- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: M-1 Lines 7a and section 4 not populating in ProConnect

M-1 Lines 7a and section 4 not populating in ProConnect

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am preparing a test return in ProConnect to make sure I understand the software before deciding on whether this is the software I want to switch over to, and my understanding is that the M-1 should be populating automatically unless an override has been put into the system.

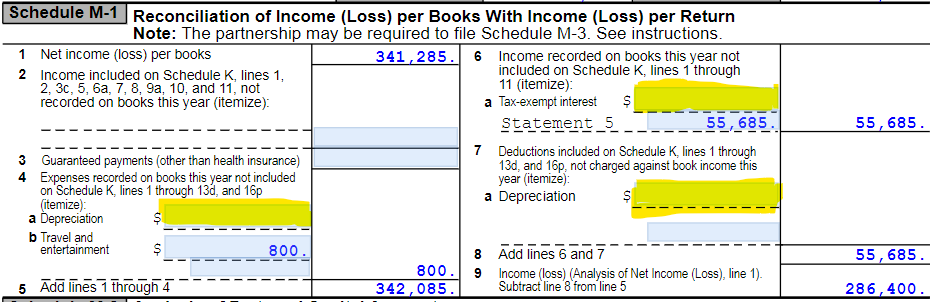

I have filled out all of the fixed asset forms with the depreciation for both the book and tax assumptions. In my example there is a sale of an asset, purchase of an asset, and variances between the client's calculated depreciation and the system's calculated depreciation. When I go to the M-1, the Gain (Loss) on Disposition of Section 179 Asset is populating as I expected it to, but for some reason the depreciation is not showing in line 7a, and the adjustment between the client's entries and our depreciation is not being pulled in which usually hits in section 4.

M-3 is not check on Schedule B, so that is not the issue, and I tried forcing Schedule L, M-1 and M-2 in the Balance Sheet Miscellaneous section which also did not work.

Any thoughts on what I am doing wrong?

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

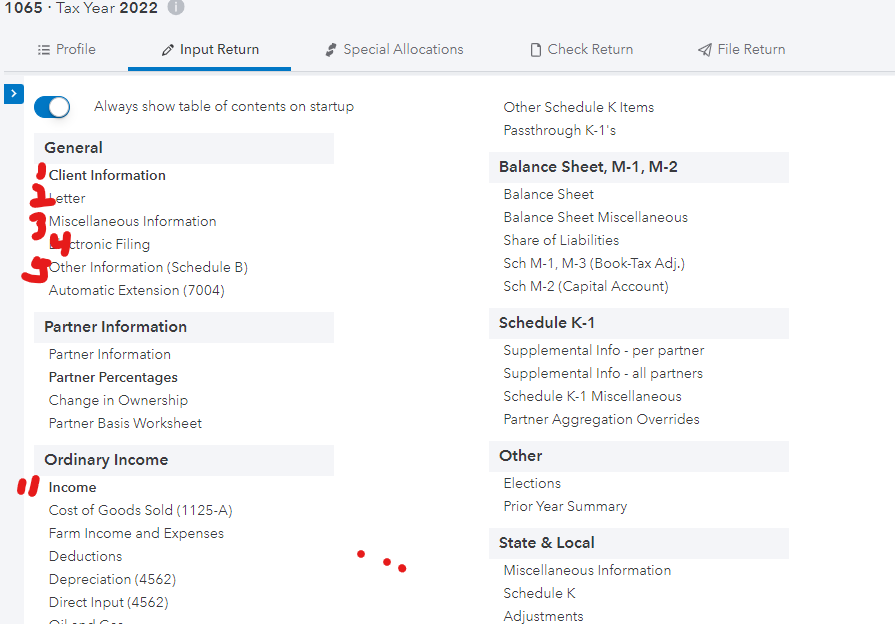

For anyone who cares to know, I figured out the issue. to fix the issue do the following:

1. Navigate to the "Balance Sheet Miscellaneous" section in the Input Return fields.

2. Under the Book Depreciation section labeled "Current year book depreciation (Ctrl+T or amount)", change the selection to "4 = Book"

3. M-1 should calculate automatically. Refresh a few times if necessary to see the changes

I hope this helps anyone else who may have the same question.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

1120? My guess is that you did not enter the beginning balance sheet figures. Line 10a should then be adjusted up or down by sale and acquisition to get and ending balance.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There are also many videos available with a Google search.

