- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Where do I report in Form 4797 abandonment of leasehold improvements by lessee (taxpayer) when business closed .

Where do I report in Form 4797 abandonment of leasehold improvements by lessee (taxpayer) when business closed .

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

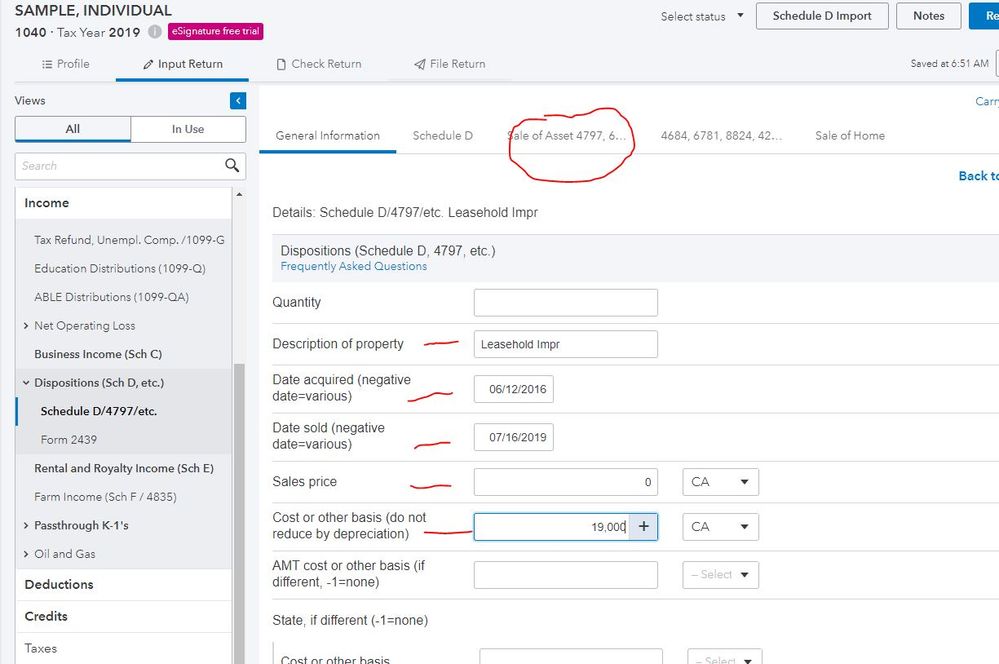

Income > Dispositions > Schedule D... > Enter purch date, sale date, sale price, original cost

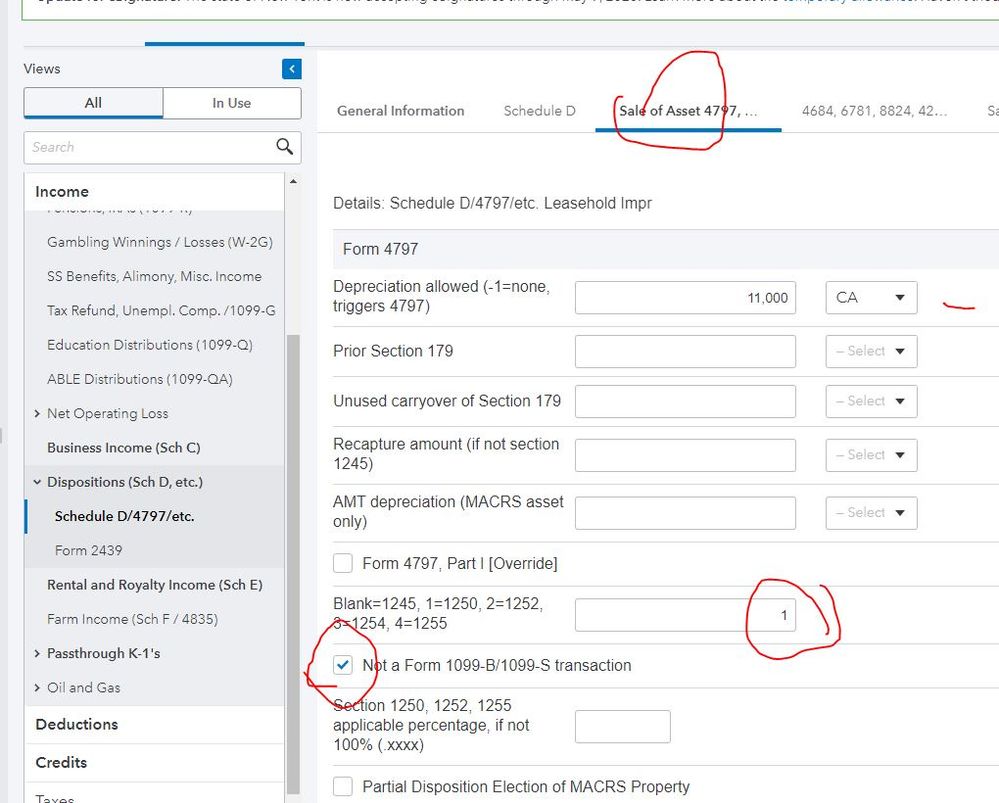

In small faint print across the top white section, select Sale of Asset 4797,...

Enter the depreciation and code section of prop and no 1099B

This will all end up on 4797

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Form 4797 Instructions: Deduct the loss from a qualifying abandonment of business or investment property on line 10.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Income > Dispositions > Schedule D... > Enter purch date, sale date, sale price, original cost

In small faint print across the top white section, select Sale of Asset 4797,...

Enter the depreciation and code section of prop and no 1099B

This will all end up on 4797

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for your reply! The info was reported on Form 4797, line 2, Part I, and the loss is carried over to Line 11. I think that's right. The loss did not show on Line 10.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks a lot! Very detailed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When business closed various equipment were either abandoned in the store or not working and were fully depreciated. Do I need to report in Form 4797 with $30,000 costs, $30,000 accumulated depreciation and zero gain/loss? Can I just group the assets in one amount instead of listing 5 assets?

When business closed should I show ending inventory as zero and inventory kept by owner should reduce purchases. How about if there were no more purchases because the business decided to close, can I have a negative purchases shown in the tax return?

Thanks.