- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Deferral of SE tax

Deferral of SE tax

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My understanding of the whole "deferral of FICA tax" COVID thing was that it was an option, not required, and that it was probably best NOT to opt in, unless the employer was financially hurting, and needed the extra time to pay those taxes. That's what I was hearing from several colleagues.

But now, filling out self-employment clients' returns, it seems that SE clients are being REQUIRED to defer their SE tax? Am I missing something? Did I do all the payroll wrong the last 3 quarters? If I'm correct that this is optional, how do I opt out of it on the Form SE? (Or is it only optional if you're incorporated, and not optional if you're self-employed?)

Great Hera, this is going to be a crazy year. Is it too late to retire?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sch SE deferral for a sole proprietor has *nothing* to do with payroll tax returns.

Apples/Oranges

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi abctax55. I guess I wasn't clear.

If an employer were going to defer, that deferral would happen on the payroll tax return (Form 941). So I was nervous, thinking that if the deferral was required, then I filed all my 941s wrong.

The Form SE says "Enter the portion of line 3 that can be attributed to March 27, 2020, through December 31, 2020." It isn't phrased in such a way that it sounds optional. The software doesn't phrase it in such a way that makes it sound optional. If I enter 0, that makes it sound like all their self-employment was between January 1 - March 26, which is false. Call me paranoid, but I get nervous putting something on a tax form that isn't true.

But if y'all tell me that I can put 0 there, I'll put 0 there.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maybe I need to go back and read it again, I just know putting zero made none of it be deferred LOL

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK, I see how to get rid of the deferral I think. Putting 0 on Line 18 of that form isnt correct.

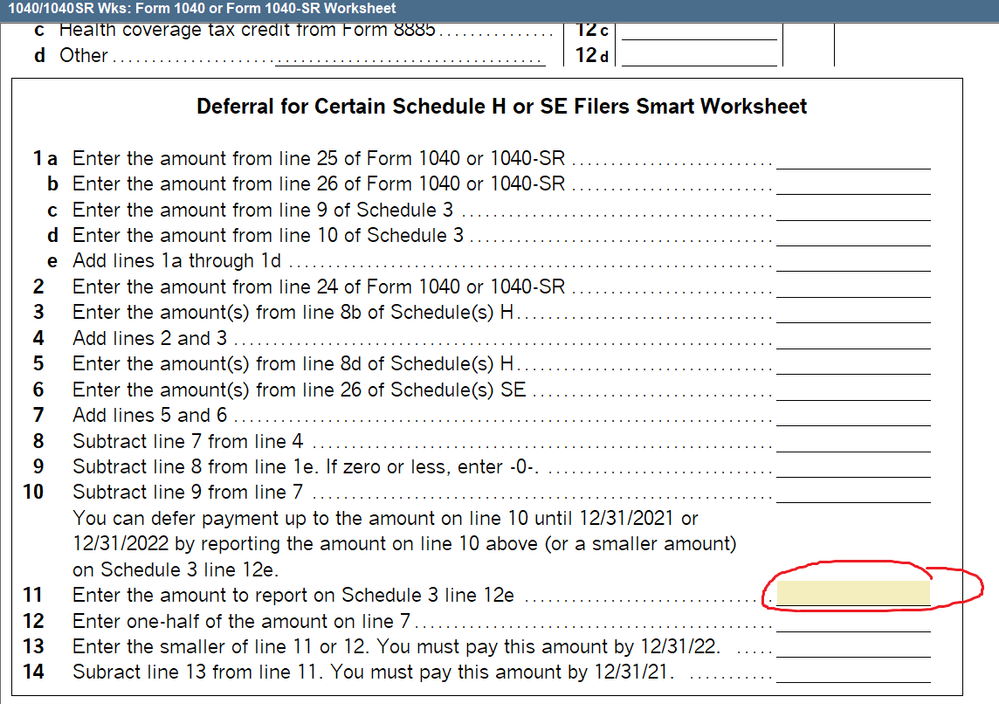

Go to the 1040/1040SR worksheet and scroll down to the Deferral for Certain Sch H and SE Filers smart worksheet looking box, Line 11 put a zero and nothing will flow to Sch 3 Line 12e.

If you do choose to defer, Im not seeing a spot on the Carryover worksheet for the deferred portion to carryover to 2021, so I dont think this part of the program is completely updated yet.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good job Lisa!

