- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Handling ERTC ( Employment Retention Tax Credit) and also CA Relief Grant - a guide

Handling ERTC ( Employment Retention Tax Credit) and also CA Relief Grant - a guide

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello all,

For anyone having a hard time with the ERTC and/or the CA Relief Grant, and figuring out where to put everything so that the balance sheet stays in balance for both Fed and State, as well as some basis adjustments on the CA K1, I've put this little guide together. When I was researching this earlier this month, I found very little guidance, so if there is still very little out there, I hope this helps.

The first part of this applies to the ERTC, and the second part to the CA Relief Grant. This is for S-Corps specifically.

Please note that the the full amount of the ERTC credits needs to be recorded as "Other Income" on your QuickBooks, even if the client didn't receive the all ERTC money in full by the end of 2021. Any unreceived ERTC money should be recorded as an asset titled "ERTC Receivable." (Also please note, this guide was not made in the context of the client receiving any advances on the ERTC credit.)

ERTC

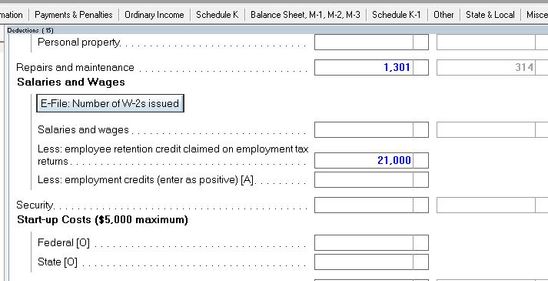

1. On screen 15, under the Salaries and Wages section, in the “Less: employee retention credit claimed on employment tax returns” enter the amount of the ERTC as a positive number.

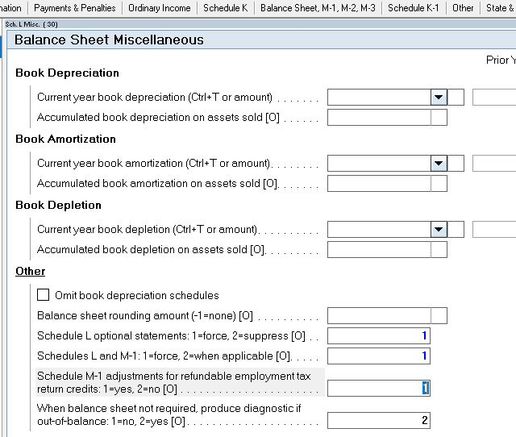

2. On Screen 30, go to the bottom area titled “Other” and on the line titled “Schedule M-1 adjustments for refundable employment tax return credits: 1=yes, 2=no [O]”, enter “1” in the box.

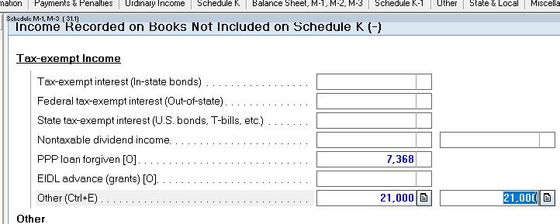

3. On Screen 31.1, scroll down to what is currently the fourth section, titled “Income Recorded on Books Not Included on Schedule K (-)”. In the section immediately below, titled “Tax-exempt Income”, go down to the line titled “Other (Ctrl+E)” and in the Federal box, enter the amount of the ERTC credit as a positive number.

California Relief Grant

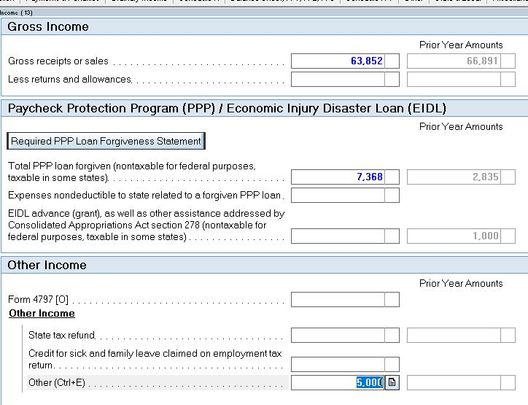

- On Screen 13, in the section at the bottom titled “Other Income,” go to the line labeled “Other (Ctrl+E)” and enter the amount of the CA Relief Grant in the box.

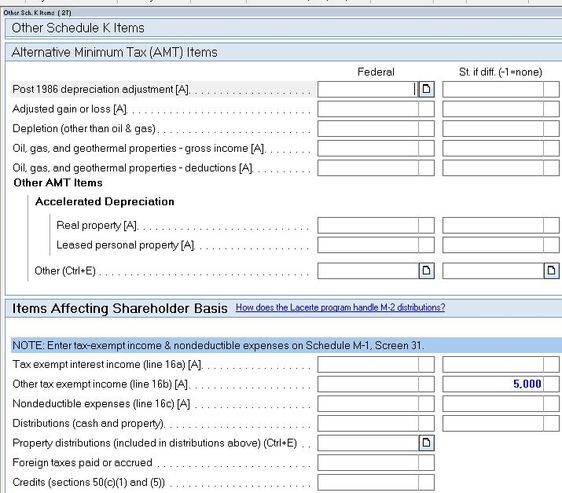

2. On Screen 27, titled “Other Schedule K Items,” go to the section titled “Items Affecting Shareholder Basis,” and on the line titled “Other tax exempt income (line 16b) [A]” enter the amount of the CA Relief Grant in the State box only.

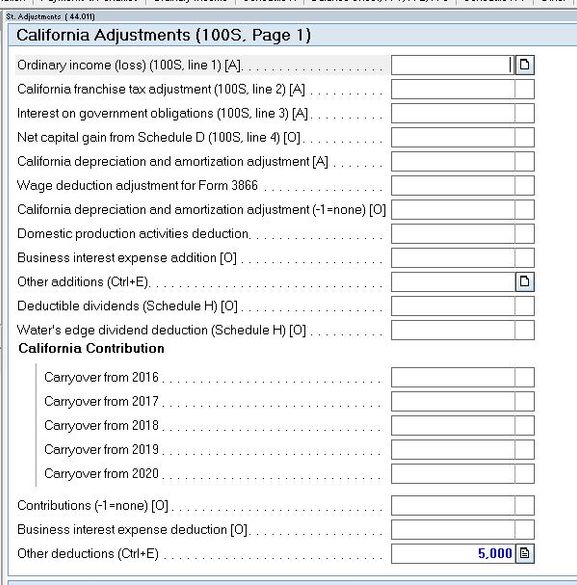

3. On Screen 44.011, titled “California Adjustments (100S, Page 1), go to the end of the first section, and on the line titled “Other deductions (Ctrl+E)” enter the amount of the CA Relief Grant.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I thought I'd put this bookmark here for reference, because some people still seem confused (these grants are subject to SE tax as business income):

The date on the topic hasn't been changed, but the content has been updated for the recent SB changes.

Don't yell at us; we're volunteers