- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Spouse' income is used twice in limiting dependent care expenses

Spouse' income is used twice in limiting dependent care expenses

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

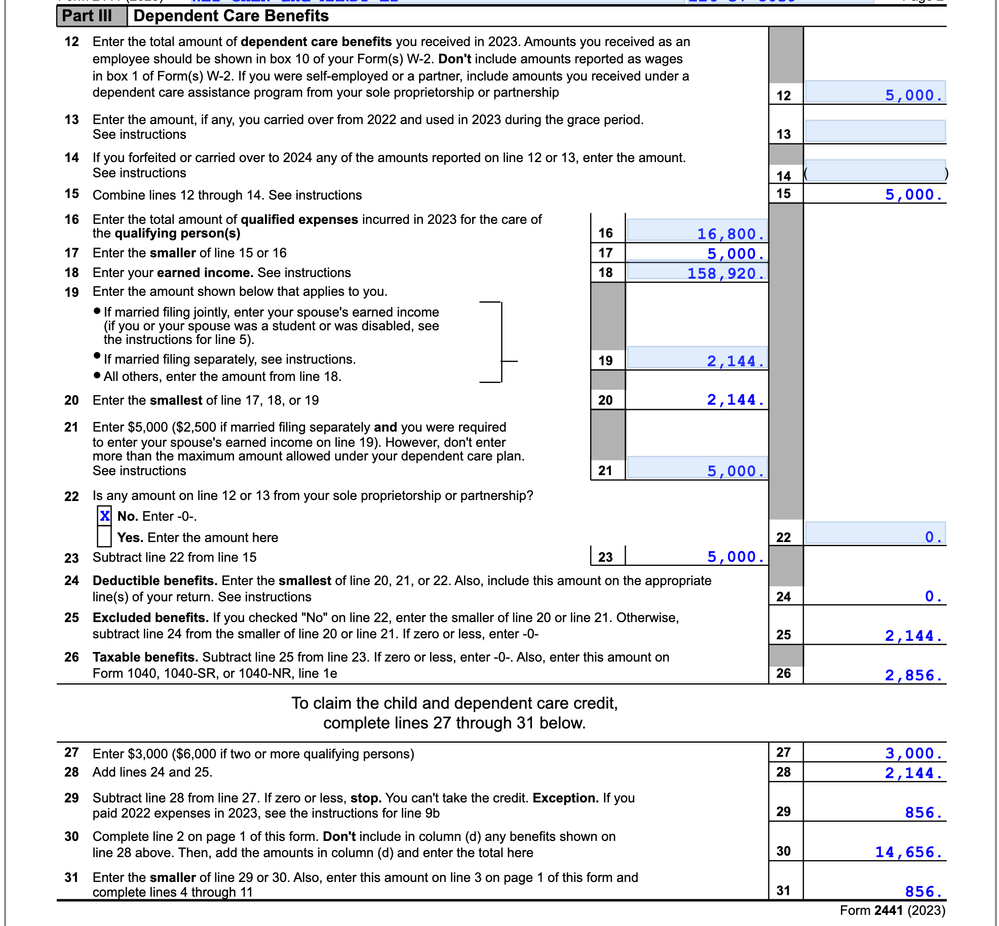

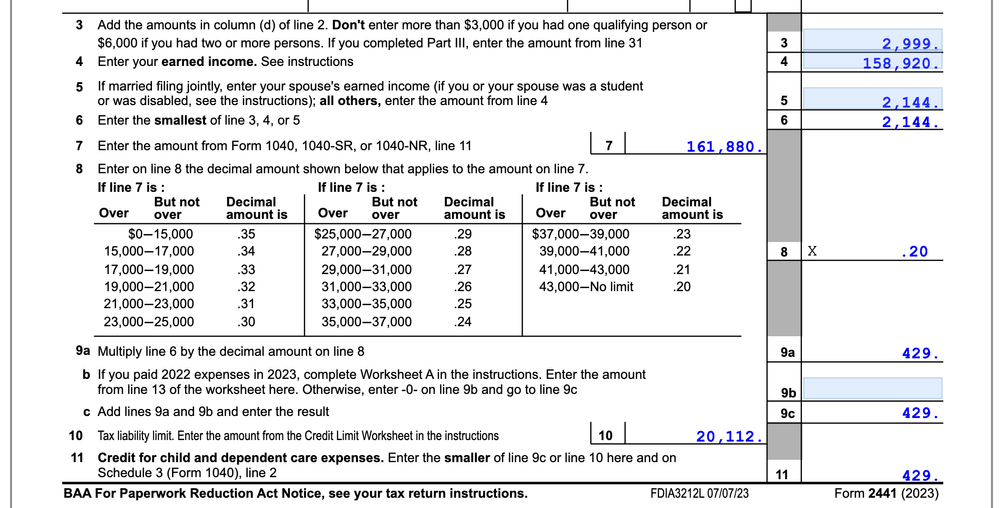

Do you see a problem in this form? Since spouse' income is 2144, so only this amount is allowed in dependent care benefit (DCB), this is fine. The remaining 856 out of 3000 is lower than spouse' income, it is allowed as well. So in total, the full 3000 is allowed though the spouse has only 2144 income.

Is this a software problem? A bug in the law? Or it is my input issue? This is a simple form and my input is limited, I cannot find a way to workaround this. I think the line 5 should be zero as it is used already in line 19. It cannot be used twice. I am using ProConnect Tax.

Click this link to vote. Like many good things in life, we have to fight for them.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What I'm seeing is two different reasons for using spouse's income

Spouse's income is used to determine taxable amount of $5000 dependent care benefits (lines 12-26)

Spouse's income is used to determine child care credit (lines 3-11)

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is it okay for double dipping? No errors on the form as I filled? Thanks.

Click this link to vote. Like many good things in life, we have to fight for them.