- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Client sold personal home he never lived or rented (used for storage) in 2020. I do not know how to put this on his return correctly.

Client sold personal home he never lived or rented (used for storage) in 2020. I do not know how to put this on his return correctly.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

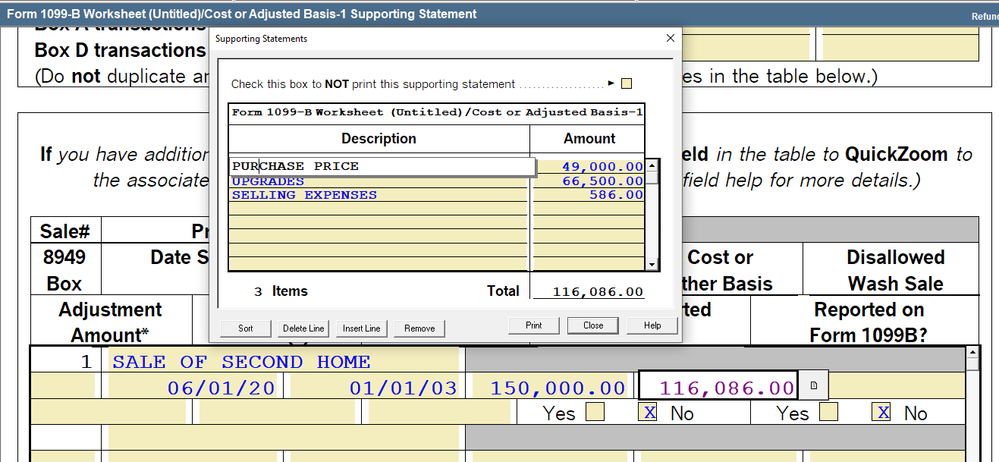

My client sold a home that he owned for 17 years in 2020. He never rented or lived in the home. I am not sure how to report this sale.

2003 purchase price $ 49,000

2020 Upfits $ 66,500

2020 Sale Price $150,000

2020 Sales Costs $ 586

Right now I have it on a form 6252. However, it is not an installment sale. I hope someone can help me.

Thank you.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Schedule D is a popular answer today for the sale of homes.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What was he storing? Inventory and business equipment?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You need Sch D, not the 6252. This is how I would do it, I like to keep my sales price actual just in case a 1099S was issued, I want them to match. Use the 1099B worksheet.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is perfect. Thank you so much. I really appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I do not need to report depreciation? He is a real estate professional and he is insisting that I need to.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

He is a bit of a hoarder!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Has he been depreciating it for the last 17 years?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would also explain that the depreciation recapture on the sale for the depreciation he never took over 17 years would decrease his basis and create a larger capital gain. Sounds like he really does not understand depreciation.