- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

inquiry

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello,

I need help. I went online and apply a EIN for an LLC for a business consists of only one owner. A computer generated a letter with the EIN, there is a paragraph that says Based on the information received from you or your representative, you must file the following form by the date shown

Form 1065 03-15-2020.

The question is do must I file Form 1065 partnership return OR Form 1040 with Schedule C. Is it OK if I choose to file 1040 Schedule C instead?

Thank you,

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

jason, you may want to join this Facebook group

https://www.facebook.com/groups/taxpreparersupportgroup/

they help lots of new preparers

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

oops... my bad. I must have missed that, and I most definitely misread the original post.

@jasontran - I apologize. It's been a long couple of days here at the office.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

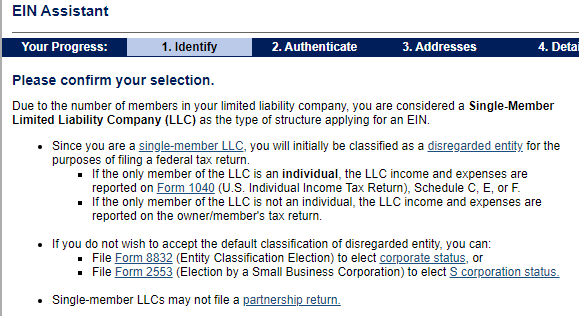

Sounds like you made an incorrect choice (or several incorrect choices) somewhere along the line in the application.

I just started an application, chose LLC and 1 member and the very next screen showed this...do you remember seeing this first page? then the next page it asks why youre applying..did you choose started a new business or what?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A single member LLC is generally disregarded, and reports on F 1040.

You evidently answered some of the questions incorrectly, and now the IRS *will* expect to get a partnership return.

Edit...my comments below is uncalled for; I didn't realize @jasontran IS a tax pro. Mea culpa

I suggest you seek local, professional help with rectifying the situation.

This forum is for tax pro's to assist other tax pro's.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think you should call in Monday morning and see if you can get that EIN voided or canceled, explain that this wasnt as intended then try again.

For questions relating to business accounts or failed EIN requests, call the Business and Specialty Tax line at 1-800-829-4933. TTY/TDD: 1-800-829-4059.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Anna, jason posted earlier, I think he is a new preparer, not a DIYer.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

jason, you may want to join this Facebook group

https://www.facebook.com/groups/taxpreparersupportgroup/

they help lots of new preparers

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

oops... my bad. I must have missed that, and I most definitely misread the original post.

@jasontran - I apologize. It's been a long couple of days here at the office.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you.