- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Schedule C

Schedule C

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm entering in vehicle info for business use of a vehicle with the year, make, model and mileage but I CANNOT get the information to carry over onto the P & L. It's driving me nuts! I've entered the data into Screen 22 but when I view the form, the Sched C, Part IV is BLANK. Can someone please assist me? I'm new to the Lacerte program and I'm practicing on Lacerte 2020 before Tax Season starts. ANY suggestions are welcome! Thanks a million!

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

General rule for Lacerte - NEVER USE direct input - NEVER USE Override [O] - There are a few rare exceptions

If you are ONLY USING MILEAGE, use 30 and be sure Form Number (Ctrl + T) is set to Schedule C and the Activity is tied to the specific Schedule C

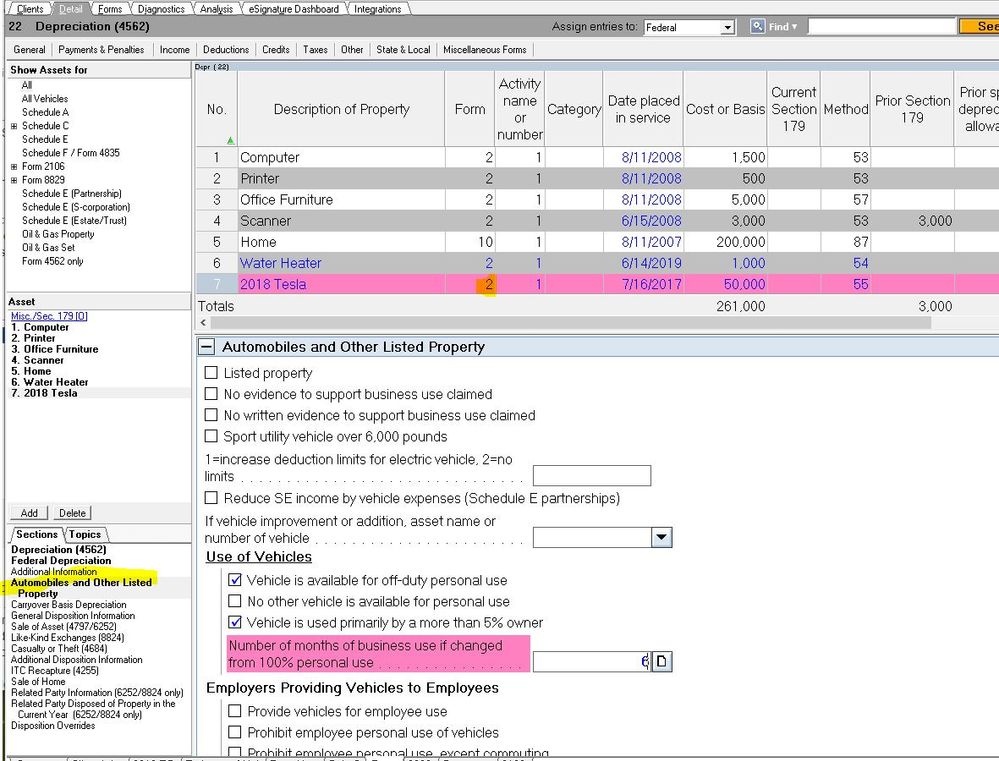

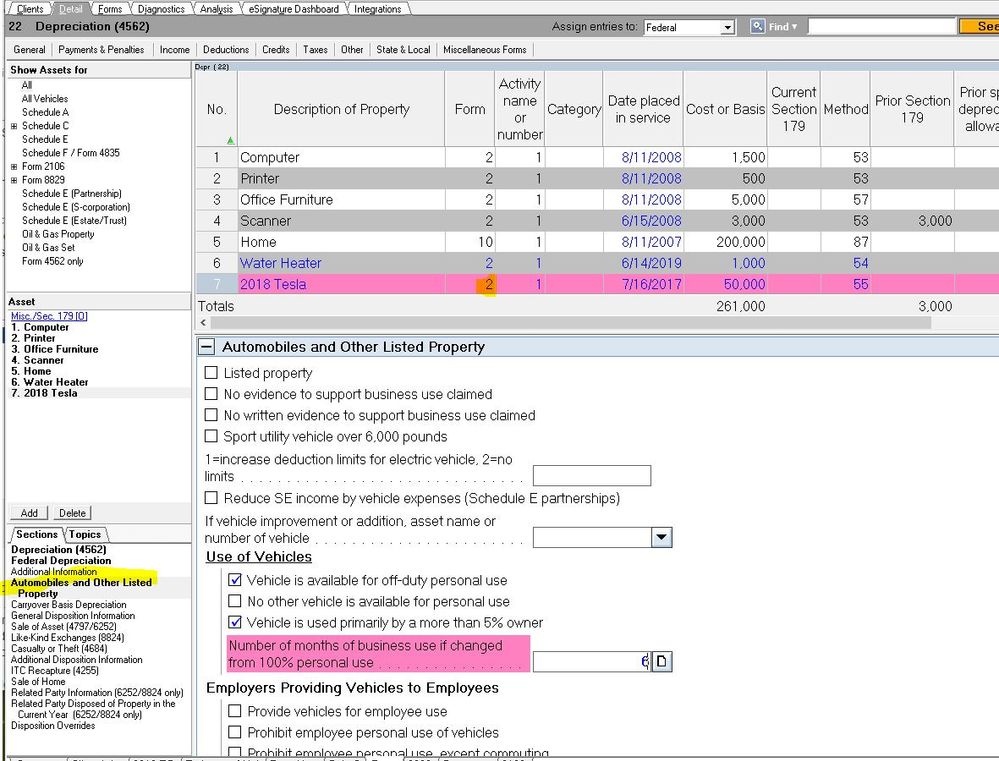

If you are depreciating and taking actual expenses, use 22 like above, be sure Form Number (Ctrl + T) is set to Schedule C and the Activity is tied to the specific Schedule C - See the following image for a bunch of things tied to Schedule C, but notice one is Form 10 for Home office. For the Tesla, you then scroll down to Automobile and other listed property to enter the mileage and expenses

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is it showing up on Form 4562 instead?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No-it transferred the vehicle info and mileage straight to the 2106. Would this be information better served by entering it into Direct Input?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do you have the asset entry for the vehicle linked to Form 2106, rather than to Schedule C? It's one of the first fields below the grid.