- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Client data export: Sale of Home

Client data export: Sale of Home

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi.

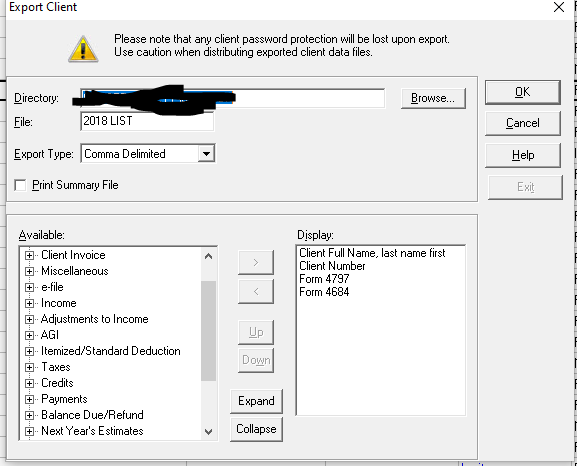

I'm trying to pull some reports from our listing of clients in Lacerte and I need to pull out everyone who had a sale of home. I cannot find where that option is in the big list of stuff to add to your export.

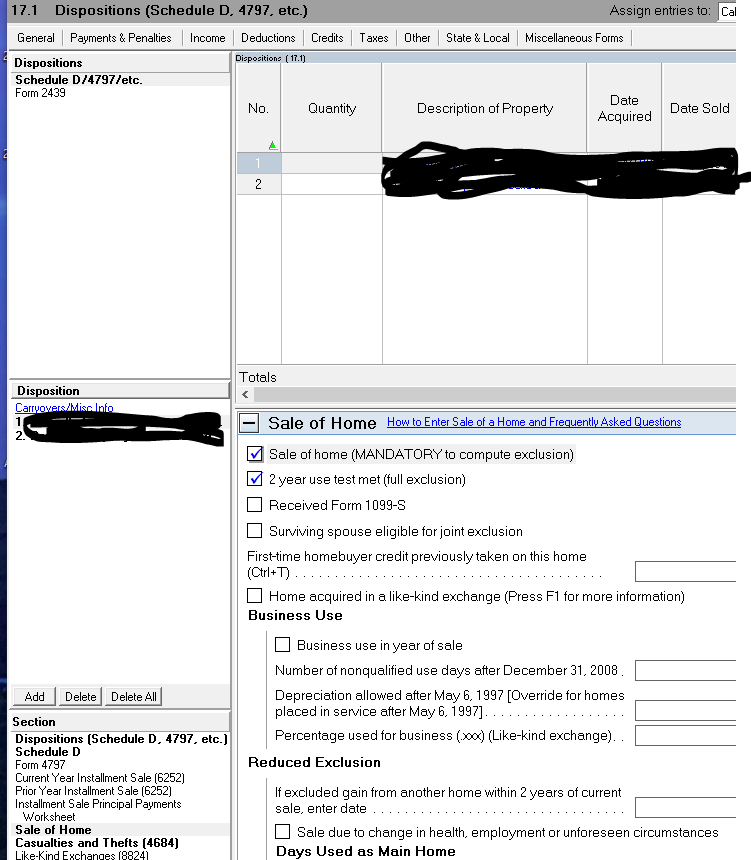

In Lacerte, there is a Worksheet created for Sale of Home to calculate if gain/loss and/or exclusion (§121). There is also a couple check boxes on the Dispositions pages of the home asset to designate it as sale of home and to allow the full exclusion. Where are these? I don't want to click through each of the 500+ clients to search!

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I normally would wait to see if anyone else chimes in, but I looked and looked and didn't see anything. You're message reinforces my search. Add that on top of Lacerte not really letting us pull out reports and data that we want in other scenarios - I'll take your answer as solution.

Lacerte is kind of that that kid whose family is in the lower-upper class, but compared their social circle, they are not as well off as their friends. They desperately want to be more well off and though of highly by others. So even though they are no better than those who may be thought of as upper-middle class, they treat everyone like they are better than them and walk around with a chip on their shoulder. They think they are just fine how they are and don't want to take time for self-reflection and just coast through life being mediocre.

Look at me with that analogy! Am I an English professional or an Accountant?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Most of my clients qualify for the full exclusion, so I don't fill out any of that worksheet stuff. I suppose I could, and charge them more. There should maybe be a way to find returns with address changes, but we have separate office systems for stuff like that.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm not talking about the worksheets, I'm talking about the actual filing. Majority of clients qualify for the exclusion, yes. But you still need to report the sale regardless if there is recognized gain or not.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have you worked with the SDK for custom reporting? There is a forum for that community at this link:

https://proconnect.intuit.com/community/lacerte-sdk-group/gp-p/501

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"...But you still need to report the sale regardless if there is recognized gain or not."

That statement is NOT correct; see the directions provided by the IRS. It says do NOT report.

Lacerte allows an override which I use to force all sales of a primary residence to show up on F 8949/Sch D. The 'disclaimer of excluded gain' shows up. It is much easier (and yes, my clients HAVE had missives from the IRS asking..) to then print the F 8949/Sch D out & respond to the notice.

YMMV

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I got tired of getting those notices because clients would tell me "No I didn't get a 1099-S" when they really did. I also force all home sales to show up.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

there's my twin, again.. 🤣

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You people who live in places where $500,000 homes sell for $3 million, remember that practices may vary in the real world. My problem is more with escrow companies that should be issuing the 1099-S, but don't. "Just sign here so we can avoid the paperwork."