actually released for e-filing. If you didn't use it, then, would it create issues for 2022?? If not, what needs to be done - especially if we didn't undo the manual adjustment after e-filing?

Hope they think these things out IN ADVANCE NOW - and provide guidance - vs waiting until the problem is detected...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do you know if Drake added the Sched B to the software?...or just has a PDF attachment work-around like Proseries plans to do?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Drake already had the following informational/tutorial page set up:

It looks like you have to still attach the PDF, but that it will be automatically generated, once you go through the various inputs.

Because of time needed to go through the learning curve on a new software - thinking is to shift over with the next tax season. Have noticed that other firms were better prepared and faster in getting their software e-file ready than Proseries. Even if they have the forms, for example for PFICS 8621 - not all the functionalities are integrated into the system, where you would be able to e-file for all scenarios - especially for the more complex ones. So, a lot of manual inputs, adjustments, etc. - as well as having to paper file.

Sense that Proseries lags when it comes to having especially new or more complex scenarios/forms. If your business is mostly for simple straight forward returns for those based in the US, or for those based abroad but earning less than the FEIE, then, good software, but if not, then, not always dependable, and quite slow on the take.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

thx for this!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Unfortunately, still not there today 3/10/2022 - which is the date that they have when I double checked just now.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is updated on ProSeries but not Basic as if yet

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Once the Form 1116 Schedule B is attached, do we need to delete the Form from the return? It appears to pass the review with the Form still included in the return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

According to everything I have read you don’t need to delete the form just make sure you include it as a .pdf

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you. We'll try it!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am having the same e-file rejection for the 1116 Sched. B attachment as a pdf. Upon closer inspection PS titles the attachment as 2116 Sched B. I wonder if the 2116, versus 1116 is what is causing the e-file rejection?!?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

when you mark off (in the drop down list)form 1116 … schedule b automatically shows up in the description. That is where you are suppose to be putting the pdf. Anything else and the tax return will be rejected.

I don’t think there is a form 2116.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Question: Do you need to print out and attach 1116 Schedule B before e-filing? Ask, as when I look at the Print menu/Filing Copy - 1116 Schedule B is already checked off.

Many thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, you need to attach the schedule by printing and scanning. The schedule shows up in the list but is not eligible for efiling only mailed in returns. If you do not attach the schedule the return will be rejected.

when you attach the drop down menu will have form 1116 as a choice. Once you choose that Schedule B will automatically show in the description.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Many thanks!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Brilliant! Your careful instructions saved my tax return. I submitted and it was accepted.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Shouldn't have to play around with the program like this for what we pay - I gave client paper return to file.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

March 21 now. Form 1116 Schedule B is in the return and a PDF of it has been attached to the e-file return.

Still being rejected. What else can I do?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When you attached… did you indicate form 1116. If you did.. description for schedule B would show up.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

file paper return and get it over with 🙂

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I had it attached as "other" and typed in the description Form 1116B, but it was rejected. I tried to change the choice to Form 1116 (wasn't there when I had first attached the 1116b, but was by the time I received the 8879 back). It appeared to change it, but e-file was rejected again. I had to remove and reattach the pdf and select Form 1116 as type and it worked.

I hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Further 'glitch' that needs fixing.

In some cases, AMT carryover amounts from prior year is NOT showing up on line 10 or going through and producing a 1116 Schedule B AMT!! Not the case that it is not showing up if not being used.

Proseries/technical - please FIX this!! 1116 Schedule B issue - NOT FULLY RESOLVED!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I can pdf and attach the 1116B for the carryover of the general type. How can I attach the 1116b for passive type and the amp carryover? You could end up with four attachments easily. Sop far I am able to make one attachment???????????????????

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maylane, I just add other Form 1116 Schedule B as "Other" then describe on the right side