- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: FSA + Dependent Care Credit

FSA + Dependent Care Credit

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Folks:

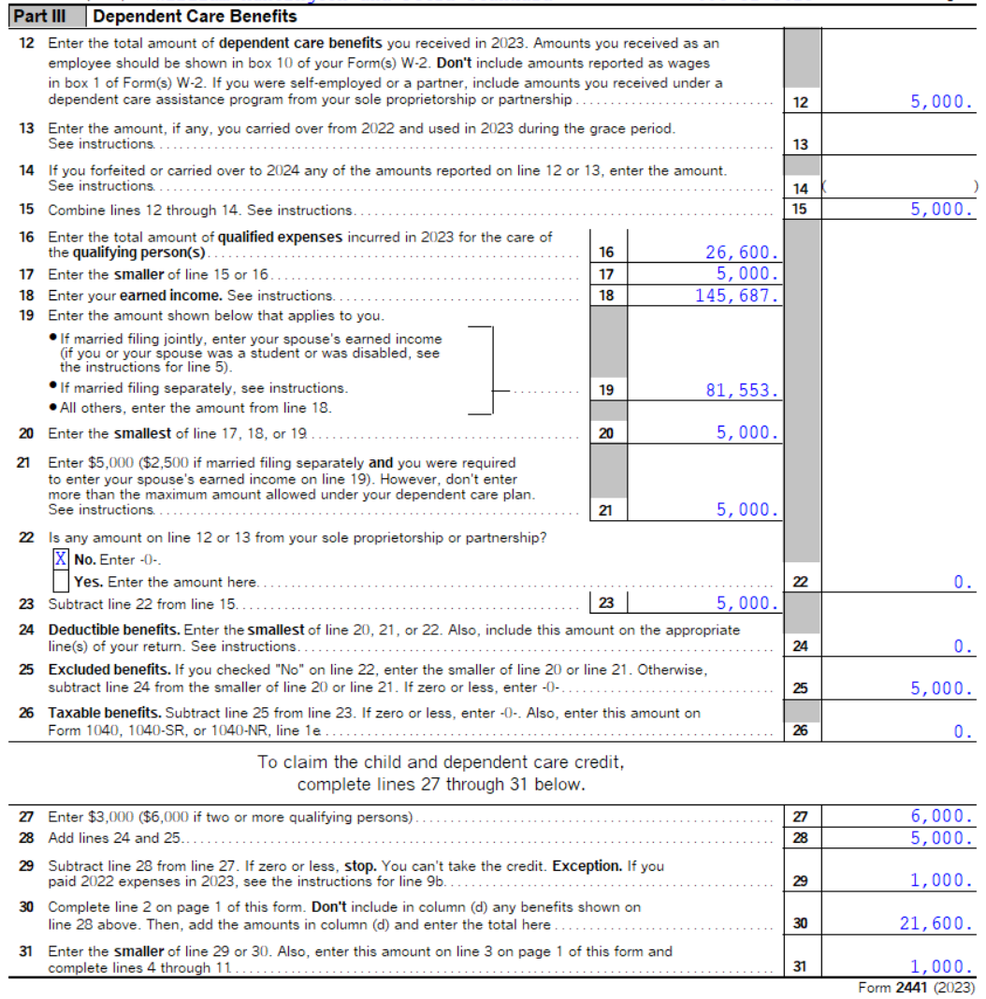

Clients have 2 children, each receiving childcare costing $10,000+, all properly entered in Screen 33.1 and 33.2. Dad has deferred $5,000 into his employer's FSA (which is reported in Box 10 of his W-2). Here is Part III of their Form 2441:

Am I misunderstanding? Doing something wrong?

Micah

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Look at the last sentence in §21(c).

The amount determined under paragraph (1) or (2) (whichever is applicable) shall be reduced by the aggregate amount excludable from gross income under section 129 for the taxable year.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The maximum child care expenses that can be considered for 2 or more kids is $6,000.

Dad got $5,000 tax free, leaving $1,000.

The 2441 is correct.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Two things:

1. Dad did not get $5,000, in the sense that the money was his own income that he sent to his FSA, though it is true that by putting it in the FSA it is tax-free.

2. More importantly, I understood that if you have adequate childcare expenses, you can allocate the FSA to pay some of the expenses and the dependent care credit to cover the other expenses.

I read IRR 1.21-1, but unfortunately it does not address the impact of an FSA on the availability of the credit. Lots of sources on the internet answer the question in the affirmative, but I can't exactly prepare a tax return on the say-so of the internet! 🙂 So I guess I'm looking for some definitive answer as to whether ADDITIONAL expenses can use the dependent care credit after the FSA has been used for other expenses.

M.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Read the 2441 instructions. They may refer you to the $5,000 dependent care benefit and child and dependent care credit Code Sections.

I know it is correct but do not have time to research it for you.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Look at the last sentence in §21(c).

The amount determined under paragraph (1) or (2) (whichever is applicable) shall be reduced by the aggregate amount excludable from gross income under section 129 for the taxable year.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am facing the same issue. How did you resolve it/end up filing for your client?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@waynec wrote:

I am facing the same issue. How did you resolve it/end up filing for your client?

What "issue" are you talking about? As we all mentioned, the software was doing it correctly.