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I go from Contents -> 22 Depreciation OR do I go from Contents ->23 Direct Input OR should it be Contents ->30 Vehicle/Emp. Bus. Expense (2106)? If it's 22 Depreciation-under General, the Form should be Schedule C, correct? Then enter the asset information along with the Date placed in Service and THEN scroll down to Automobiles and Other Listed Property? I believe I'm missing something somewhere because it shouldn't be this complicated to enter a vehicle used for business that should show up on Part IV of the P & L... I'm glad I know what a P&L is supposed to look like or I would be lost...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

General rule for Lacerte - NEVER USE direct input - NEVER USE Override [O] - There are a few rare exceptions

If you are ONLY USING MILEAGE, use 30 and be sure Form Number (Ctrl + T) is set to Schedule C and the Activity is tied to the specific Schedule C

If you are depreciating and taking actual expenses, use 22 like above, be sure Form Number (Ctrl + T) is set to Schedule C and the Activity is tied to the specific Schedule C - See the following image for a bunch of things tied to Schedule C, but notice one is Form 10 for Home office. For the Tesla, you then scroll down to Automobile and other listed property to enter the mileage and expenses

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Practice" - If you are REP, use all 9s for the SSN or EIN on the practice returns to avoid a fee.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Oh-Thank you SO much! This was the answer I was looking for and it was having me pull my hair out. And yes - I'm actually learning for the first time ProSeries 2019 and Lacerte 2020. All of my tax preparation experience has been with proprietary software with not much comparison. I am formerly a LibTax and ProFiler user. Your assistance and clarification is greatly appreciated! Happy Holidays!! :))

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you really want to pull out your hair, try ProConnect (Online version of Lacerte, SORTA)

Glad I could help. Phoebe gave you the answer, but I have always felt a picture is worth ....

Answers are easy. Questions are hard!