- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Adding Direct Pay Option to Client Letter

Adding Direct Pay Option to Client Letter

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In the standard client letter navigation I see the direct pay header and wording, but it does not print in my client letters. I feel like there is a box I didn't check somewhere so that it will print. Suggestions Anyone? Thanks!

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

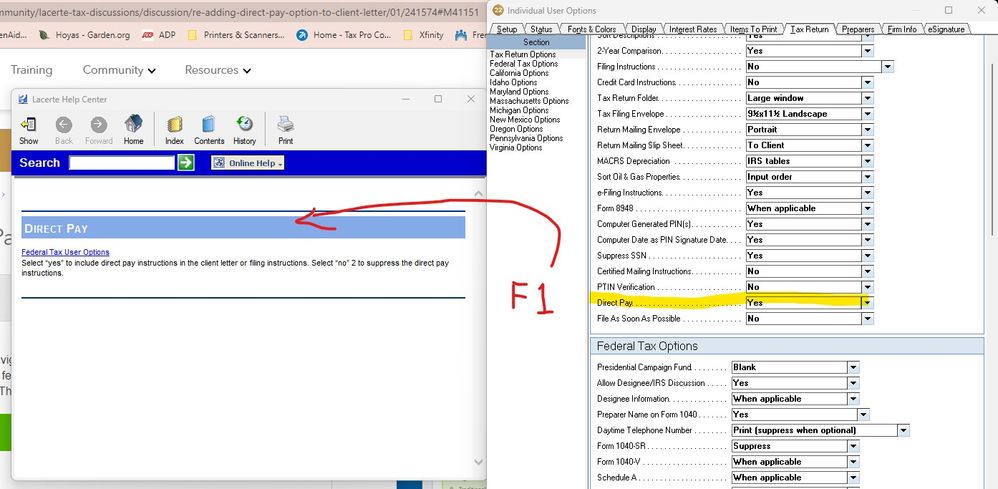

Typically you can find where it would be as a default by pressing F1 at that entry point. In this case it does not say anything, so my initial guess is NO.

If you go to Settings > Client Letter > you will not find any "options". You can take the text of the Direct Pay Section and copy it, then paste it in the Main Letter Body in each of the 3 IRS Address (Payments...) sections as a more generic version such as "As an alternative to paying by paper check, federal income tax payments can be made using the IRS Direct Pay electronic payment method. This service is free and can be used to pay your individual tax bill or estimated tax payment directly from your checking or savings account. To access online, visit www.irs.gov/payments for more information. This may be done in lieu of using 1040V and/or 1040ES"

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Screen 5 > Second Section (Client Letter) > last check box in that section.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you!! Do you know if there is somewhere in the setup where it would apply to all returns similar to the credit card instructions? That way each return with a balance due would not have to be adjusted in screen 5?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Typically you can find where it would be as a default by pressing F1 at that entry point. In this case it does not say anything, so my initial guess is NO.

If you go to Settings > Client Letter > you will not find any "options". You can take the text of the Direct Pay Section and copy it, then paste it in the Main Letter Body in each of the 3 IRS Address (Payments...) sections as a more generic version such as "As an alternative to paying by paper check, federal income tax payments can be made using the IRS Direct Pay electronic payment method. This service is free and can be used to pay your individual tax bill or estimated tax payment directly from your checking or savings account. To access online, visit www.irs.gov/payments for more information. This may be done in lieu of using 1040V and/or 1040ES"

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for the quick response. That was my next alternative, but I wanted to be sure I wasn't missing and easy check box. Thanks for the help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just stumbled over the checkbox for this. Settings>Options>Tax Return In the Tax Return Options section, second from the bottom (just before the Federal Tax Options). You'll see the check box, actually a Yes/No option.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I like pictures. This includes what you get when you press F1 at that entry area found by @pamdory

Answers are easy. Questions are hard!