- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Ohio Preparers - Form IT Bus

Ohio Preparers - Form IT Bus

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

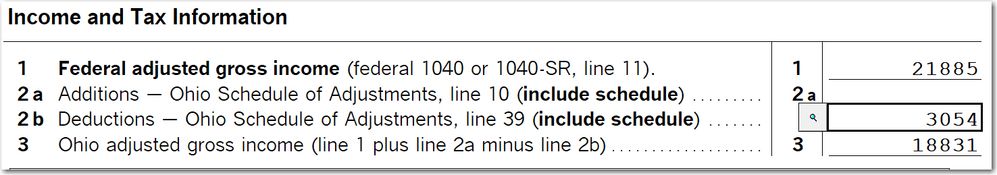

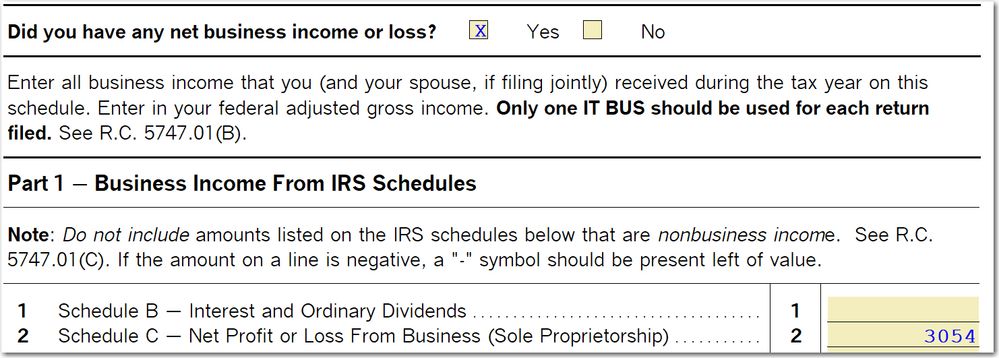

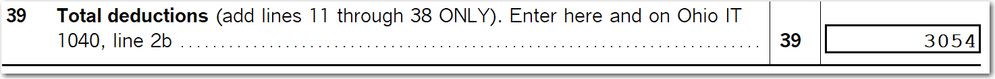

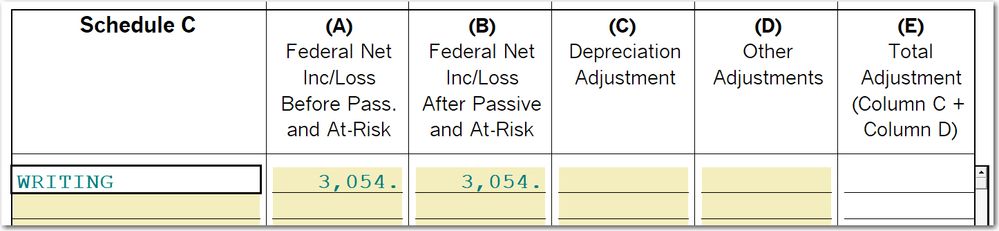

I have a small Schedule C on the federal return. Net income of $3,054. When preparing the Ohio return, it is using that $3,054 as a negative adjustment on the Schedule of Adjustments. Is that correct?

This is the first Ohio return I've prepared and I feel i must be doing something incorrectly. Would appreciate your feedback. Thank you.

Adding screenshots from the Ohio 1040, IT Bus, Fed/State Depr Adjustment, and the Schedule of Adjustments.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From Ohio website. https://tax.ohio.gov/individual/Business-Income-Deduction

Ohio taxes income from business sources and nonbusiness sources differently on its individual income tax return (the Ohio IT 1040). The first $250,000 of business income earned by taxpayers filing “Single” or “Married filing jointly,” and included in federal adjusted gross income, is 100% deductible

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you. Ohio is business friendly.