- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Error message for Form 1099-Misc with other income linked to Schedule C

Error message for Form 1099-Misc with other income linked to Schedule C

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

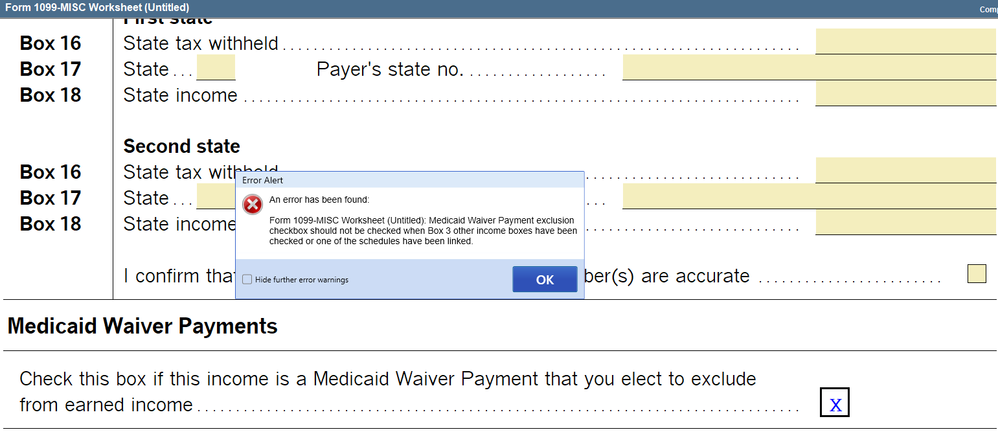

I have a client with a 1099-Misc where the amount is reported as other income. It is actually SE income, so I have linked it to a Schedule C. When I finished the return on Monday, there were no error messages. Now it says "A link to Schedule C should not be included when the MWP qualifying as Difficulty of Care payments exclusion box has been checked". I assume this is just a weird programming thing in ProSeries that will be fixed. Anyone know where the box to which it refers is located in the software? I can't find it. I know I have ways around the problem, but I would like the software to do things correctly.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We're currently working on this fix, if there's an update available feel free to test this out.

Some of our product features are connected to TurboTax functionality, so if you see a fix here it will hopefully reflect in the TurboTax program as well.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"MWP qualifying as Difficulty of Care payments exclusion box has been checked"

I know the W2 has a new checkbox for this, I dont see it for the 1099MSIC.

You sure you dont have a W2 that the statutory employee box, page 2, Part I (would create a Sch C) and the MWP box, Page 2 Part VI (would create that error) got checked down near the bottom of the W2 worksheet?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am positive I do not have that situation. This is specifically on the 1099-Misc. It wasn't an error on Monday but is today.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I HAVE THE SAME PROBLEM - what is an MWP?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

MEDICAID WAVER PAYMENTS

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Must be some weird issue that rode in on an update yesterday (late Wed, early Thurs is when updates go out), Id ditch the 1099MISC worksheet and enter the income direct on the Sch C.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ohhh, scroll down to below Box 18 on the 1099MISC worksheet, theres a Medicaid Waiver box there, its not checked, right?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

when that box is checked, I get the error...maybe check it then uncheck it?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Same exact issue here. I was in the client yesterday and no issue. Go to finalize this morning and this error.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't even have that box as an option on my worksheet....

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Late February programmer motto: "If it doesn't need fixing, let's break it!"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I deleted the 1099 MISC and put the income on 1099 NEC and got rid of the error - what a waste of time.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

on the 1099-MISC and 1099-NEC worksheet, there is a check box for MWP. Are you sure it's not accidentally checked on your return?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That box is NOT checked on any of the W-2s in the return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Exactly. That is why I believe it must be a crazy random ProSeries error.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That box is NOT Checked. I even tried deleting the 1099 and reentering it. I only completed FEIN, Payor name, Box 3 amount and Linked it to the Schedule C. It has to be a weird programmiing error!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The MWP box does not exist on the 1099 MISC worksheet. This error started after a software update last night.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Looks like this is a hiccup with the last release.

We're looking into it and will keep this thread updated.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That picture of the Medicaid Waiver line with the checkbox - does not exist in either the 1099 MISC or 1099 NEC worksheet after the software update that downloaded last night 2/22/2023. So, clearly the software checked the box causing the error, and there is currently no way to uncheck that box.

Intuit needs to fix.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A lot of folks find posts and add to them, but not so many actually read what is posted by others. 😳

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am having the same issue here as well.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Jeff.... no kidding... you would think I'd realize that by now.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Looks like this is a hiccup with the last release.

