- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: How to enter Sch B Part III?

How to enter Sch B Part III?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

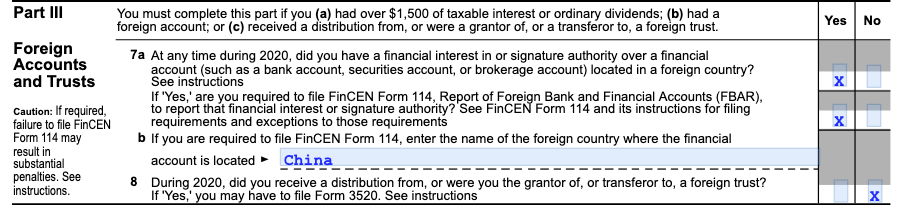

If you have foreign banks, then Sch B Part III needs to be entered, for example:

The question is how do I enter the info?

Currently, I go to the details of any of the interest item, check the boxes and make selection, but this is not correct because: firstly Part III does not pertain to any particular interest item, and secondly what do I do if there is no interest items?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, in Proconnect Tax Online, I can click details on a blank interest item. Suppose you have two countries, then you would click two blank interest items, one for country 1, and the other for country 2?

Short answer is Yes.

Here's the long answer:

Well, if I do one (entering on a blank interest item solely for Part III disclosure) for Country 1, why not for Country 2?

Yes, I would need to double check it every year to make sure the info is still applicable to both (or in fact, either) countries. But then, this has to be done regardless of whether the interest item is blank or has description. Interest income items with zero interest would NOT show up in Part I anyway.

I don't have a lot of those. Some years ago, a client with Canadian RRSP (who under the old rules made the election to treat it as nontaxable for US) also had set up a Trust in another country. Form 114's (formerly under an old form number that I no longer remember, something to do with 22.1) had to be filed. Neither account generated US income. He passed away several years ago. Thus, this example has expired so to speak. (It's still sad that don't ask me if pun is intended.)

The problem for putting it in General is that for those e.g. @George4Tacks who has a taste for Tacking the Part III info onto a Part I interest income item, they can't do the tacking from General. If Lacerte put it in BOTH General and as a feature for individual interest income items, it would confuse the heck out of some users. Then we would have posts here like "Why in the world would Lacerte have input in two separate areas for this? How do we decide whether to do it in General or in .... things like that. Then George would have to explain the flip side of the above....

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The answer at the bottom of Schedule B is NOT for a particular interest item, but rather a YES/NO question and whether you need to file FinCen 114.

You will find the linking of specific interest items, the amounts, the countries and much more in the input for FinCen 114

Scroll down to Miscellaneous Forms > Foreign Reporting (114, 8938) and you will a great number of items to add to your data for the return.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What y

@George4Tacks wrote:The answer at the bottom of Schedule B is NOT for a particular interest item, but rather a YES/NO question and whether you need to file FinCen 114.

You will find the linking of specific interest items, the amounts, the countries and much more in the input for FinCen 114

Scroll down to Miscellaneous Forms > Foreign Reporting (114, 8938) and you will a great number of items to add to your data for the return.

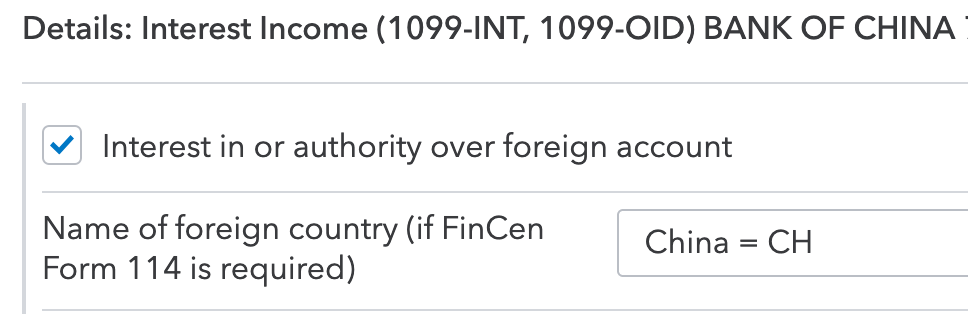

What you said makes sense and that is what I am looking for, but I cannot find it. I can only find it under a particular interest item, as shown below:

Can you please send an image? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

