"Error while getting Calculation Data from engine" in Lacerte

by Intuit•3• Updated 2 months ago

For more resources on program errors in Lacerte, check out our troubleshooting page where you'll find help with installation, program launch, and program use.

When attempting to process a return or selecting the Forms tab in Lacerte, the user may receive the following error message:

"Error while getting Calculation Data from engine [client#]"

This message is a generic error that can have several root causes. This article will help you narrow down the most likely cause and resolve the error.

Before you start:

- This article references default installation paths and uses YY to reference the tax year in 20YY format. C: will always indicate the local drive and X: will always indicate the network drive.

Table of Contents

First, determine which clients are affected:

- If you only receive this error on one client file, the cause is likely input related. See A. Reviewing client input below. However, if the affected client is an extremely complex return, follow the instructions for D. Increase Java Engine memory.

- If you receive this error for all clients within one tax type (for example, all Partnership returns), but clients in other modules are unaffected, see B. Repair the database below.

- If all of your clients in all tax types are affected, or if all of your clients with a certain state are affected, the cause is likely a bad installation. See C. Repair your Lacerte installation below.

A. Review client input:

Before checking input on the return, check to see if the return is locked. If so, try creating a copy of the return by selecting it in the Clients tab, then going to the Client menu and choosing Copy. Once you have a copy of the return, unlock the copy and see if it calculates.

A common cause is a Married Filing Jointly return where either the taxpayer or the spouse has an invalid Social Security Number (for instance, entering "NRA" instead of an actual number). This only affects returns with certain states on them, such as Colorado. If this is not relevant for your return, proceed with these steps.

Another potential cause is when a consolidated return is improperly set up. For more information on setting one up properly, see here.

To determine if bad input is present:

- Hit the F10 key on your keyboard to bring up the Lacerte Technical Support window.

- Select the Errors tab.

- Scroll through the error log until you see the phrase Caused by: java.lang.NullPointerException.

Immediately below that line, there should be a form listed, as well as other information that can help you determine what is triggering the error.

Example: The error is generated by the Montana Form 2, related to Credit for Taxes Paid and the Other State Tax Credit. There was an entry on Screen 52.381, Montana Other State Tax Credit that listed England as the jurisdiction. Taxes paid to England would be taken as Foreign Tax Credit, not an Other State Tax Credit.

Since it may take several attempts to determine the exact cause of the error, we recommend you make a copy of the client file and make all changes on the copy until you have the issue resolved.

To review the input related to forms listed in the error log:

- Go to the appropriate Detail input screen in Lacerte based on the error log.

- Check for special/extended characters (ie: &, %, #, $, etc) in text or description fields.

- Check for incomplete, missing, or invalid input. This may often be an item that proforma'd from the prior year return.

- Delete the suspected input, then exit the client and come back in to verify that has cleared the error.

- Hit Ctrl + W to enter batch mode and double-check the same areas, also for random characters, extra spaces and letters.

B. Repair the database:

If you're unable to locate an input issue, or if all clients in one tax type are affected, repair the database by running CLPACK. See Lacerte Client Database Repair Utility - CLPACK.

After running CLPACK, attempt to process the return. If the error continues to generate, continue with C. Repair your Lacerte installation.

C. Repair the Lacerte installation:

In many cases, a force install using Lacerte Tool Hub can resolve the issue.

Step 1: Download and install the Lacerte Tool Hub

If you do not have the Lacerte Tools Hub already on your computer, complete the following steps:

- Close Lacerte.

- Download the Lacerte Tool Hub Install file. Save the file somewhere you can easily find it (like your Downloads folder or your Windows desktop).

- Open the file you downloaded (lacertetoolhub_setup.exe).

- Follow the on-screen steps to install and agree to the terms and conditions.

- When the install finishes, double-click the icon on your Windows desktop to open the tool hub.

If you can't find the icon, do a search in Windows for Lacerte Tool Hub and select the program.

