- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Depreciation of retail leasehold improvements

Depreciation of retail leasehold improvements

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Rev Proc 2020-25 changed the depreciation of qualified retail leasehold improvements from 39 yr to 15 yr life. When I try to amend the 2018 and 2019 returns and I select J2 for QRLI it still calculates the depreciation over 39 years. Has anyone figured out how to correct this without doing an override?

Thanks

Dorothy Ann Snowball

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

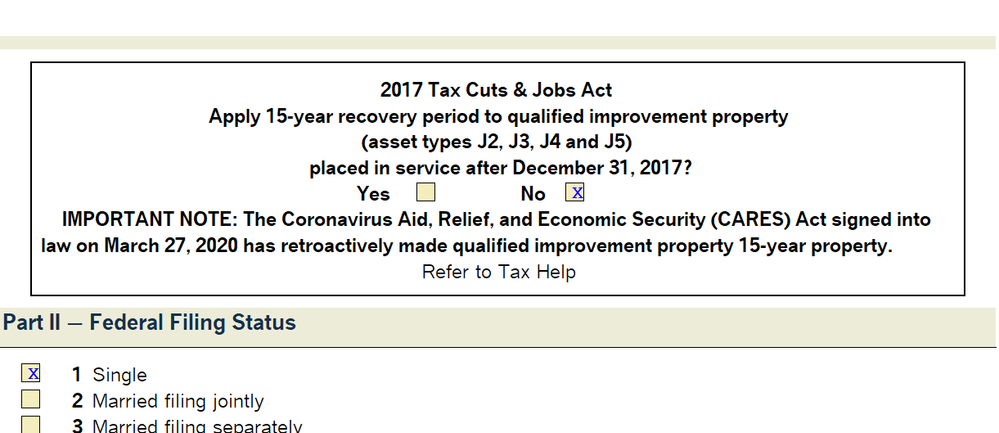

Is this box checked as YES ?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@dasnowball wrote:the 2018 and 2019 returns and I select J2 for QRLI

???

What year was this property "placed in service"?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks so much. That did it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That solution worked for amending the 2018 return but when I try to amend the 2019 return it will not accept J2 as the life for the 2018 QRIP. What else do I need to check or correct.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That is why I asked you what year it was "placed in service".

Qualified Retail Leasehold Improvements did NOT exist in 2018 or 2019, so you mis-categorized that. The 2019 program even warns you about and give you an error.

But it might qualify as "Qualified Improvement Property" (J5?).

As a comment from your original post, NO, Rev Proc 2020-25 did NOT change the depreciation of qualified retail leasehold improvements from 39 yr to 15 yr life.

The CARES Act changed Qualified Improvement Property from 39 years to 15 years retroactive back to 2018.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Improvements added in 2018. I could amend the 2018 return and use J2 as the category but it doesn't seem to work for those same 2018 assets in 2019.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, that did work in 2019 changing to J5.