- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: CA 540 - Unemployment exclusion

CA 540 - Unemployment exclusion

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

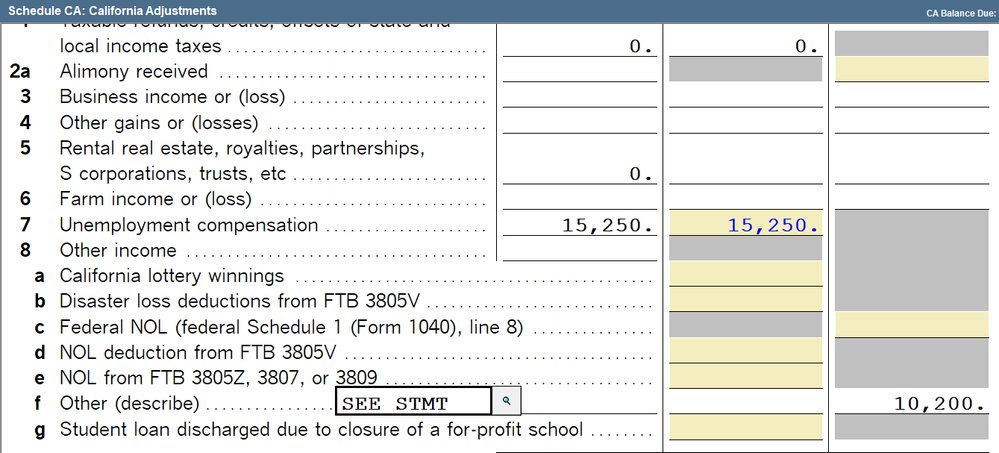

Having challenges applying the unemployment exclusion in CA Form 540 and hope you can shed some light.

The Federal Adjusted Gross Income already excludes $10,200 in unemployment benefits. This federal AGI carries over to Line 13 of CA Form 540. Line 14 of 540 excludes the entire unemployment amount. So line 17 CA Adjusted Gross Income reflects the unemployment benefits deducted twice ----- once from Schedule 1 of form 1040 and again Line 14 California Adjustments of Form 540.

How can I reflect Line 17 CA Adjusted Gross Income to only reduce the unemployment benefits once?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I believe that is what the update it is going to do. Just make sure and remember a couple of things if you decide it to do it manually, it is up to 10200 per taxpayer, make sure you do not deduct manually 10200 if the unemployment amount is less than that, (a couple of people already did it in Turbo tax) and asked me to check it) and make sure for people making more than 150k it could cause a problem. That is why I would prefer to wait until next week to see what the programmers do. For now, do not send any amended yet although I believe an amended will have to be done. It is too much calculations in some cases for the IRS to fix this alone. Just my opinion. Thank you everybody.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just wait for the software update.

You need to make a Schedule CA adjustment for the adjustment you made on the federal to adjust the UI. In other words, why not wait for the software to do it for you in a much easier and better manner.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do you have any idea how long it will take for Lacerte to update program--has IRS even issued guidance yet?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

IRS has issued guidance and my guess is that @Cookie2021 followed it to get to this problem. I am very hopeful that Lacerte will update on Thursday, but I am not holding my breath. I think the clients that are affected will just be happy to see their total tax go down and should be willing to wait a week or two for the software to update.

https://www.irs.gov/faqs/irs-procedures/forms-publications/new-exclusion-of-up-to-10200-of-unemploym... but don't try this without training wheels.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

