msindc1

Level 5

04-04-2024

05:23 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Folks:

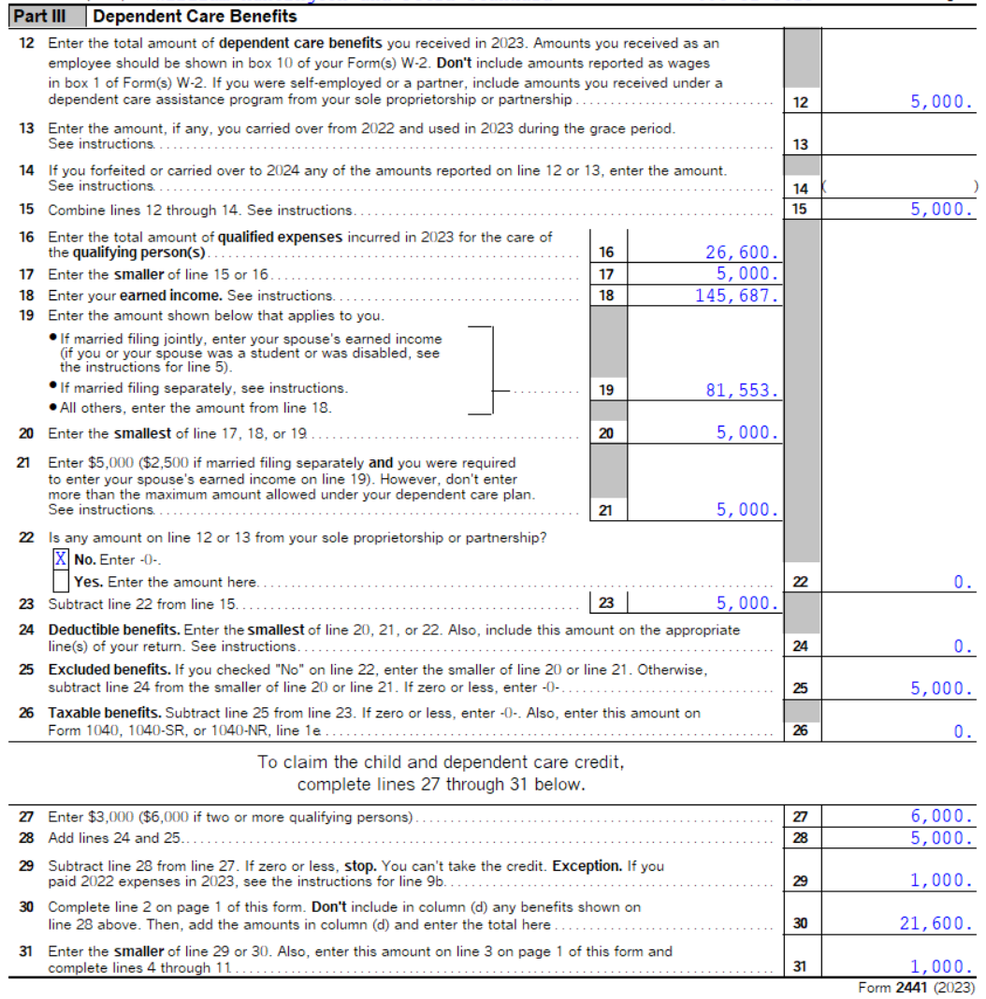

Clients have 2 children, each receiving childcare costing $10,000+, all properly entered in Screen 33.1 and 33.2. Dad has deferred $5,000 into his employer's FSA (which is reported in Box 10 of his W-2). Here is Part III of their Form 2441:

Am I misunderstanding? Doing something wrong?

Micah

Best Answer Click here

Labels