- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Allow two K-1s to flow to one 8829.

Allow two K-1s to flow to one 8829.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

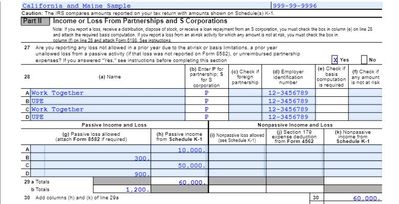

A married couple works together in an LLC in a non-community property state. The IRS requires treatment as a partnership (on Form 1065). This then generates one K-1 for each spouse, citing the same partnership (i.e., the same EIN). For an MFJ return, they ought to be entered to ProConnect separately so that they match the K-1s the IRS receives. However, the tabs that result in the input screen will both have the same partnership name, but the K-1s appropriately should be marked one as TP and one as Spouse. Moving on to the Business Use of the Home: Both work together in one dedicated workspace. This should drive one Form 8829, showing the home's square footage and the dedicated business space's square footage. However, if just one 8829 is entered, the business income of only one of the K-1s shows up in the Business Use of Home worksheet. Of course, both need to show up there, on the one worksheet. If instead two 8829 inputs are used (one for each K-1) and the same square footages are entered, the home office deduction is improperly doubled. ProConnect should allow multiple K-1s to be entered for the same business and then used for but one 8829. All other solutions are awkward.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

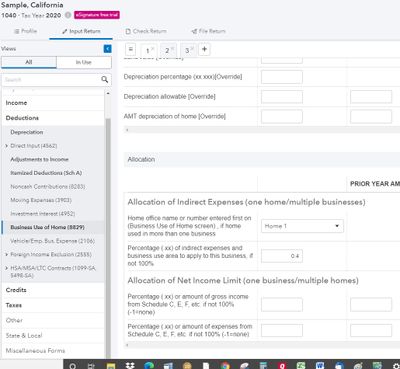

At the bottom of the input for Office in Home is Allocation - one for one 8879 and multiple businesses and the other for Multiple 8879s and one business. Use the first

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Both Intuit tech support and I tried using this and failed. The situation I described is not multiple businesses. There is one business, an LLC between husband and wife, that has to file as a partnership and thus generate two K-1s for the same business. Let's call the business P2, with the partners sharing 50/50. The couple shares one workspace and thus should file one 8879 (one square footage for the office / one square footage for the home). If, in 1040 input, you enter two separate K-1s (one designated as TP, one as Spouse, so that they can match the two that the IRS receives, but both citing the same P2 and the same EIN), if you try to produce one 8879, it fails--because, in the 8879 input, you have to designate one of the P2's as the one the 8879 pulls from. In that situation, the one 8879 then picks up the business income of just one of the K-1s. The workarounds are awkward: 1) You could do two 8879s and claim 50% of the office space for each; or 2) You could add the two K-1s together and enter them as if one K-1 (thus not matching what was sent to the IRS). Note that the section you recommend is one 8879 for two businesses. This is one business. Now, since entering two K-1s for P2 gives what ProConnect thinks is two businesses, is there a way to use that allocation section to give a correct result? If so, can you be specific on what to input there?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Rather than jumping in with making a suggestion for improvement of the product, start with a question on how to use the product to get feedback from other users. Here is how I would answer that question:

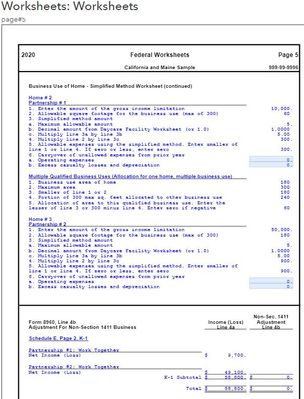

I just used a sample return - 1 schedule C (40%) and the two K-1s both with the same name, but one to TP and one to SP (each with 30%) - First image is a snapshot of the 8879 input (simplified method for all, but you could set up 3 with the same Interest, taxes, depreciation etc) - 2nd is the worksheet for UPE on the third image for page 2. Two Schedule SE are also affected for this scenario

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

8829, not 8879. Typo.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"If instead two 8829 inputs are used (one for each K-1) and the same square footages are entered"

So why not enter just half the square footage on both?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Because that's just an ugly workaround (and I noted that as a possible ugly solution). It just doesn't represent the reality of one workplace.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I appreciate your explanation as proper use of ProConnect Online.

To your comment of "Rather than jumping in with making a suggestion for improvement of the product, start with a question on how to use the product to get feedback from other users": I didn't just jump in assuming ProConnect was flawed. Rather, I chatted with ProConnect Online support to find how to do this in the software. After their digging in, they said that it could not be done. My assumption was that ProConnect support would understand its own software. I guess I was wrong. So, it seems I should reach out to the Community rather than asking ProConnect!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"So, it seems I should reach out to the Community rather than asking ProConnect!:"

Yes. Most of the time you'll get a quicker answer that is correct.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Some clarifications, please:

1. So, even though there is but one home, for each Sch. C or K-1, you cite different homes (Home 1, Home 2, and Home 3 in your example, as I see Home 2 and Home 3 in the Federal Worksheet and Home 1 on your input screen). And then you have to enter the business square footage and the total square footage on each. I.e., multiple entries of the same data. Yes? I would prefer that ProConnect would handle this better, as but one home (Home 1). So, why does ProConnect say "one home/multiple businesses" if you are entering multiple "Homes"?

2. Where do you come up with 40% for the Sch C "home"? I do understand that the K-1s for each of the equal partners would get half of the remainder (70%/2).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What Code section defines "ugly"? What you mean is "I'm fixated and can't move on."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sure. I also could do all my calculations offline and override everything in the program. That's also ugly. Ugly is when you are doing a kluge--something inherently illogical to create the correct result, when the software should not require this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

And I'm not hung up in doing the return. I did my own less-ugly kluge. I entered one set of K-1 data that was the sum of the two K-1s received. That also works.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Please, Intuit, don't raise my fees so you can hire more programmers to produce pretty returns.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, there could be easier input, but I think it is not that common and this program has been in use for decades (Lacerte is under the hood of this model.) They just massage it as time goes on.

Answers are easy. Questions are hard!