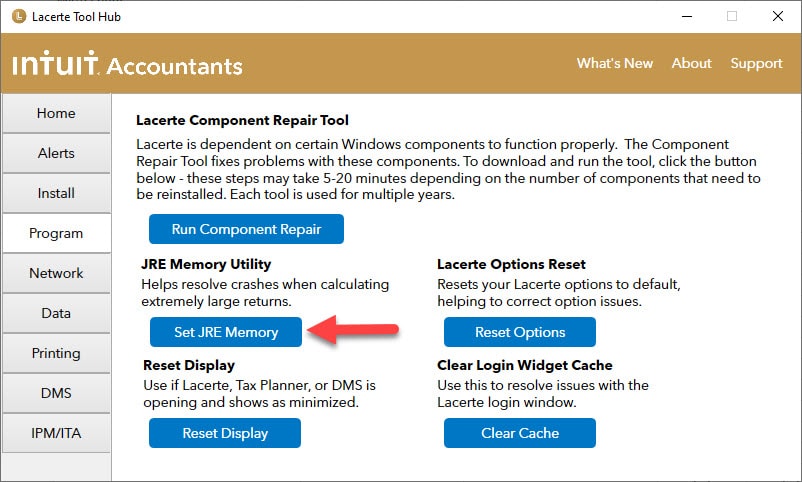

Step 2: Using the tool in the Lacerte Tool Hub

- Open the Lacerte Tool Hub.

- Select the Install section on the left.

- Follow the on-screen instructions to run the tool.

If Lacerte Tool Hub didn't resolve the issue

First, uninstall and reinstall the Java engine:

- Exit Lacerte on the affected computer.

- Open File Explorer.

- Browse to C:\Lacerte\YYtax\SetupYY.

- Right-click on JRESETUP.MSI and select Uninstall.

- When complete, right-click on JRESETUP.MSI and select Install.

Launch Lacerte and try to calculate an affected return. If the issue persists, continue with the steps below.

- Open the Lacerte program and press the F10 function key on your keyboard.

- In the System Information tab, copy the System File Path and make note of it.

- Close the program.

- Press the Windows key and the letter R on your keyboard to open the Run dialog.

- Right-click to Paste the System File Path in the Open box.

- Add SetupYY\taxsetup /force to the end of the System File Path (where YY represents the two-digit tax year) and press Enter.

- Select Yes when asked if you are sure if you want to replace the current version.

- Follow the instructions on the screen to complete the installation.

- When the installation is complete, open Lacerte and try to calculate a return again.

If the issue persists after a forced installation, follow these steps to rename the setup folder and re-download Lacerte:

- Close Lacerte.

- Open Windows Explorer.

- Navigate to the System File Path you previously recorded.

- Open the YYTax folder, and locate the SetupYY folder inside.

- Right-click the SetupYY folder, and select Rename.

- Rename the folder to SetupYY-OLD, and press enter.

- Press the Windows key and the letter R on your keyboard to open the Run dialog.

- Type, or copy and paste, "C:\Program Files (x86)\Common Files\LacerteShared\websetupYY.exe" into the window. Make sure to leave out the quotation marks, and substitute the 2-digit tax year for "YY", like websetup25.exe .

- Press enter.

- Lacerte will rebuild the setup files and reinstall the latest versions from the web. Once complete, open Lacerte and try to calculate a return again.

D. Increase Java engine memory:

Step 1: Download and install the Lacerte Tool Hub

If you do not have the Lacerte Tools Hub already on your computer, complete the following steps:

- Close Lacerte.

- Download the Lacerte Tool Hub Install file. Save the file somewhere you can easily find it (like your Downloads folder or your Windows desktop).

- Open the file you downloaded (lacertetoolhub_setup.exe).

- Follow the on-screen steps to install and agree to the terms and conditions.

- When the install finishes, double-click the icon on your Windows desktop to open the tool hub.

If you can't find the icon, do a search in Windows for Lacerte Tool Hub and select the program.

Step 2: Using the tool in the Lacerte Tool Hub

- Open the Lacerte Tool Hub.

- Select Program on the left.

- Click on Set JRE Memory.

- Follow the on-screen instructions to run the tool.

