- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Do I have to report the sale of a personal residence?

Do I have to report the sale of a personal residence?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do I have to report the sale of a personal residence if the total gain was less than $250k?

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Technically no if all the gain is excludable.

But, having been burned a few times when IRS got a 1099-S and sent a matching notice, I always report. I don't believe the clients when they say they didn't get a 1099-S. Reporting it and claiming the exclusion takes far less time than responding to the notice.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Technically no if all the gain is excludable.

But, having been burned a few times when IRS got a 1099-S and sent a matching notice, I always report. I don't believe the clients when they say they didn't get a 1099-S. Reporting it and claiming the exclusion takes far less time than responding to the notice.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I totally agree! I hate when my people get letters from IRS. As you said, I'd rather report it & not have to worry than to exclude & wonder if a letter will come. Thank you for the speedy reply!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I always report them, takes a couple minutes saves a potential letter down the line.

I did get a letter once anyhow, even when it was reported...so nothing is foolproof.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I do the same as SJR (but we're in the same metropolitan area). If you look to the 1099-S instructions that may clue you in on whether or not a 1099-S was required to be filed:

https://www.irs.gov/pub/irs-pdf/i1099s.pdf

See exceptions in page 1 column 2. Note the requirement doesn't look to the GAIN, it looks to the SALES PROCEEDS. Almost everything I see is over the $250/$500K threshold so I'm confident that there's a 1099-S "out there" somewhere. The last property I sold had it buried in the ~60 pages of closing documents. Most clients think that if it doesn't come in the mail in January with "important tax document" printed on the envelope it must not exist.

If we know they're under the exclusion I do report it but I don't spend a lot of time on it and I don't bill by the form. "Here's what the county says you paid for the property, here's what you sold it for minus the selling expenses from the closing document. If you'd like to dig into your records we can include more accurate numbers for original cost basis and improvements. We'll still end up with $0 taxable gain though so we can get their quickly or thoroughly, your choice, but the end result will be the same." 🙂

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This reminds me of all the people in Iowa who are buying living trusts because New York and California have backwards probate laws that encourage living trusts, and much of the national media is located in those states, so they publish a lot of stories about how everyone needs a living trust.

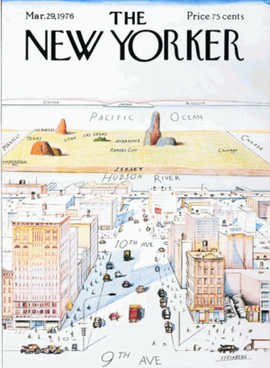

Before Californians started moving to my state, and buying up rentals here, there were many home sales for under $250K/$500K. So I believed clients when they said they did not receive a 1099-S, and I figured even if they did, IRS wouldn't send a notice. And it worked. It still works, so let's not Californicate the advice here too much. Or look at the rest of the country based on the view from Manhattan.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I always report the sale for the same reasons listed above.

Regarding the 1099S being buried within the closing documents, in many instances it does not even look like a 1099 form but rather just another legal document very easy to overlook.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"So I believed clients when they said they did not receive a 1099-S"

There are five questions they need to answer Yes on, to avoid a 1099-S being issued. If you can get that, you can confirm if they were subject to 1099-S. Here's a version, although this uses True/False. I've seen item 2 be confusing under Y/N as a double-negative. It's the section for Seller Assurances:

http://www.titleguarantee.com/LegalForms%5CNJ%5CDeeds%5CPDF%5C1099_SForm.pdf

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Some escrow agents in my area fill those out for clients with all "Yes" answers and just tell them "Sign Here." Saves them the trouble of preparing the 1099-S. They do it for estates and trusts, even when obviously not eligible.