- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: How do I set up a residence that is being used as a rental for depreciation reporting purpose?

How do I set up a residence that is being used as a rental for depreciation reporting purpose?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You probably want to start by entering the house as an asset for depreciation. But always remember, part of the cost is for land and that isn’t depreciable.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi and thank you for the reply.

Yes, I understand that I need to enter the house as an asset for depreciation... I also need to add a washer/dryer and some window treatments I want to take the Section 179 deduction on. I'm a former IRS auditor so I understand also that land is not depreciable... It's my first time using ProConnect software and the issue is I can't figure out where I go to enter these assets?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Specifically... where to go in the software. I'm having a brain freeze.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It was 20 below last night, but I think I did successfully avoid brain freeze. But since I use ProSeries, I can't point you in the right direction on that one.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for trying.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Depreciation screen is under Deductions. In Lacerte (which looks a lot like ProConnect), it's the first item under Deductions.

There's also a Depreciation link at the top of the Sch E input screen that will take you to the same place.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If Phoebe's help doesn't get you there, maybe @George4Tacks can help.

For Section 179, doesn't the rental activity need to rise to the level of a trade or business in order to qualify? Either way, be consistent with 179, QBI, 1099s.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Start by entering the Rental - I assume 1040 Schedule E https://proconnect.intuit.com/support/en-us/help-article/form-1099-misc/common-questions-entering-re... should have all you need

Depreciation https://proconnect.intuit.com/support/en-us/help-article/federal-taxes/entering-depreciation-new-cli...

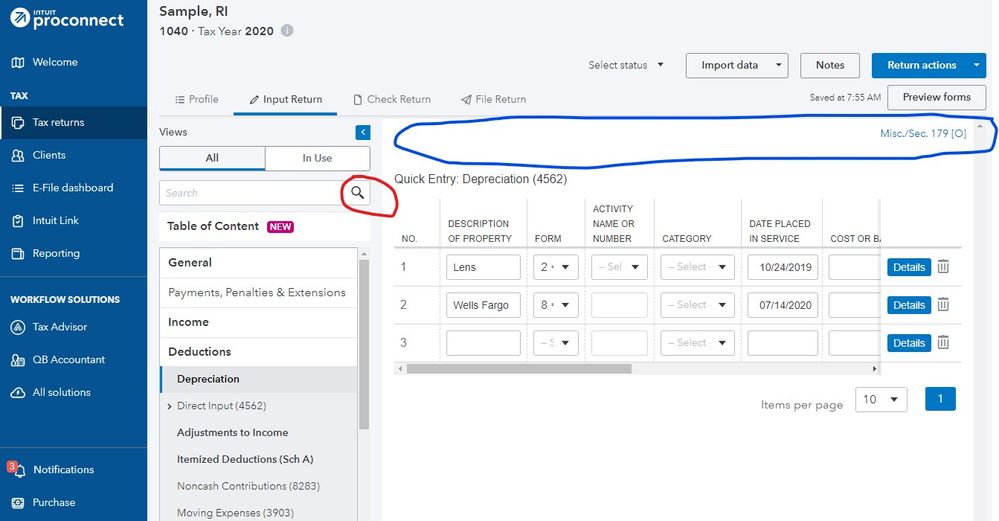

First item entered is Description, then FORM (3 for Schedule E), then ACTIVITY NAME OR NUMBER (1 for 1 rental, 2 for 2nd, but you will see those descriptions you used in set when you click the down arrow)

https://proconnect.intuit.com/support/en-us/help-article/fixed-assets/depreciation-methods/L7qfgF8FA... Shows the codes for methods 99 for Land, etc.

This should get you up and running.

Here a few helpful hints:

If you want a zero, use -1 (negative 1). 0 and blank are the same = NOTHING. The only way to say you TRULY WANT A ZERO is to enter -1

When you go to check return, you can view the forms. If you want to enter something on a particular line or in a box, click that line or box and you will jump to the input, or at least close to it.

See this sample image. Red circle shows where you can start a search for a form or a word that will get you to an input area. Often the input grids will offer several sub screens, accessible by clicking the wording, such as Misc/Sec. 179 [O]. Notice [O] - Entering in a field with this is an OVERRIDE. If it is [A], then this is an adjustment to be added to or subtracted from the enter.

Welcome to one of the more confusing softwares out there. Works well, but awkward.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks Rick, this woke me up this morning, I needed that.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks George. I picked the right username this time, much easier than saying Beetlejuice 3 times.