- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Disregard, This was PEBKAC! 8915E 3 years spread checkbox, seems to be getting auto checked to opt out

Disregard, This was PEBKAC! 8915E 3 years spread checkbox, seems to be getting auto checked to opt out

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

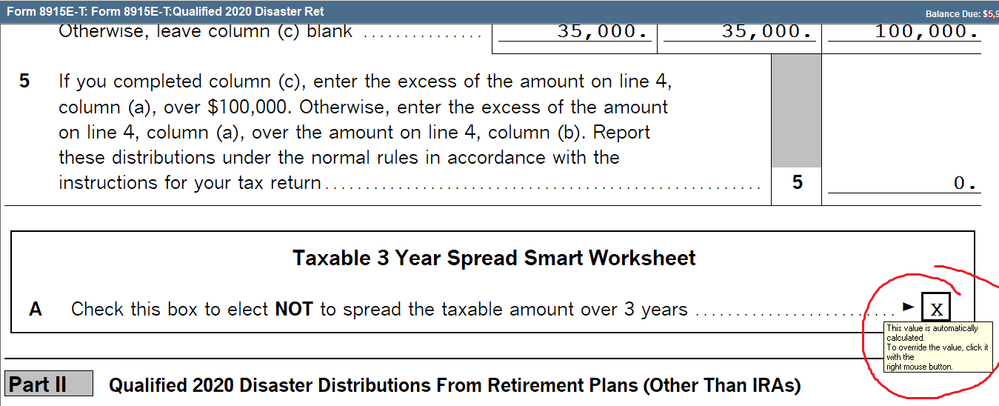

I FIGURED IT OUT! I had my sample file guy marked as deceased...no 3 year spread when youre dead!!

I didnt notice this at the office yesterday, but when I saw people over in the PS Facebook group complain, I checked my home system and that box on the 8915E below box 5 to opt out of the 3 year spread seems to be getting automatically checked and taxing the entire amount. I updated and still the same.

Work Around seems to be you can Right click on the boIx, Override, then you can delete the X in the checkbox and magically it takes away the override error.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We've done about 5 or so and the box was not automatically checked. Two that wanted to opt out I had to check the box because it wasn't automatically checked.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On the 1099R worksheet under "Qualified Disaster Distribution Smart Worksheet" are the boxes for A & B checked?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I didn't have to check box either. Mine is unchecked to spread over three years. I up dated 2/28/2021

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That is weird.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Not too weird for PS last couple years. 😉

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Nope, same thing. I even deleted the 1099R worksheet and started over from scratch.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK, this is extra weird. Im seeing this issue in a sample file that I transferred into the program the other day.

If I enter the same 1099R situation in my own file, as well as a different sample file that Ive had in there for months, no issue. Create a new file, no issue either, I transferred another client file in, no problems on that one....just this one file forces that checkbox. This makes no sense.

At any rate, IF you see this problem, my work around seems to do the trick!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"I had my sample file guy marked as deceased"

Did he already get the EIP, though? That's the burning question.

Don't yell at us; we're volunteers