- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Deduction for allowable attorney fees as adjustment to income on schedule 1

Deduction for allowable attorney fees as adjustment to income on schedule 1

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

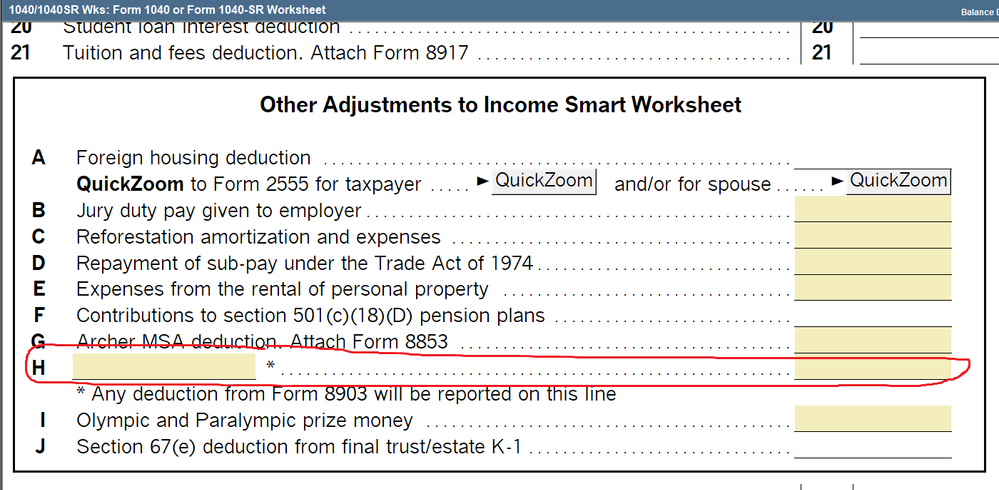

There are instances where a plaintiff wins an award against an employer for discrimination suit and the attorney fees are deductible under sec 162q as an adjustment on schedule 1. ( see pub 525 pg 32).

Yet, I can't see where in proseries for schedule 1, it facilitates this entry.

Any insights here on how to enter those fees as an adjustment for schedule 1, and would still pass error checking for e-file?

Thank you all!!

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Find this section in the 1040Worksheet and put your cursor in the entry box on the circled line and hit the yellow ? button on the toolbar, if gives you a list of items that can be placed there, I think this is where it goes....at least a few years ago, this is where it went.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Find this section in the 1040Worksheet and put your cursor in the entry box on the circled line and hit the yellow ? button on the toolbar, if gives you a list of items that can be placed there, I think this is where it goes....at least a few years ago, this is where it went.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK Ty!

Using the help list, I don't see a specific reference to attorney fees in discrimination lawsuits but I guess "H" is the place for all other legitimate above the line adjustments with a write in description.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Settlements like this typically result in a 1099-Misc or a W-2 being issued. Do you have any information reporting form for the taxpayer?

Don't yell at us; we're volunteers