- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: E-filing CA SME where sole member is another LLC

E-filing CA SME where sole member is another LLC

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In another post I had an issue where an EIN for the sole member of a SME was invalid. With the help of @Just Lisa Now and my own research I realized filing a 1065 for a SME is unnecessary and in fact impossible.

However, I have also determined that I still need to file a CA form 568 after looking at CA website. Intuit instructions in an article posted here dictate that the data should originate in the taxpayer's schedule C, E, or F.

However, in this case, the sole member is another LLC so none of these forms exist. They file their own 1065. Is there a way for me to link the data there or otherwise file the original return with California? I would rather not have to mail this stupid thing.

thanks

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, as stated, I do have a few pointers.

And I always LOVE to give suggestions that's "better than nothing"....

Now, don't get too frustrated here when (1) your post is sliced and diced and every typo, misuse of word, or contradiction-in-appearance (because you're dealing in different contexts with points that should be understood / deciphered by others) is analyzed and dissected to the kingdom come; or (2) your issues are taken off on a tangent with sub issues and possible sub-sub-issues are further analyzed and sliced and diced.

Sometimes, you'd see someone asked a simple question, and the discussions got more and more convoluted and more and more off the tangent from what the Asker needed. (That would be when @Just-Lisa-Now- say she'd out while the others are getting more and more charged up. But that'd be a different story.)

In any case, I'm always glad to have such enthusiasm here. Had we been medical doctors instead, patients would come in with plantar fasciitis and walk out with a kidney transplant...

Back to filing CA F568 for SMLLC of which the sole member is a pass-through entity. I wouldnt say these are solutions, but for what it's worth...

1. Lacerte (likely PS) supports efile for SMLLC in individual module ONLY. Ideally, in your case, SMLLC (LLC A) would be efiled in the PS module under LLC B's PS (F1065) filing. Sorry, NOT available in Lacerte.

2. Consider this approach:

a. Prepare LLC A's 568 filing as part of Partner Y's 1040. (One of the @Just-Lisa-Now-'s earlier response seemed to indicate SMLLC efiling is available for 1040 in PS.)

b. Manually enter the info for "Total income from Form 568" for Sch IW. Because the income for LLC A was reported under LLC B and NOT Y's 1040, you would not be able to pull the total income info directly from Y's data.

c. CA is concerned about Total income because that's used to determine the LLC fees.

d. Update the payment info.

e. Enter the "Sole Owner" info to show LLC B. The TIN and FEIN have to be changed and not Y's info. Review the info carefully. Because the info is off Y's file, you need to make sure all info is correct and the Sole Owner reflects LLC B. (Lacerte has a section under "Sole Owner" for this)

f. Question Q can't be overwritten. Lacerte checks the NO box and can't be changed to Yes. I attach a NOTE to state that due to software limitation, it was checked No, but the answer is Yes.

g. In the above software limitation note I also disclose the Sole owner is a Pass-thru entity and not individual (the owner entity info - printed above the signature line - can't be changed in Lacerte).

That was how I approached it. So far FTB has not yelled at any of my clients.

One thing important: The due date for F568 for SMLLC owned by a pass-thru entity is generally 3/15 and NOT 4/15. Mine are all write-up or compilation clients of mine. As soon as Dec financials are done, I'd file them and do NOT wait for the 1065 or 1120S, let alone 1040.

Hope the above could be the "solution" you're looking for. If not, add two words. Change this to "not much better than nothing.'

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@ejdtaxman wrote:

In another post I had an issue where an EIN for the sole member of a SME was invalid. With the help of @Just Lisa Now and my own research I realized filing a 1065 for a SME is unnecessary and in fact impossible.

However, I have also determined that I still need to file a CA form 568 after looking at CA website. Intuit instructions in an article posted here dictate that the data should originate in the taxpayer's schedule C, E, or F.

However, in this case, the sole member is another LLC so none of these forms exist. They file their own 1065. Is there a way for me to link the data there or otherwise file the original return with California? I would rather not have to mail this stupid thing.

thanks

Why does this sole member LLC file a 1065. I find this very confusing? Does this other LLC have more than one member/partner and if therefore must file a 1065? How many partners does it have? What type of business activity does this other LLC engage in?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maybe I did not write this clearly.

The LLC in question (lets call this LLC A) is a SME.

The owner LLC (call it LLC B) has multiple members. thus they file 1065 as a default.

So LLC A doesn't have to file any 1065 because having only one member/owner, they are exempt, or whatever, from such requirement.

LLC B has to file because they have several members.