I just went down that rabbit hole and tried to follow the flow on all of the forms. You end up in a worksheet on the 1040 instructions to Schedule 3. Line 10 says:

"You can defer payment on up to the amount on line 10 until 12/31/2021

or 12/31/2022 by reporting the amount on line 10 above (or a smaller amount)

on line 12e of Schedule 3 (Form 1040)"

and then Line 11 of that worksheet:

"Enter the amount you reported on Schedule 3, line 12e"

Are we having fun yet!?!

Edit: https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

See PDF page 102.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Same worksheet, lines 13 and 14.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you pick up a new client in 2021 or 2022, how will you know if they had this deferral?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you pick up a new client in 2021 or 2022, how will you know if they had this deferral?

Best I can tell, there's no way to know. I did find this section in the instructions for Schedule 3 Line 12e interesting:

"If you file Schedule H or Schedule SE, you can defer some of the

household employment and self-employment tax payments you may owe on

your 2020 tax return and pay them later

instead. However, you can't defer

amounts that you have already paid."

Does that mean they'll use any refund on the 1040 to offset the deferral? What a mess!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is on the actual form -- Schedule SE, lines 18-23. If they deferred anything, it would show up there. If they didn't defer, that section would be $0.

Still, what a mess.

That's why we get the big bucks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Oh, I guess if you pick up a new client and you see a figure on 2020 Sch 3 Line 12e, then you know that 2021 and 2022 will have the same figure.

I will NOT be encouraging any of my clients to defer these taxes.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"If an employer were going to defer, that deferral would happen on the payroll tax return"

And that wording also warns the employer that any amounts already paid in through the 941 deposit process cannot be refunded for that period where you would have wanted to keep the money (defer deposit), as an afterthought process (when filing the form 941 or 944).

" "However, you can't defer amounts that you have already paid."

Does that mean they'll use any refund on the 1040 to offset the deferral?"

It means the other way around. Think of this as a step towards parity for the self-employed to get to the same place as employers and employees for these deferrals.

"30. Is a self-employed individual who defers 50 percent of the Social Security tax on net earnings from self-employment income, or a household employer that defers the employer's share of Social Security tax under section 2302 of the CARES Act, eligible for a refund of the deferred amount of tax at the time the taxpayer files its Form 1040, Individual Tax Return? (added July 30, 2020)

Generally, no. A taxpayer who has deferred his or her payment of the employer's share of Social Security tax or 50% of the Social Security tax on net earnings from self-employment under section 2302 of the CARES Act is not eligible for a refund due to the deferral because the deferral amount is a deferral of payment, not a deferral of liability. Therefore, the deferral itself does not result in an overpayment of taxes reported on Form 1040. However, if a household employer is eligible for advanceable paid leave credits under the FFCRA and reports those credits on Schedule H, Form 1040, the taxpayer may receive a refund of the paid leave credits even while deferring the employer's share of Social Security tax. This does not apply to credits for sick leave and family leave equivalent amounts for self-employed individuals.

Self-employed individuals and household employers should consider deferrals under section 2302 of the CARES Act in determining their estimated tax payments and any income tax withholding from wages and other sources of income. Publication 505, Tax Withholding and Estimated Tax for use in 2020 provides more details on determining these amounts."

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

These are the 2020 instructions for form SE from IRS

Changes to Schedule SE (Form 1040).

New Part III has been added to Schedule SE to allow self-employed persons

to figure a maximum amount of self-employment tax payments which may be

deferred. All maximum deferral amounts will be carried to Schedule 3

(Form 1040), and the total amount that you may elect to defer may be further reduced.

Seems like section 3 is for folks that want a deferral, and if so fill out section 3. Personally I am only going to fill it out if someone wants a deferral.

I think some of you are making it more complicated than is necessary. Just my 2 cents

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just has this issue with line 11. It does not allowing put "0". Does not like it. I am breaking my head. Client does not want to defer anything. and his line 10 ended up being negative number. Anyone experienced this yet?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just got this myself filing taxes, line 10 is negative.... appreciate anyone's help on this. It won't let me complete the review until this is fixed up otherwise tells me to submit via mail. 😞

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Got my answer on another thread. leave it blank!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Max deferral line 18 is too large

i have entered 0 but it keeps saying

Max deferral line 18 is too large

any help with that?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What i ended up doing was living it blank and so i was able to finish it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you using ProSeries to prepare your clients' tax returns? If not, you seem to be lost on the internet.