To do this manually:

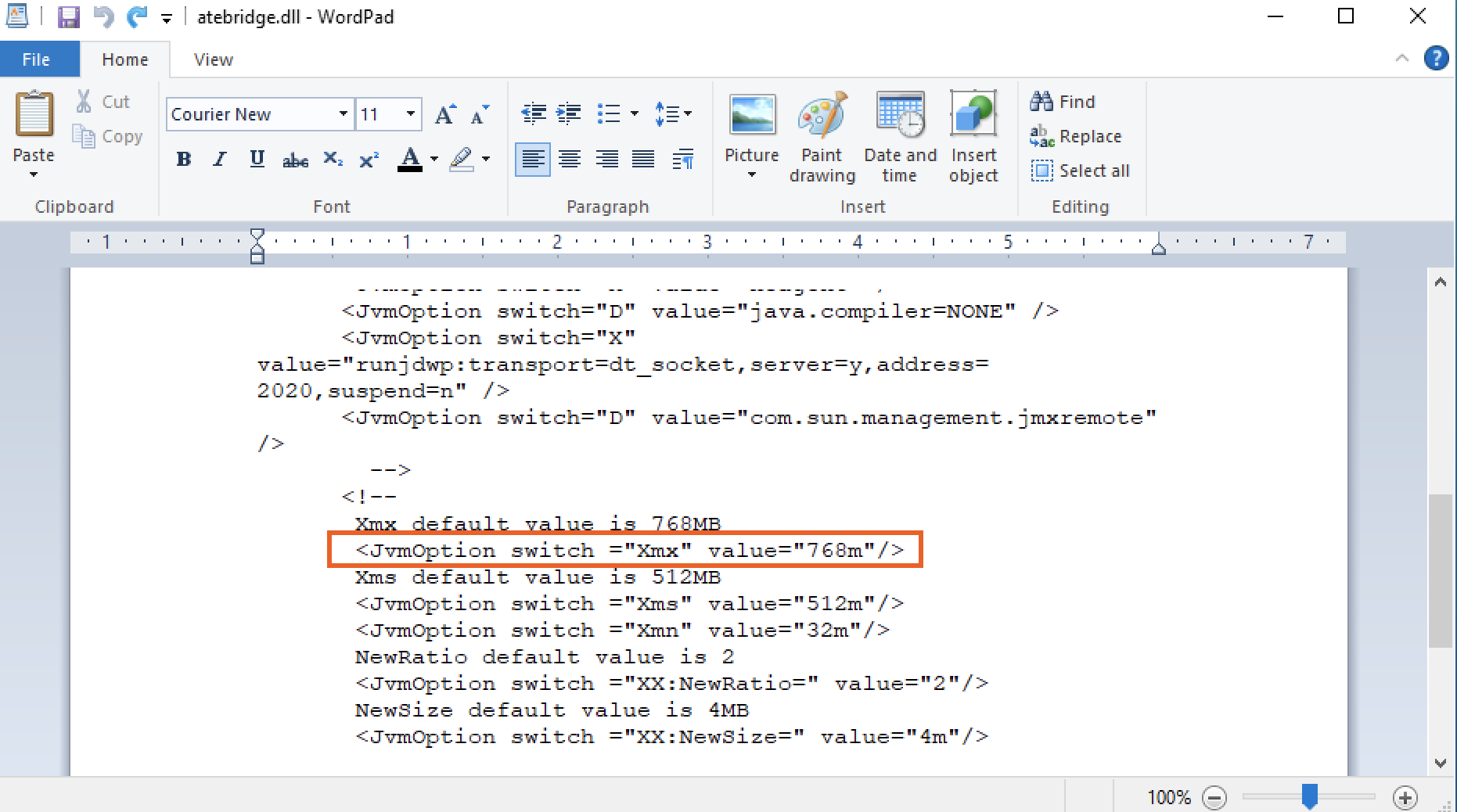

- Using File Explorer, browse to C:\Lacerte\YYTax.

- In the YYTax folder, look for the atebridge.dll.config file.

- Double-click on the file to open it.

- If Windows doesn't know how to open the file, choose Select the program from a list and open it with a word processor, like Notepad or Wordpad.