Hopefully this is clear now. sorry for the confusion.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

the single member that manages LLC A is LLC B.

I know LLC A has to file a return. that is my quandry as pro-series seems like it won't let me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does LLC A file a 1040? Then the 568 will go along with the 1040 and the 540.

Make sure you install it or you wont see it as a choice when you switch from the 1040 to the state.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm sorry if I sound frustrated but I have written this multiple times.

LLC B is a multi member LLC and files a 1065. I assume what you meant is, does the owner of LLC B file a 1040, but in light of the above it should be obvious they do not.

The individual involved in all of these ventures (real estate if you are curious) files a 1040 and has the K1 from LLC B on his return.

He can't put LLC A as a schedule C because LLC B is the intermediary that owns LLC A.

I don't know if I can make this any clearer, but maybe there is something I am missing? I hope not because LLC B's return as well as the individual's has already been e-filed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is there where things are getting confused: "because having only one member/owner, they are exempt, or whatever, from such requirement."

There is no Exemption. There is "the right form." It goes somewhere.

"He can't put LLC A as a schedule C because LLC B is the intermediary that owns LLC A."

The non-partner LLC that is a Single-Member Entity, is Disregarded, or "pass through." If LLC B is the single member of LLC A, then LLC A's info goes on the LLC B filing, which is the concept as "disregarded."

"I hope not because LLC B's return as well as the individual's has already been e-filed."

Uh-oh.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does LLC A get a K-1 from the 1065 filed by LLC B?

If so LLC A would report in on the 1040 as a K-1 entry and from that info produce the 568 for LLC A.

Easy peasy, nice & easy?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Does LLC A get a K-1 from the 1065 filed by LLC B?"

I read it as the other way around.

Person(s) in multi-member LLC B. LLC B is sole owner of LLC A.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

this sounds correct, and is exactly what I did. LLC B gets the K1 from LLC A and lists it on their return. the end client, indivudual investor person that is the man behind the curtain, then puts K1 from LLC B on his return. sure, easy peasy. I already knew all this and this is how the returns were filed.

You still have not answered what I do with LLC A??? You unequivocally stated that LLC A must file a return, but have not stated HOW I file the return, so I am still at square 1.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

correct, LLC B is the single owner of LLC A so LLC B gets the K1.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"so LLC B gets the K1."

There is no K-1 from LLC A. It's a Disregarded Entity.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maybe it is not clear what my question is.

I am only concerned with filing CA form 568. I know that I cannot file a 1065 for LLC A, and I have already reported all data from LLC A on LLC B's 1065.

MY ONLY QUESTION is how do I file, SEPARATELY, form 568 as California wants the form filed even for SMLLCs?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

so what? A disregarded entity can issue a K1. How else would I put the income and other info on LLC B's return? either way I don't really care all I really want and need to know is HOW CAN I FILE FORM 568?

if I can't e-file it, I will just mail it, as it looks like nobody has an answer.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Who on first?

(Sorry, an Abbott & Costello fan here. Have to slip it in.)

First, let's straighten out the facts. There are two possible fact patterns. I think @George4Tacks 's solution is for Pattern II.

Pattern I:

LLC B owns 100% and is a single member of LLC A. Therefore, 100% of LLC A's activities (real estate, you said) would be recorded in LLC B's 1065 and state return - because LLC A is a disregarded entity, being a SMLLC owned by a PASS-THRU ENTITY.

For example, if LLC A runs a rental, its rental income and expenses would be reported on F8825 of B's F1065. This is because A is disregarded and its activities are 100% reported in B's filing.

Now, B has filed its 1065 and whatever State return(s). All good. Oh chit, someone (perhaps B's tax preparer) forgot to file F568 for A to comply with A's California filing obligation as a SMLLC - again, its single member being LLC B.

Now, B is an LLC. It has members, X, Y, Z. After processing its tax activities, it issues K-1 to X Y and Z.

@ejdtaxman 's client could very well be one or all of X Y or Z.... BUT I have NO idea why @ejdtaxman said:

a. RE: LLC B is a multi member LLC and files a 1065. I assume what you meant is, does the owner of LLC B file a 1040, but in light of the above it should be obvious they do not.

In the above fact pattern, X Y Z are the members of LLC B. But WHY would it be obvious that X Y and/or Z don't file 1040??? Why would there be only one owner ("the owner) of LLC B, instead of multiple owners, unless LLC B is ALSO a single member LLC. but in the later part of the line, "THEY" do not... "The owner" suddenly became THEY??