You’ve come to a Peer User community for Intuit Tax Preparation products supporting tax preparation professionals using ProSeries, Proconnect and Lacerte , and you may be looking for support as an individual taxpayer. Please visit the TurboTax Help site for support.

Thanks.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does anyone know if we can add to the standard letter to show there has been a deferral of SE Tax until 12/31/21 and 12/31/22 and to show what the payments will be and when they need to be paid? How will the client know what was deferred and when to pay, etc.?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sorry, a bit late response, but that's what I did too- just left it blank, and was able to go forward.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm not sure who this was directed to?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Line 18 will determine if you would like to have more time to pay your self-employment tax ( Eligibility is based on whether you paid household employees or had self employment income, when you earned that income, and whether you owe taxes this year.) If you enter a number there you will have time to pay self-employment tax on a later date. Therefore enter 0 in line 18 and you will be opting out of this option.

On another note if you did not earn self-employment income or pay household employees in 2020, you are not eligible for this deferral.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"I'm not sure who this was directed to?"

Your topic here for how to use ProSeries for the client's data, has now been hijacked by what appears to be TurboTax users. They seem to be trolling the Lacerte, ProSeries and ProConnect community.

They don't seem to realize that to Help Each Other, as a Community, they should go to the TurboTax Community forums, here:

https://ttlc.intuit.com/community/discussions/discussion/03/302

And instead, are interfering with your ability to do your job for your clients.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

i added my actual income in that line im so worried will they take my return?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

im not sire where im suppose to ask a question. i messed up on my refund i thought i was suppose to enter the amount in that time period i made on line 18. an now im worried will my tax return be takin

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"im not sire where im suppose to ask a question."

Not here, unless you are using the ProSeries tax preparation program to prepare your clients' tax return.

Otherwise, no one is using the program you are using, whatever it is.

You seem to be lost on the internet.

You’ve come to a Peer User community for Intuit Tax Preparation products supporting tax preparation professionals using ProSeries, Proconnect and Lacerte , and you may be looking for support as an individual taxpayer. Please visit the TurboTax Help site for support.

Thanks.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Leave it "BLANK"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Entering zero solves it immediately.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client that is self employed and chose the SE deferral. When she got her refund it was exactly shorted the amount of the deferral. She called the IRS and they told her that she didn't qualify and that they needed some kind of documentation. I filed her taxes on February 12 and the Proseries program automatically put the data in for the deferral. They told her that their mess up was that she should have gotten a letter. Anyone having this experience?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@zanie wrote:

I have a client that is self employed and chose the SE deferral. When she got her refund it was exactly shorted the amount of the deferral. She called the IRS and they told her that she didn't qualify and that they needed some kind of documentation. I filed her taxes on February 12 and the Proseries program automatically put the data in for the deferral. They told her that their mess up was that she should have gotten a letter. Anyone having this experience?

No, it didnt automatically put it in for deferral, you entered the wages that taxes could be deferred on, and then you didnt opt out.

If they had a refund, you cant defer, the money was already paid in, so they reduced the refund.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

👍

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"If they had a refund, you cant defer, the money was already paid in, so they reduced the refund."

I'm not clear on what good these topics are, when people find them later and don't seem to read all the info already here. Perhaps these things should just go away after a few months.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am grateful for all sharing and glad the community doesn't go away.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newsflash

Another intrinsic flaw in the multi thousand software.

Beware of the SE deferral and Proseries handling thereof. Garbage India based programmers - garbage out.

If the deferral is over 0 your clients refunds will be adjusted and mega delayed by the IRS.....who knows - maybe a formal review.

Thanks Intuit....guess you want folks to buy TurboTax as you are putting me out of business.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newsflash: the IRS tells you this is what happens. Intuit has nothing to do with it. Why would you even think that? Did you read the info provided in this topic?

Are you using IRS resources:

"30. Is a self-employed individual who defers 50 percent of the Social Security tax on net earnings from self-employment income, or a household employer that defers the employer's share of Social Security tax under section 2302 of the CARES Act, eligible for a refund of the deferred amount of tax at the time the taxpayer files its Form 1040, Individual Tax Return? (added July 30, 2020)

Generally, no. A taxpayer who has deferred his or her payment of the employer's share of Social Security tax or 50% of the Social Security tax on net earnings from self-employment under section 2302 of the CARES Act is not eligible for a refund due to the deferral because the deferral amount is a deferral of payment, not a deferral of liability. Therefore, the deferral itself does not result in an overpayment of taxes reported on Form 1040. However, if a household employer is eligible for advanceable paid leave credits under the FFCRA and reports those credits on Schedule H, Form 1040, the taxpayer may receive a refund of the paid leave credits even while deferring the employer's share of Social Security tax. This does not apply to credits for sick leave and family leave equivalent amounts for self-employed individuals.

