- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Electronic extension got lost

Electronic extension got lost

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I filed my electronic extension for a client on 4/15 and I have the 9325 to prove it. Now ProSeries says the extension is "in process" and "has not been filed", and will not allow me to electronically file the completed return. I lost extensions twice last year and paid penalties because I couldn't prove it. This time I kept the 9325 (which has also disappeared from the return). How do I convince ProSeries that the extension was accepted?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

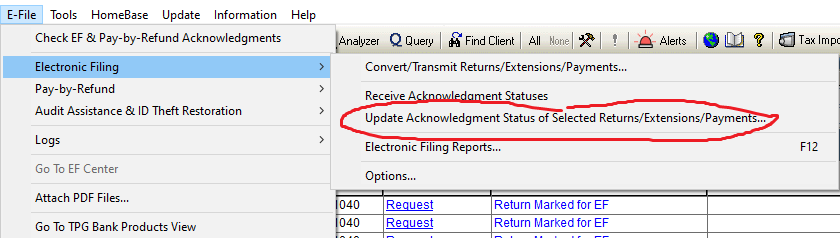

Switch the names back to how the extension was filed, then go to the EFCenter, highlight the file, and use this option to pull the ack back in.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I did not unclick it. What I DID do was switch the taxpayer and spouse names. I filed for the extension under the scenario of husband-taxpayer and wife-spouse, but when I started doing the return, I remembered the husband died on January 6, 2021. The taxpayer now is the widow, and the spouse is the deceased husband. The names and social security numbers are in different places, but they are the same names and socials. The location name of the file is the same as it was. An extension is filed and approved. How do I FIX THIS so I can efile this return?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Switch the names back to match how you filed the extension.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Anything is worth trying, but, not unexpectedly, it didn't work. The extension has still not been filed, the 9325 that I have with the names, addresses and social security numbers of this client is nowhere in the return now, Filed extensions REALLY shouldn't just vanish. Nothing filed should vanish. I couldn't prove last year that this is what happened so I paid the penalties, but this year I can prove it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Switch the names back to how the extension was filed, then go to the EFCenter, highlight the file, and use this option to pull the ack back in.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

THANK YOU! It came back!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

One additional bit of information, as this appears to be a chronic problem. You have to open and save the return before selecting the update acknowledgment status. (I have no need to change anything in the return. I just re-save it.)

I just e-filed a large batch of returns and, halfway through, I noticed that many of my returns had their e-file statuses re-set to before the extensions were filed. Forms 9325 were blank until I opened the returns, saved them and then updated the e-file status. If I just tried to update, the software indicated that there were no pending e-filings that required updating.

Same thing happened last year. This is very troubling.