- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: 1099-B - Multiple Transactions - How to summarize?

1099-B - Multiple Transactions - How to summarize?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client who provided me with their 1099-B that has thousands of transactions. It would take me days to enter each transaction one by one on Form 8949...

Does anyone know how I can submit it by just writing see broker statement and attaching the broker statement and just summarizing the totals?

Thanks!

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sch d workflow was rewritten this year. Create the new worksheet for the 1099b and follow the workflow for summary. Attached pdf to return (in efile center) before filing

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where is the workflow?

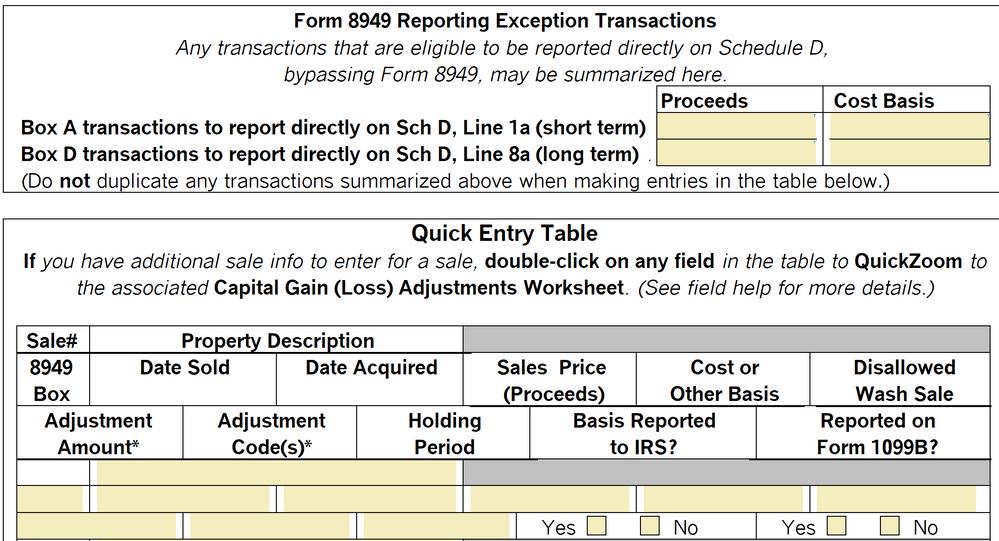

the summary section above the detail is only for boxes a and d, that are reported to the irs. The section below requires various amounts and dates. It gives me an error message if I type in various under date acquired or date sold. Thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just separate the summary for the short and long terms stocks and attach a copy of the detailed pages. Otherwise you will be spending hours in some cases on each transaction. Just make sure the amounts match the gains and losses. That how I do it and I have never had any problem. But attach the detailed pages. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm not sure I am following.... When you say summary section, it only has a section for box A & D and there is no input field in the summary section for wash sales... Here is a screen shot of what I am looking at? Please assist. Also, if I try to enter various into the dates section of sold or acquired it says error... THANK YOU!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That is all you need. Used the information in the 1099 B Summary page to enter the information there. You need to make sure if the stocks are short or long term. Just select a name from the detailed page of the Form 1099 B , (to fill the description stock) and a couple of dates from any of the stocks making sure if they are all short term, the dates do not last more than 1 years, and if they are long term the opposite. Just make sure they calculations match the gain or the loss on the form. The software will place them in the corresponding worksheet and form according to the dates you entered. Enter the dissallowed wash sales to make sure they loss is exempted. That is all you need to do. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We have to enter every wash sale? That seems ridiculous if the 1099B shows that basis is reported. i have a 1099B- all short term sales, all basis reported to the IRS, but there is a wash sale loss disallowed. Hundreds of transactions. I am supposed to enter "fake" dates to force the short term status and do a bulk entry? And attach the 1099B?