- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Amortization of legal fees

Amortization of legal fees

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

First question, can I amortize legal fees?

If so, what is the recovery period? is it the fixed time frame of 15 years or can I pick something different?

and what is the IRC section code that I would need to use ? code 197?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

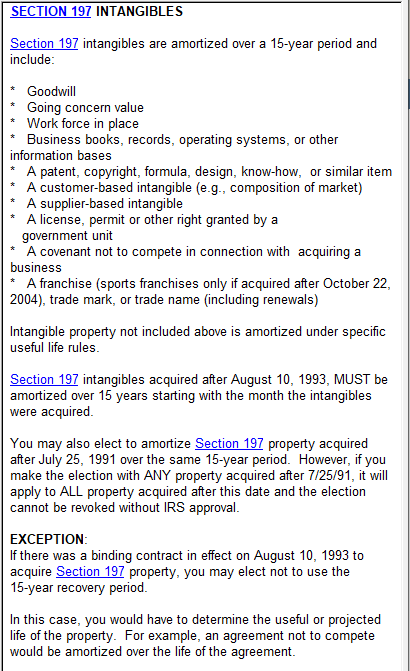

what kind of legal fees? why would you amortize? Heres the list of 197 intangibles in the ProSeries help file

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The legal fees were acquired from a decade long settlement. The fees are $120000 and was trying to figure out if we could spread this out over future years

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What is the nature of the settlement? Did your client pay or receive?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Legal fees are deductible, IF ALLOWED, in the year that they are paid.

Legal settlement for discrimination: deducted from the settlement income, above the line.

Not for discrimination: on Sch A Miscellaneous before 2018. After 2017, no longer allowed on the federal Sch A, but might be on certain states.

IOW, we need more information to help you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I initially fully expensed out the legal fees due to a settlement of $120000 on the 1120 return Once looking at the bottom line I would like to see if I can amortize these expenses out as they are not needed in full for 2019

The corporation took out a loan for $75000 over a 15 year period to help pay off the $120000 legal fees

Is there a way to spread these out for the future?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't see where you are answering the question regarding the Settlement Reason.

Taking a loan is how they are paying for something; that doesn't change the "thing" (tangible or not) that was purchased or being paid for. The Loan isn't the Fees; it's the Money for the banking part.

Without more details, no one can help you with specifics. In general, you described it as a "decade" long settlement. Without knowing what that means or is, the point is the Fees incurred are not the Loan or Settlement Terms. The Fees might be deductible or not, based on what the suit related to. The Terms are a fulfillment process, for the loser. None of this paragraph is Tax Treatment of the fees.

Don't yell at us; we're volunteers