So, Joshua here may be barking up the wrong tree while chasing its own tail.

b. The individual involved in all of these ventures (real estate if you are curious) files a 1040 and has the K1 from LLC B on his return.

Is "The individual" - one of X Y Z in my example?

c. He can't put LLC A as a schedule C because LLC B is the intermediary that owns LLC A.

Who is "He". Who's on first?? is HE just one of X Y and Z?

By saying LLC B is a intermediary, it seems to fit this fact pattern - A's tax activities flow to/reported by B and then passed through to X Y Z....

Pattern II.

LLC A is a SMLLC and its single member is Y. Y invests in LLC B and is one of the members, but Y's ownership in LLC B is under LLC A. K-1 (reflecting Y's ownership) is issued to LLC A because LLC A is technically on title for the ownership of LLC B. NOW, the intermediary is more like LLC A, between Y and LLC B.

Under Pattern II, @George4Tacks's easy peasy solution would be THE solution.

If Pattern I is what it is, let me know. I use Lacerte and there is a way to use LACERTE to report the 568 for an SMLLC of which the sole member is a pass-thru entity. Lacerte does NOT offer SMLLC reporting under the S Corp or Partnership modules. Thus SMLLC held by pass-thru entities reporting can be done only under individual. There are a few tricks.

Sorry this gets to be so long (too long to edit. So, if my words are confusing with typo or mix-ups, you'd have to make do). But then, it took a whole episode but still "Who's on first?" was not cleared up.

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

RE: Too convoluted for me, Im out.

@Just-Lisa-Now- You sounded like what the sharks often say on Shark Tank.

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I see that CA has the disregarded entity provision here: https://www.ftb.ca.gov/forms/misc/3556.html

Did we narrow this down enough for you to be able to help?

This still confuses me: "so what? A disregarded entity can issue a K1. How else would I put the income and other info on LLC B's return?"

Because which form is that K-1 from?

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You correctly identified an error in my writing. the members of LLC B are individuals (husband and wife in fact) and file their 1040 together. Do not bring up the fact that, therefore, filing a 1065 is unneccesary, they said they wanted to do it anyway even though not required as CA is a community property state. more fee for me so whatever.

Anyway, when I wrote "it should be obvious they do not" I meant it should be obvious that LLC B does not file a 1040 because a business would never file a 1040. thats all.

Scenario 1 is correct. LLC B owns LLC A. I wrote incorrectly above because I rushed, since I am getting tired of writing the same thing over and over and I feel the conversation meandered into another area that was not relevant to the question of filing in CA.

Be that as it may, yes LLC B reports the income and all other data from LLC A on its 1065. now the real question about Cali that I have yet to solve....

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OMG I didn't see this while typing my LOOOOOONG post.

so what? A disregarded entity can issue a K1. How else would I put the income and other info on LLC B's return?

I guess I was more like chasing my tail more than barking up the wrong tree.

First, when you have a SMLLC disregarded entity, report the SMLLC's tax thingies on the SINGLE MEMBER's tax return. Thus, a SMLLC running a hot dog stand? Report the activities on the SM's Schedule C. THUS, "disregarded". Likewise, another disregarded entity: An investment account held by a living trust? Report the income etc on the GRANTOR's tax return.... This is what DISREGARDED is about.

Since you made the above statement, I guess there is a "Scenario III" branched out of the fact patterns and convoluted convolutions.

Lisa.... Lisa.... wait for me!!!

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

forget I wrote that. My boss prepared the return and didn't give LLC B any K1. we just put the info directly on the 1065. I normally work only on individuals and rarely come across this scenario so I wasn't familiar.

It's just that I'm the one that writes on these forums since he doesn't have time, and types slowly, so I incorrectly made that statement since I didn't have all the info.

Can we just disregard this whole discussion about disregarded entities and get to the matter at hand?

If there is no one from CA who has filed a SMLLC 568 then I will give up on this and just mail the **bleep** thing.

ugh

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Be that as it may, yes LLC B reports the income and all other data from LLC A on its 1065.

is mighty different from

so what? A disregarded entity can issue a K1. How else would I put the income and other info on LLC B's return?

1. Did you or did you NOT include LLC A's income in Form 1065 of LLC B?

2. Confirm Pattern 1 is correct.

3. Many are trying to help. If you say "You correctly beat me up", it is important to identify who the You is... The way to do it is do an @ and find the culprit.

Still too convoluted . I'm going to catch up with @Just-Lisa-Now- and see if she would share her ice cream with me. I'll be back after lunch and perhaps the dust would settle by then. If Pattern 1 is what it is, I'll share with you a few pointers about filing 568 for a SMLLC owned by a pass-thru item. Pray that Lisa waits up for me.