Self-employed individuals and household employers should consider deferrals under section 2302 of the CARES Act in determining their estimated tax payments and any income tax withholding from wages and other sources of income. Publication 505, Tax Withholding and Estimated Tax for use in 2020 provides more details on determining these amounts."

That's already in this topic. It helps to Read the forum you seem to want to flag with your complaint, in case you didn't truly understand the situation.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Newsflash Intuit Drone;;;;; WORKER counter truth spy

Tail not connected to the Rat ?

Intuit Proseries Rep informed me 2:16pm Eastern Time (US not India Programmer Time) -

KNOWN PROBLEM WORKING ON YET ANOTHER PATCH. Should be out tomorrow.

How's the KOOLAID Now?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I like iced tea better than Koolaid, so thanks for the offer anyway.

I provided you with the IRS link and the IRS text. Perhaps you need to take this up with the IRS?

Because any Intuit person that told you the Deferral would be honored for an overpaid condition, is wrong. In other words, you stated this incorrectly:

"If the deferral is over 0"

and your client has paid in enough to cover some of that deferred amount...

"your clients refunds will be adjusted"

Your client's refund is reduced by the amount they owed, because the deferred amount is not Refundable.

Fixed it for you.

"and mega delayed by the IRS.....who knows - maybe a formal review." <== now that's jut inflammatory. Did you threaten your Clients with IRS action like this? I'm sure that really helps give them peace.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Rude, crude, unprofessional @Mike Chaput

Mods notified as such behavior isn't to be tolerated.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No Intuit person said anything about lost refund money. Just miscalculations.

The Intuit software compelled the users to enter an amount in the field everyone is referencing. It would not allow 0. It had a range of amounts it would take.

Any amount entered over zero is being adjusted by the IRS.

The IRS Agent I spoke with today on the Practitioner Hotline said several software companies were having trouble with this field.

This is your software. Any return with a Schedule C with an SE Tax is funneled into this field.

Listen, the VID has been a catrastro-f$%# for the IRS, the software companies and the preparers and I regret my harsh words.

What to I enter into Schedule SE-T, Part III Line 18 for returns with a Schedule C profit? The form states if zero leave blank. Intuit Proseries 2020 won't let you do that my friend.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I put 0 on Line 18 of Sch SE of every SE return I had.

You could have also chosen to put zero here to opt out:

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"This is your software."

This is a Peer User Community. This is not Live Chat, not Customer Support and not Tech Support. It's your software, too.

There is no requirement to defer. That is an option.

The IRS isn't adjusting 0. It's not refunding amounts if you try to defer but also already paid enough to cover that amount. It's not Refundable. That's what you stated wrong.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

garbage software is crude rude and unprofessional

and bad for business

how many patches? what of returns already filed.

Every 2019 return I open that has already been filed long ago has active error flags for virtual currency activity.

What of the query tools to see if software garbage affected your returns?

There have been so many problems over the years with this product. Look at your CRM data at the credits you gave me for the poor programming. Hundreds to thousands of dollars

Twit

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Never spoken to by an Intuit Rep like you though.

Me thinks me vote with thy wallet next year....

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't know who "your CRM" is directed at. Sorry.

Meanwhile...

I found your Help article:

And another Peer posted this:

Because this Peer Community helps each other.

"Listen, the VID has been a catrastro-f$%# for the IRS, the software companies and the preparers and I regret my harsh words."

Whew; that didn't last long, then.

Play Nice on the Internet.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Never spoken to by an Intuit Rep like you though."

And you still haven't. I guess you need to look up the definition of Peer Users or Community.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

the software wound not take zero !!!! I don't know how to say that differently. NOR COULD YOU LEAVE BLANK.

I gotta bounce - I thought techs dipped into this and laid down some knowledge.

The patch is on the way according to a ProSeries Tech Rep I spoke to today. She said tomorrow.

I guess I would have nailed it had I prepared the 58 page return by hand. Maybe next year.

GOOD LUCK

is my level going to go down to negative 1 now? shucks