- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- CA IRA Deduction

CA IRA Deduction

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Proseries Pro 2020 is subtracting a spousal IRA contribution on California Sch Ca line 22. Doesn't show why or how it came up with that answer. Is there a way to find out where the calculation is coming from? It doesn't show a worksheet or a jump to a worksheet. Just a number sitting there. The spouse is not covered under a retirement fwiw. Frustrated with proseries that it's not easy to see where the numbers come fro

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does this explanation from TurboTax apply? How old is your spouse?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No. The cross-reference is grayed out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The spouse doesn't have to be covered by a retirement plan, for the taxpayer to contribute to an account for the spouse. Have you looked at the amount entered that is for the taxpayer, to see if there is an Excess being allocated to the spouse?

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I pointed out that the spouse is not covered, so it's not limited. Let me rephrase. Neither spouse is covered under an employer-provided retirement plan but the software is subtracting for the wife's IRA contribution on the state and I don't know why. The stupid software just plugs numbers in and doesn't let you jump to where the calculation is coming from. That's not the first time I run into similar issues where I can't see where the numbers are coming. Frustrating.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ok, Ive got clients with a similar situation in 2020, (husband sole earner, self employed, wife didnt work at all) they each put 6000 into IRAs, but Im not seeing any adjustment for the IRA on the California CA....

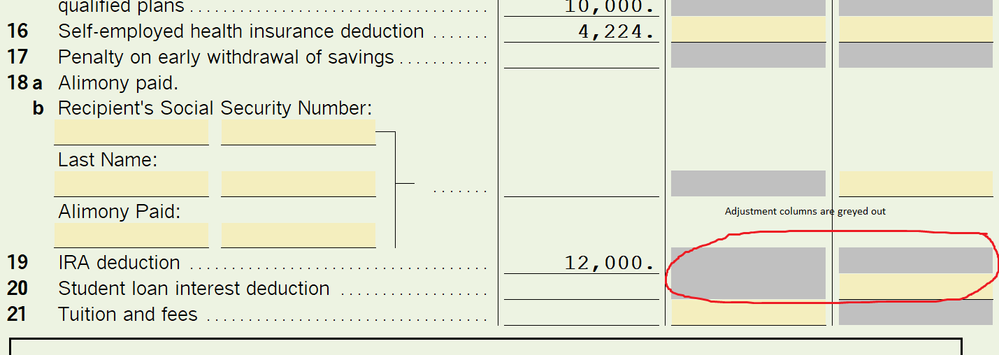

Line 19 of the California CA is the IRA contributions (and I dont see any column for making adjustments to the IRA line, theyre greyed out), Line 23 is the total of adjustments from the lines above....are you sure its the spouses IRA thats being adjusted?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'll try and do a cut and paste like you did and post.

My screen shows:

Line 19 IRA Deduction ...... (column a) $2,400

Line 22 ... Disallowed IRA ........ (column b) $1,200

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Im at home now, but I think I can pluck that same client file from my cloud backup and see if I can create a situation like you see.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does this explanation from TurboTax apply? How old is your spouse?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The IRA is a deductible IRA on the Federal. It is allowing the deduction on the federal for both but it adjust on CA.

I think just-lisa-now touched on something though. I was focused on the wife thinking the adjustment was for her. I looked at her age. She was 69 in 2020.

But now I think the adjustment is for the husband who had the wages. He was 71.

It's frustrating that proseries doesn't provide worksheets and just plugs numbers in without being able to jump to the source.

I appreciate your help on this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does ProSeries have a worksheet or schedule somewhere in the California program to track the basis for these disallowed Traditional IRA basis amounts for individuals who are 70 1/2. The CA and fed basis will now be different and it would be nice to be able to track the diff in the software.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Well dammit, I even hadn't considered that....Now I cant remember which client I had with this situation to go back and dig through the return or make a note in the file. Ugh!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