https://www.youtube.com/watch?v=Hdnb-4tz9CI&t=10s I can't find Part 1

ProConnect also has training at https://proconnect.intuit.com/training/software-webinars/ Look a "recorded

for a corporation.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

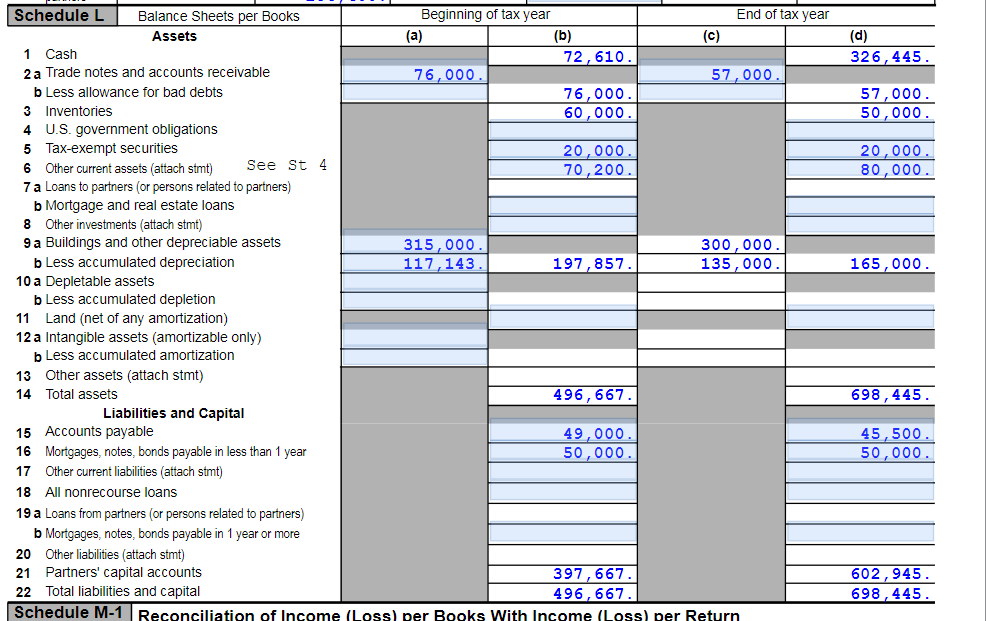

It is for a 1065. I had filled out the balance sheet items, in this case 9a and 9b in addition to the fixed asset worksheets which should allow for the system to calculate the book tax difference and depreciation differences on M-1. You can see below the items that I would expect to populate automatically, but for some reason they are not pulling in without me putting in an override. I've contacted ProConnect support, and they don't seem to have an answer either, so I wanted to reach out to the community to see if there is some kind of common input error that I am doing that would cause it to not populate.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@PhoebeRoberts might be able to give you some guidance. Unfortunately we can't see your input, so sharing what you did as overrides and what Statement 5 has on it could help in the discussion.

Generally the software works well, although finding input can be difficult. Overrides are really discouraged. It is very closely related to Lacerte, but describing where to find input is more difficult because Lacerte numbers their screens and PCT does not. If you look up help with Lacerte, here is an idea of the screen number (sorry for crude quick numbers)

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Muni interest should populate automatically, but I think there are a couple places you can enter it and only one gets the Sch M right? (I might be thinking of Treasury interest - I swear I entered that 3 different places before everything came out.)

I don't use book depreciation (I'm a tax person, not a GAAP person; I don't calculate book depreciation for any purpose), but it doesn't surprise me that ProConnect doesn't make assumptions about how much total book depreciation you have.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is that Balance Sheet book basis or tax?

That may affect your outcome.

Sometimes you just have to fiddle with the M-1 to get it right.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The Balance Sheet has been entered in on a GAAP basis assuming that is what the client would provide. In the depreciation worksheets, I put into both the book and regular basis assuming the software would calculate the difference and put it in a worksheet and the M-1.

I do not have any overrides put in the system that I am aware of, so it should work. 🤷

I've gone through and verified that no Overrides have been entered. My M-1 line 1 is off, 4a is not pulling in from form 4562, nor is 7a. The difference between 7a and 4a is the amount that I am off in line 1.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found where to put the Tax-exempt interest, so that is now flowing through to 6a, thank you for that. Any ideas on the M-1 4a and 7a not flowing through?

I've included more detail in other posts. I've gone through all of the fixed asset forms and disposal forms, and I believe everything is in there correctly.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For anyone who cares to know, I figured out the issue. to fix the issue do the following:

1. Navigate to the "Balance Sheet Miscellaneous" section in the Input Return fields.

2. Under the Book Depreciation section labeled "Current year book depreciation (Ctrl+T or amount)", change the selection to "4 = Book"

3. M-1 should calculate automatically. Refresh a few times if necessary to see the changes

I hope this helps anyone else who may have the same question.