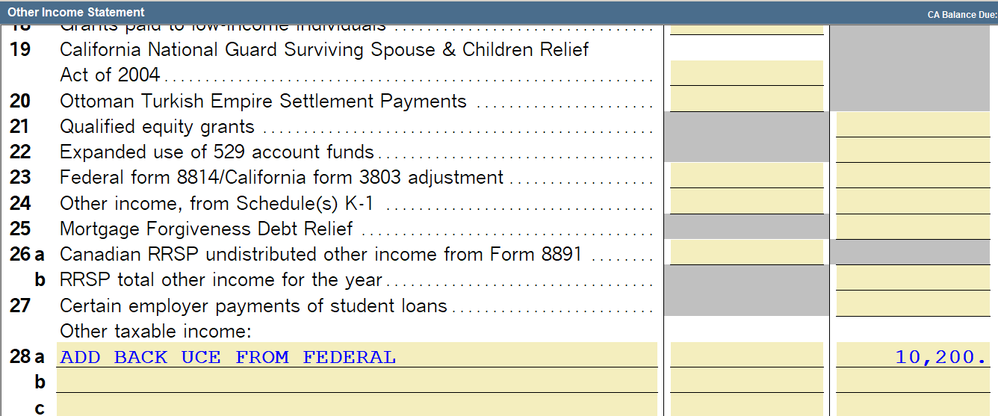

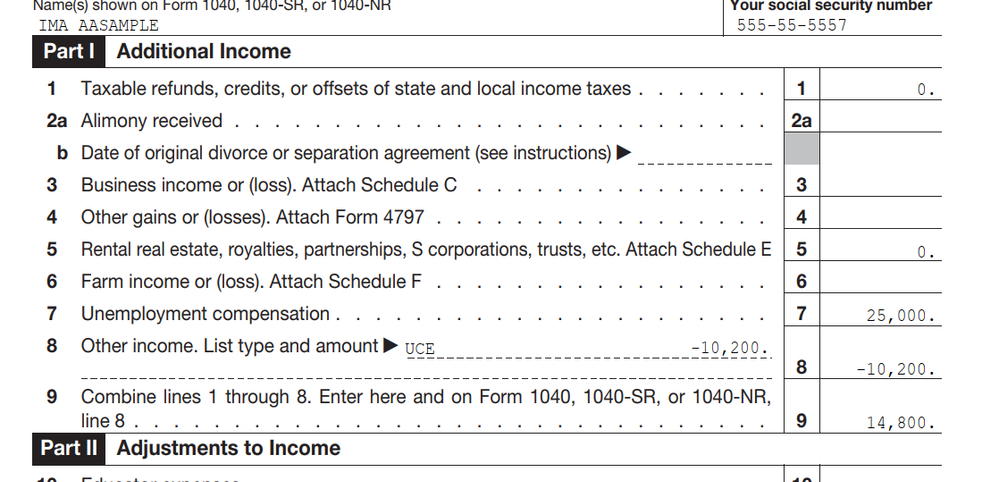

I did it like this

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- Does "UCE" print on the dotted line by Line 8?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

UCE is on the dotted line, yes.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

so.... if we did this, we don't have to wait on a software update on the federal returns????

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I believe that is what the update it is going to do. Just make sure and remember a couple of things if you decide it to do it manually, it is up to 10200 per taxpayer, make sure you do not deduct manually 10200 if the unemployment amount is less than that, (a couple of people already did it in Turbo tax) and asked me to check it) and make sure for people making more than 150k it could cause a problem. That is why I would prefer to wait until next week to see what the programmers do. For now, do not send any amended yet although I believe an amended will have to be done. It is too much calculations in some cases for the IRS to fix this alone. Just my opinion. Thank you everybody.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Filing a return with unemployment compensation from CA. I run Federal return diagnostics, and received this message:

Unemployment Compensation Exclusion

Important: While the Federal product has been updated according according to IRS guidance for unemployment. State returns may also be impacted by these changes and have not yet been updated. Please review your state returns for possible impacts before filing or wait for the state update that addresses unemployment.

Is this message generic? Any updates on CA?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- Did PS do an update for the new IRS worksheet as to how to calculate the exemption? Lacerte just did an update this morning.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It looks like ProSeries works after the update. You will have problems shutting down, but it gets fixed after you update Microsoft OS and apply the updates again. The big question is California.