We're looking into it and will keep this thread updated.

Sure glad this thread is going to be updated. It is so reassuring to know Intuit does not want to keep us in the dark. Those updates we got on Forms 8960 and Forms 8915 were so informative and timely...oh wait, never mind.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

IntuitGabiU--Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Exactly!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Frustrated-in-IL - But it is so much easier for Intuit to just assume that everyone that uses their software reviews every post here everyday than it is to actually provide its users with a list of known issues. Funny after all of this time nobody has suggested to Intuit how nice it would be to have a nice list of known issues. 🙄

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As a side note, that sucks. I'll have to go back and update my list.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have the same problem and it started with the overnight update.

Looking forward to the fix.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This problem is also in the Turbotax Home and Business version. There is no box to uncheck!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Kyote this isnt Turbotax support, sorry.

Im really surprised that so many people enter 1099s for Sch C, I've never done that, I just enter all the business income directly on the Sch C

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi. Any updates on this? The rep I'm speaking with has no clue how to solve this. Keeps telling me to uncheck a box that does not exist in my software. The issue did not exist a few days ago and the error popped up today. I don't wan to enter a 1099-MISC as a 1099-NEC which seems to solve the issue but I don't want to create a problem for my client in the future.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

the box that needs to be unchecked disappeared in this weeks update... why are people using the 1099 worksheet, I just enter total business income directly on Sch C.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi, how do we override the MWP 1099 S error. I see all the posts and yes this error started due to the release. Does Intuit monitor these errors? I can't figure out how to post it directly on the Schedule C. Do I need to provide the payer's TIN when reporting income for the client on their Schedule C. My client makes the 1099 income from one payer? Appreciate your responses.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi - regarding the MWP error - I solved it by deleting the 1099 MISC and putting the info on a 1099

NEC

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yep, i logged in tonight to submit my H&B 1099 and boom. now im in the **bleep** loop with 2 of my 1099's. I have 8 or so NEC's, no issue. These 1099 Misc's are causing this issue. Now I wait until a NEW update fixes this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Stupid question #1,253,668 - why are so many people entering 1099s into the software? They aren’t like a W-2 - they don’t get transmitted with the returns. Just enter the total revenues on schedule C or wherever the income belongs and move on with life.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I also have the same problem using Home and Business version. 1099MISC. I was on the phone with a rep from TurboTax for over 2 hours today. She could not even help me. We deleted the 1099MISC and reentered it. She had me uninstall Turbotax / clear my computer cache/ power computer down/ turn back on and reinstall Turbotax. The Error was still there. So I started a NEW return and just entered a 1099MISC and guess what? The same error showed up! I sure hope they get this corrected!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Others say just enter as 1099NEC. No, I will wait until a new update resolves this. It is my tax return and I don't need the refund (only 1k), so no biggie. Got time.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

You’ve come to an Intuit site supporting tax professionals, and you may be looking for support as an individual taxpayer. Please visit the TurboTax Help site for support.

Cheers!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

You’ve come to an Intuit site supporting tax professionals, and you may be looking for support as an individual taxpayer. Please visit the TurboTax Help site for support.

Cheers!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sometimes I act a little silly and think we are using a forum for professional tax preparers——— how goofy is that 😮

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN wrote:

Stupid question #1,253,668 - why are so many people entering 1099s into the software? They aren’t like a W-2 - they don’t get transmitted with the returns. Just enter the total revenues on schedule C or wherever the income belongs and move on with life.

Ummm - they aren't tax professionals?

Ummm - no concept of basic double entry accounting/bookkeeping and income tracking?

Ummm - unclear on IRS reporting requirements/needs?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Well, it is a bit late in your neck of the woods - perhaps that's why you are being silly?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am experiencing the same problem. Error message received: "A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked."

Turbotax, can you get on this ASAP? I've got an underpayment of taxes issue (first time self-employed - oops) and the longer I wait apparently the more I'll have to pay.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

WOW people. I feel like I am looking at Facebook. I came here looking for an answer to my question and most of these answers just chastise me for the way I choose to prepare returns. If you don't have an answer to my direct question, just scroll on by!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This isnt TurboTax support, youre in the wrong place.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Turbotax, can you get on this ASAP

As this is NOT TurboTax - maybe you should wander back over to that forum for your suggestion that they get on it?

This is (supposed) to be a forum for tax professionals, not DIYers.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Me too!!!!!!!!!!!!!!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We're currently working on this fix, if there's an update available feel free to test this out.

Some of our product features are connected to TurboTax functionality, so if you see a fix here it will hopefully reflect in the TurboTax program as well.