Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- How to make excess HSA contribution carryover to the next year?

How to make excess HSA contribution carryover to the next year?

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

puravidapto

Level 8

02-23-2024

09:05 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

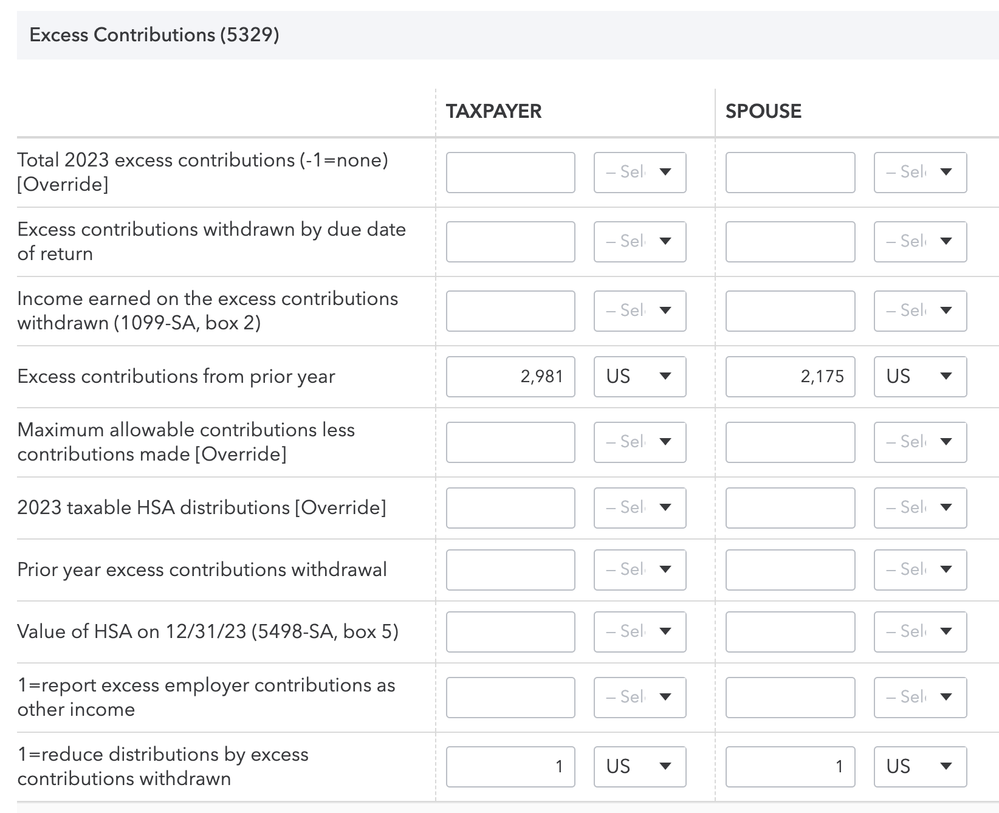

I had excess HSA contributions in 2022 due to contributions made through 2 employers, and forms 5329 (penalty) were generated. However, the excess contribution were not carried over to 2023, and I have to manually entered on Form 8889 as shown in graph below.

In 2023, they made the full contribution, so the excess contributions from 2022 become excess contributions in 2023 as well, and as in 2022, the excess contributions will not be carried over to 2024. My question is, How do I makes the excess contributions carryover to the next year automatically? Thanks!

-- Click here to vote.