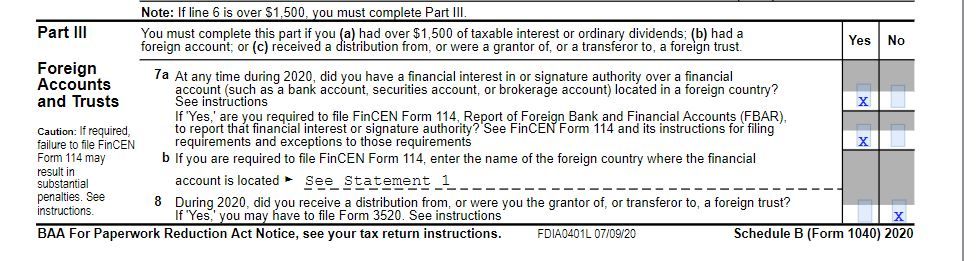

I believe I misspoke - I may still be uncertain of what you are looking for. For EACH interest income, you can go to the screen you showed in the detail for EACH interest income. If you have multiple countries, then the Schedule B will refer to a statement that will list all of the countries selected.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The Sch B Part III entries are not related to a particular interest item, but rather whether you have filed form 114, and if so the foreign countries. Imagine that you have filed form 114, but there is no interest to report (there minimum peak amount is 10,000 only). So I believe there should be a general input field for this which is not tied to an interest item, but there is not?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I use Lacerte; therefore, I may be barking up the wrong tree. In so, I'd really have to blame in on Joshua.

In Lacerte, I can enter the Foreign Bank Account info for Part II for a blank interest item.

In you example, your entries were for Bank of China. But in your software, can you enter the bottom (foreign bank) info for a blank interest item?

I have clients with dividends income only in a foreign broker account. I would enter the dividends in Screen 12 and Sch B Part III info in the Interest screen (Screen 11). Sch B Part I and Part II would be blank and part III has the info with a statement of the countries entered under the blank interest items. (Yes, in Lacerte, the Part III info can be entered to multiple blank interest items.)

I hope this helps.

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It should read:

In Lacerte, I can enter the Foreign Bank Account info for Part III

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It works AS IS.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, for bank account with zero interest income, that'd work.

I have clients who have foreign accounts with no interest income or U.S. Taxable income. If I sent them tax organizers with the account names filled, I would invariably get questions of why and what. Over the years, I just got tired of addressing the same thing over and over. Yet, Part III is needed for them. So, I just leave the account/bank name blank.

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@joshuabarksatlcs wrote:In Lacerte, I can enter the Foreign Bank Account info for Part III

Yes, in Proconnect Tax Online, I can click details on a blank interest item. Suppose you have two countries, then you would click two blank interest items, one for country 1, and the other for country 2?

While this is doable, I feel this input field should be in general section, not under any particular interest items, and countries should be a list of items that can be checked. [If you have multiple foreign bank interests, you can just use any of the interest items].

Thanks for your response, now I know someone else is doing the same thing as I do, don't you feel it is kinda strange?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, in Proconnect Tax Online, I can click details on a blank interest item. Suppose you have two countries, then you would click two blank interest items, one for country 1, and the other for country 2?

Short answer is Yes.

Here's the long answer:

Well, if I do one (entering on a blank interest item solely for Part III disclosure) for Country 1, why not for Country 2?

Yes, I would need to double check it every year to make sure the info is still applicable to both (or in fact, either) countries. But then, this has to be done regardless of whether the interest item is blank or has description. Interest income items with zero interest would NOT show up in Part I anyway.

I don't have a lot of those. Some years ago, a client with Canadian RRSP (who under the old rules made the election to treat it as nontaxable for US) also had set up a Trust in another country. Form 114's (formerly under an old form number that I no longer remember, something to do with 22.1) had to be filed. Neither account generated US income. He passed away several years ago. Thus, this example has expired so to speak. (It's still sad that don't ask me if pun is intended.)

The problem for putting it in General is that for those e.g. @George4Tacks who has a taste for Tacking the Part III info onto a Part I interest income item, they can't do the tacking from General. If Lacerte put it in BOTH General and as a feature for individual interest income items, it would confuse the heck out of some users. Then we would have posts here like "Why in the world would Lacerte have input in two separate areas for this? How do we decide whether to do it in General or in .... things like that. Then George would have to explain the flip side of the above....

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Until I played with this, I had no idea that PCT could even do two countries. I can't explain a thing. This software continues to mystify and surprise me. I am not a user of PCT, only a person that enjoys challenges and this definitely is one.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If we have an interest one interest item (per country), then the current input method is logical, you identify the source of the interest item.

If there are 2 and more interest items (per country) which is often the case, the this method appears to be unnatural, as you have to randomly pick a random item, or do it for all unnecessarily.

If there are 0 interest items, then you have to be creative to think that you can input details on an interest item that does not exist - it maybe helpful to put a label like "foreign interest" and maybe $1.

I think the current way is Okay as long as we understand how it works, and now we do thanks to both of you who participated the discussion! I thought I did it all wrong, it is kinda strange nevertheless.