Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Be sure to check out & bookmark our Everything you need to know about electronic filing page. View the site.

Be sure to check out & bookmark our Everything you need to know about electronic filing page. View the site.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Estimated Federal Taxes

Estimated Federal Taxes

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

meenan89

Level 1

04-08-2024

06:34 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good morning,

I have a client who is paying her 2023 tax due in a single payment yet her tax file is showing estimated payments even though we didn't opt to make estimated payments for 2024. Can the IRS automatically debit my clients account for the estimated payments?

Thank you

Labels

2 Comments 2

Level 11

04-08-2024

07:02 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

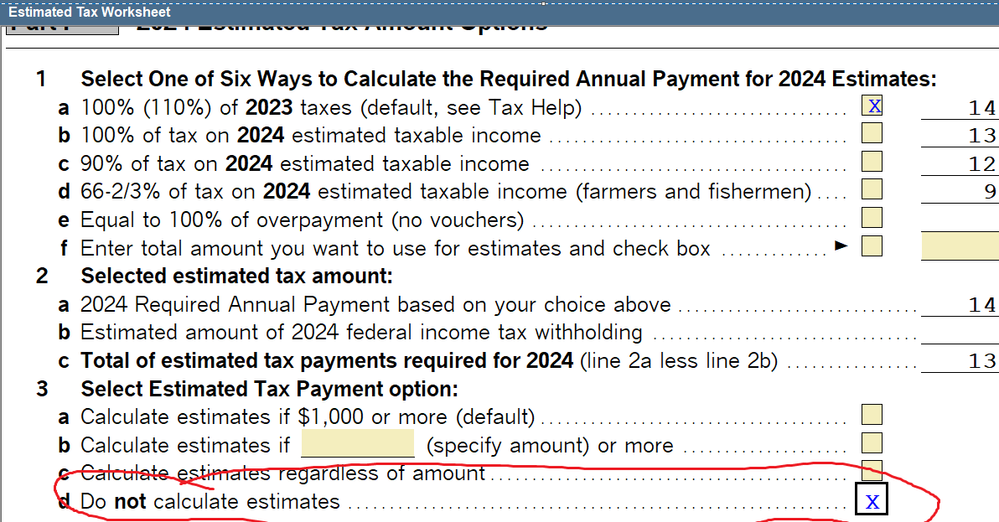

Those vouchers that populate are just suggested vouchers.. you can check the box on the 1040ES worksheet to turn them off.

Level 15

04-08-2024

07:23 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, they wont auto debit those unless you checked those boxes on the 1040ES worksheet.

You can turn off those ES vouchers by checking this box.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