- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: 7202 for 2021

7202 for 2021

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi to all. I was wondering if self-employer able to get 10 days for part I and 10 days for part III and 60 days for part IV ( in deferent dates ) in total 80 days ? Am I right ? While in 2020 was able to get just 10 days!

Client also wants to get 50 days for part II, but I told him schools were opened.

Thanks for your help!

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@HOPE2 wrote:

for sick leave equivalent, let me know please this sick leave equivalent refer to self-employer when he/she had a problem because of Covid or it is referring to one of his/her son -daughter during ?

It is referring care for the son/daughter. That is why I pointed you to the Instructions - it is clearer than how it is phrased on the form.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the client is coming to you now and asking for the full amount of days on the 7202, that waives GIANT RED FLAGS in my mind. Whether it is intentional fraud or being mislead by something he saw on TikTok, I don't know, but it is very likely wrong.

I wouldn't touch it unless the client gave me clear documentation of everything.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree with Bill, this has been making the round on social media and people are looking to take advantage of this fraudulently.

I asked my clients about this back at the time of preparation, before people knew about this big credit and knew how to answer, I only had maybe 4 or 5 out of 140 Sch C people that took it, myself included, but only for a few days. Not one had anywhere near the full amount of credit days allowed.

Any new clients that come around now asking about this in particular credit, I wouldnt touch.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@TaxGuyBill @Just-Lisa-Now- thanks a lot. you guys awesome.

I agree with you and I did not touch tax return.

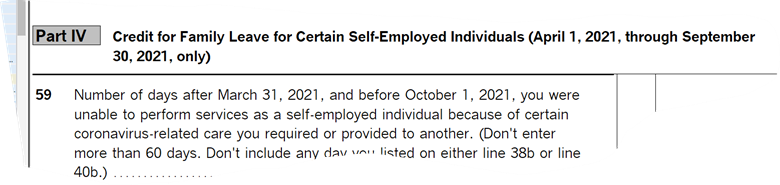

But for my question I want to know : can self-employer able to get 10 days for part I and 10 days for part III and 60 days for part IV ( in deferent dates ) in total 80 days based on authentic documents?

Since I am confused for part IV, I expressed this question. In this part, I have two understanding: 1- self-employers can take 60 days for him/herself or 60 days for son or daughter! If I am correct it means self-employer can take 80 days for himself. Is it true?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@HOPE2 wrote:

Since I am confused for part IV, I expressed this question. In this part, I have two understanding: 1- self-employers can take 60 days for him/herself or 60 days for son or daughter! If I am correct it means self-employer can take 80 days for himself. Is it true?

Have you looked the Instructions for line 59? It makes it a bit clearer.

Enter the number of days in the period from April 1, 2021, through September 30, 2021, that you were unable to perform services as an eligible self-employed individual because of certain coronavirus-related care you provided to a son or daughter whose school or place of care is closed or whose childcare provider is unavailable for reasons related to COVID-19 or for any reason you may claim sick leave equivalent credits.

https://www.irs.gov/instructions/i7202#en_US_2021_publink100085617

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@TaxGuyBill Perfect.

it says ......because of certain coro...-related care you required, it means for any reason you may claim sick leave equivalent credits?

for sick leave equivalent, let me know please this sick leave equivalent refer to self-employer when he/she had a problem because of Covid or it is referring to one of his/her son -daughter during ?

Thanks for your patience.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@HOPE2 wrote:

for sick leave equivalent, let me know please this sick leave equivalent refer to self-employer when he/she had a problem because of Covid or it is referring to one of his/her son -daughter during ?

It is referring care for the son/daughter. That is why I pointed you to the Instructions - it is clearer than how it is phrased on the form.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"it means for any reason you may claim sick leave equivalent credits?"

There is Sick Pay and there is Family Leave Pay. You don't get both for the same events or dates, though. Maybe it would help to review the basis of these provisions. This is meant as a simplified overview. To read in more detail, go to the IRS resources and read what applies to that specific taxpayer, such as:

https://www.irs.gov/instructions/i7202#en_US_2021_publink100085618

No one here can answer every matrix of what applies. Even the IRS FAQ is over 100 Q&A at this point.

Employees had provisions for sick pay (for when they are the sick one) or for family leave (when someone in the family is sick or the restrictions caused them to need to be away from work to care for a dependent). The next thing to know is the word "parity" and that means, providing a matching, similar or equivalent, provision to self-employed individuals (not self-employer).

When you work with your clients, you are going to examine their data two ways:

1. Were you the one who was sick (or quarantined, or whatever qualifies) and this prevented you from being able to run your business activity (as a self-employed individual)?

2. Were you unable to run your business because family issues impacted your ability to run your business activity (child was sick, school or daycare was closed)?

That's why you see there are multiple parts to the form, and that's why you can't double-dip if things overlap (can't use specific dates for both types of qualifying events) and 3) that's why you might see a W2 that included FMLA or sick pay, which needed to be taken into account for an Employee (W2) who also runs a sole proprietorship (self-employed) and might run into that similar conflict of having either type of leave available in both scenarios (no overlap, no double-dipping allowed).

This is all about, "Were you available to do your business, or were you prevented from doing that business by one of the qualifying scenarios for dates that fall under the provisions, and did you also have a regular employer job that we need to also take into consideration, for the days and events we are trying to determine if they qualify or not?"

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@TaxGuyBill . Thanks for your supportive assistance for it was a lot.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@qbteachmt your reply was very helpful especially for part of if self-employed been on W-2 as well

Thanks a lot.