- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Why are Dividends Appearing as Foreign Source?

Why are Dividends Appearing as Foreign Source?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Colleagues:

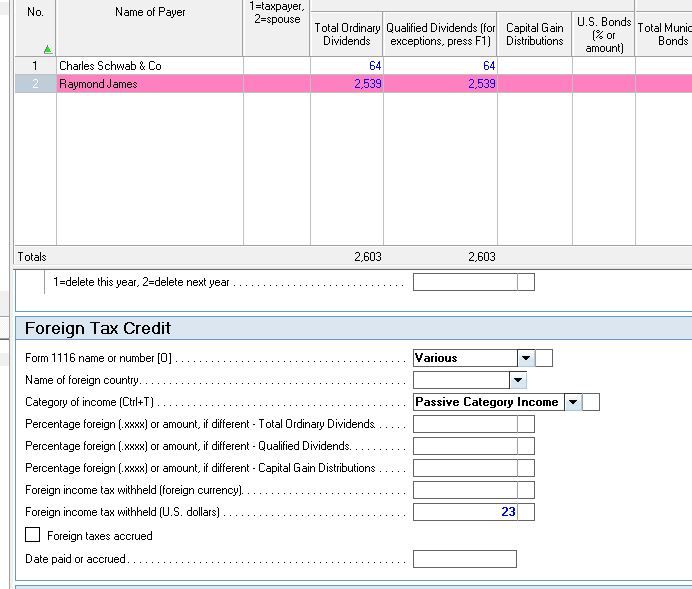

I copied information from a 1099-DIV to Screen 12 boxes (1a, 1b, 2a, and 2b). I also had small numbers to input in field 5 (Section 199A dividends) and from box 7 of the 1099 some foreign tax paid.

My Form 1116 is reporting all of the Screen 12 data as foreign source. But it isn't. I assume that I have entered something incorrectly, but I cannot see where or how.

Can anyone help?!

Micah

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Choose your own adventure. This is what we get paid the big bucks for.

Depending on materiality:

- Elect not to file the 1116, because then you don't care

- Assume all are foreign

- Look at the dividend detail and pick out all the items that have foreign taxes withheld and assume those are 100% foreign

- Look at the dividend detail and pick out all the items that have ADR in the name and assume those are 100% foreign

- Google every mutual fund to determine the percentage of foreign source income, then multiply

- Ask your client to ask their investment advisor, whose hapless assistant surely has nothing better to do and wouldn't consider just blowing you off

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Directly above where you enter the amount of foreign tax are boxes to enter how much of the divs / QDivs / CGDs are foreign source.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you make an entry such as the image shows, just to get the $23 foreign tax and you leave the Percentage foreign .... for the Ord, Qual and CG dividends blank, the program ASSUMES all dividends are foreign. You must input the portion of the totals that are foreign for each foreign tax entered FOR ALL 3 FIELDS.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On Screen 12 where you entered the dividends & cap gain distributions, scroll back down to the Foreign tax credit section and enter only the ordinary dividends, qualified dividends, and cap gain distributions from which foreign taxes were withheld.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is very helpful. But the 1099 does not report how much foreign-source income there was! Where do I get that info?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Those 2..35..46 pages of back up that comes from the brokerage house has the info. You often have to hunt/peck thru them to determine which dividends generated the foreign tax withheld. A *few* brokerages provide a total; I *like* those companies.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Choose your own adventure. This is what we get paid the big bucks for.

Depending on materiality:

- Elect not to file the 1116, because then you don't care

- Assume all are foreign

- Look at the dividend detail and pick out all the items that have foreign taxes withheld and assume those are 100% foreign

- Look at the dividend detail and pick out all the items that have ADR in the name and assume those are 100% foreign

- Google every mutual fund to determine the percentage of foreign source income, then multiply

- Ask your client to ask their investment advisor, whose hapless assistant surely has nothing better to do and wouldn't consider just blowing you off

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Ask your client to ask their investment advisor, whose hapless assistant surely has nothing better to do and wouldn't consider just blowing you off

LOL Phoebe... oh to be a fly on the wall when that call is made 😂

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You people are ridiculously helpful! THANK YOU!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can we quote you on that the next time some grumpy poster rags on us for having a sense of humor?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would say yes but I don't want to get caught in the cross-fire!