- Scroll down and look for the following line:

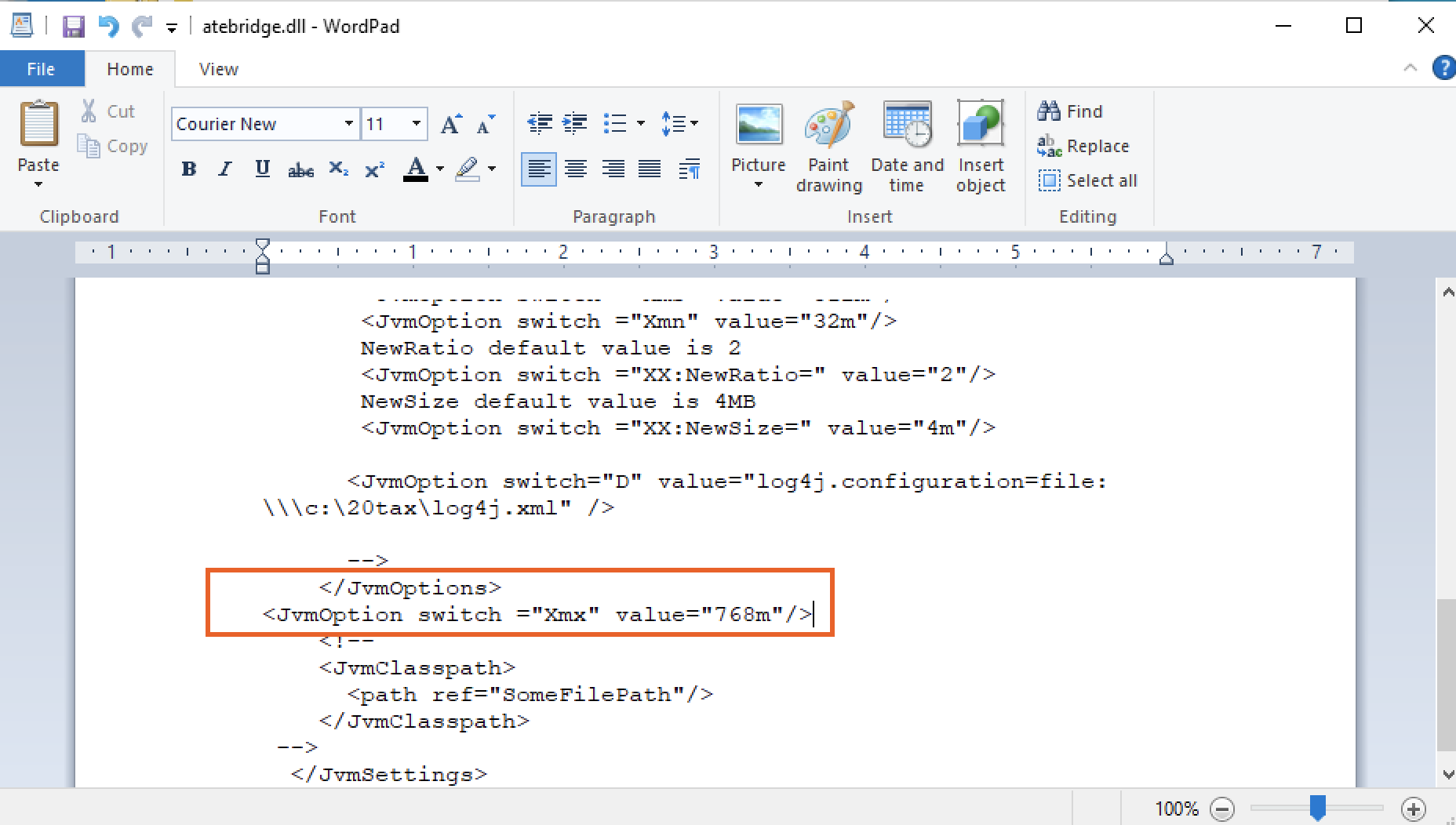

- Copy the entire line and paste it on the line after . See the two images below.

- Then change the value from 768 to 1024.

- From the File menu, click Save.

- Close the file and then launch Lacerte to try the operation again.

More like this

- Troubleshooting the Lacerte error: Error while updating Tax Service Databy Intuit

- How to resolve Lacerte errors "Exception in InitProcessing - Catastrophic Failure" and "Exception Dispatching Message ID: 1127"by Intuit

- What's new with Lacerteby Intuit

- Resolving the error: Exception occurred in the Tax Engineby Intuit