- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Form SE - Part 3 Line 18

Form SE - Part 3 Line 18

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Under Part 3, line 18, it says "Enter the portion of line 3 that can be attributed to March 27, 2020, through December 31, 2020. It seems the purpose of the question is to determine how much of your SE you want to delay until the end of the year based on net profit on line 3.

My question is regarding the instructions. I do not want to delay my SE payment. As such, it looks like I should enter "0" but instructions do not address if you do not want to take this path. Question assumes that you want to delay.

Is it correct to enter 0 and not follow the instructions on the form? Currently I owe, $5,800, if I follow the instructions, I will owe "0". If I enter "0", I own $5,800.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

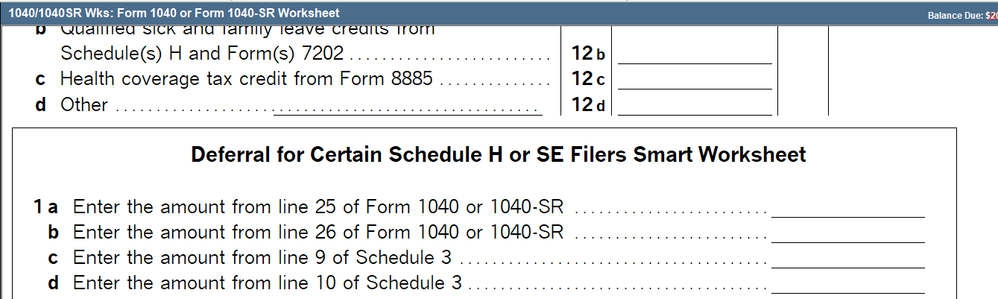

Alternatively, you could enter the amount of income on that line 18, then go to the 1040/1040SR Worksheet and scroll way way down to the Smart Worksheet I show below and in that box Line 11, you can enter zero, Im not sure which way is technically correct, they both accomplish the same thing.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"is to determine how much of your SE you want to delay until the end of the year"

It's deferred as 50% year end 2021 and 50% year end 2022.

"I do not want to delay my SE payment"

Are you using ProSeries for your personal tax return, a client's tax return, or are you using Turbo Tax and simply lost on the internet?

Don't yell at us; we're volunteers