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

if your solution is for Lacerte, it might not be useful for me since I use proseries, but shoot it to me anyway because it's better than nothing. it might translate across platforms.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

1. I just stated that we did do that.

2 yes. again, this is correct. pattern 1 is correct. YES

3. I didn't specify you because my reply was directly under yours. but ok, next time I will write @joshuabarksatlcs . ok?

do you have a possible solution>? if not, we are just wasting each others time.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, as stated, I do have a few pointers.

And I always LOVE to give suggestions that's "better than nothing"....

Now, don't get too frustrated here when (1) your post is sliced and diced and every typo, misuse of word, or contradiction-in-appearance (because you're dealing in different contexts with points that should be understood / deciphered by others) is analyzed and dissected to the kingdom come; or (2) your issues are taken off on a tangent with sub issues and possible sub-sub-issues are further analyzed and sliced and diced.

Sometimes, you'd see someone asked a simple question, and the discussions got more and more convoluted and more and more off the tangent from what the Asker needed. (That would be when @Just-Lisa-Now- say she'd out while the others are getting more and more charged up. But that'd be a different story.)

In any case, I'm always glad to have such enthusiasm here. Had we been medical doctors instead, patients would come in with plantar fasciitis and walk out with a kidney transplant...

Back to filing CA F568 for SMLLC of which the sole member is a pass-through entity. I wouldnt say these are solutions, but for what it's worth...

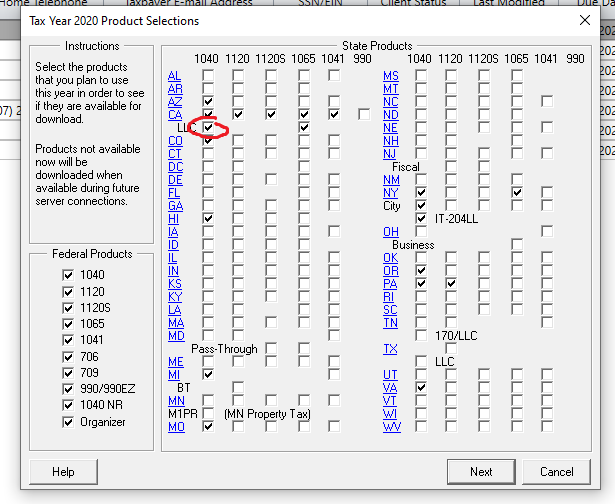

1. Lacerte (likely PS) supports efile for SMLLC in individual module ONLY. Ideally, in your case, SMLLC (LLC A) would be efiled in the PS module under LLC B's PS (F1065) filing. Sorry, NOT available in Lacerte.

2. Consider this approach:

a. Prepare LLC A's 568 filing as part of Partner Y's 1040. (One of the @Just-Lisa-Now-'s earlier response seemed to indicate SMLLC efiling is available for 1040 in PS.)

b. Manually enter the info for "Total income from Form 568" for Sch IW. Because the income for LLC A was reported under LLC B and NOT Y's 1040, you would not be able to pull the total income info directly from Y's data.

c. CA is concerned about Total income because that's used to determine the LLC fees.

d. Update the payment info.

e. Enter the "Sole Owner" info to show LLC B. The TIN and FEIN have to be changed and not Y's info. Review the info carefully. Because the info is off Y's file, you need to make sure all info is correct and the Sole Owner reflects LLC B. (Lacerte has a section under "Sole Owner" for this)

f. Question Q can't be overwritten. Lacerte checks the NO box and can't be changed to Yes. I attach a NOTE to state that due to software limitation, it was checked No, but the answer is Yes.

g. In the above software limitation note I also disclose the Sole owner is a Pass-thru entity and not individual (the owner entity info - printed above the signature line - can't be changed in Lacerte).

That was how I approached it. So far FTB has not yelled at any of my clients.

One thing important: The due date for F568 for SMLLC owned by a pass-thru entity is generally 3/15 and NOT 4/15. Mine are all write-up or compilation clients of mine. As soon as Dec financials are done, I'd file them and do NOT wait for the 1065 or 1120S, let alone 1040.

Hope the above could be the "solution" you're looking for. If not, add two words. Change this to "not much better than nothing.'

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

thanks, I will try this. If it doesnt work I will file by mail.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good luck!

This morning, I found out CCH doesn't do SMLLC for PS or SC either. I guess the demand isn't there.

I come here for kudos and IRonMaN's jokes.